- USSD is used extensively across Africa to enable mobile banking and mobile payments

- Despite its widespread use, USSD has significant limitations. The menus can be cumbersome and difficult to navigate, transactions are susceptible to interception and lack robust encryption.

- WhatsApp chatbots represent a promising alternative to USSD in Africa’s digital financial services sector by offering a more user-friendly, secure, and cost-effective solution.

Unstructured Supplementary Service Data (USSD) have been quoted as a catalyst for financial inclusion in Africa for over a decade now. However, with the advent of new technologies and platforms, the use of USSD has been largely overshadowed by more advanced forms of mobile banking. The integration of banking services through WhatsApp has the potential to revolutionize the way we manage our finances. With its wide reach and user-friendly interface, WhatsApp can quickly become the go-to channel for customers to access their banking services.

USSD was introduced in the 1990s after engineers discovered they could use it as a supplement to the existing GSM. It was more focused on person-to-person communication between a mobile network operator’s computers and its subscribers’ handsets.

USSD has been a reliable tool for mobile banking and financial services across Africa due to its compatibility with basic mobile phones and its ability to function without internet connectivity. It allows users to perform transactions such as balance enquiries, money transfers, and bill payments through simple text-based commands.

Also Read: USSD driving digital and financial inclusion in Africa

Taking financial services to WhatsApp chatbot

Despite its widespread use, USSD has significant limitations. The menus can be cumbersome and difficult to navigate, especially for users who are not tech-savvy. Transactions are susceptible to interception and lack robust encryption, posing security risks. The text-only interactions and limited transaction options restrict the user experience, and each session can incur costs, which may be a barrier for low-income users.

WhatsApp has revolutionized the way we communicate and stay connected with our friends and family. The popular messaging app is projected to reach almost three billion unique active users worldwide in June 2024, up by seven percent compared to the corresponding month in 2023.

WhatsApp has gained immense popularity across Africa, with millions of users leveraging the platform for communication. As of the third of 2023, Nigeria saw approximately 95.1 per cent of the country’s digital population engaging with mobile social messaging platform WhatsApp on a monthly basis. Approximately 93.9 per cent of internet users in South Africa reported using WhatsApp every month.

Its widespread adoption can be attributed to several factors such as an intuitive interface that is easy to use for people of all ages, affordable data packages provided by many telecom operators, and the support for rich media such as text, images, voice notes, and videos, enabling a richer user experience. The integration of chatbots into WhatsApp can significantly enhance the provision of digital financial services making it a highly valuable platform for businesses to reach out to their customers.

WhatsApp chatbots provide a conversational interface that is easy to navigate. Users can interact with the chatbot using natural language, making transactions simpler and more intuitive. WhatsApp offers end-to-end encryption, ensuring that all communications between users and the chatbot are secure. Chatbots can reduce transaction costs as they operate over the internet, which can be more affordable than USSD sessions.

Additionally, they can provide round-the-clock service without the need for human intervention, ensuring that users have access to financial services at any time. Moreover, chatbots can be programmed to understand and respond in multiple languages such as Swahili, Zulu, Xhosa, Shona, Ndebele e.t.c catering to the diverse linguistic landscape of Africa. chatbots also do not require you having to memorize ambiguous USSD codes for different services and different banks.

Several financial institutions and fintech companies in Africa have begun to deploy WhatsApp chatbots to streamline their services. Banks are using WhatsApp chatbots to enable customers to check account balances, transfer funds, and request mini-statements. Microfinance institutions leverage chatbots to provide loan application services, repayment reminders, and customer support.

Mobile money providers use WhatsApp chatbots to facilitate money transfers, bill payments, and airtime purchases. For example, the Kenyan mobile network operator Safaricom integrated its M-Pesa services with WhatsApp, allowing users to perform various transactions through the chatbot interface. This integration has made financial services more accessible and convenient for millions of users.

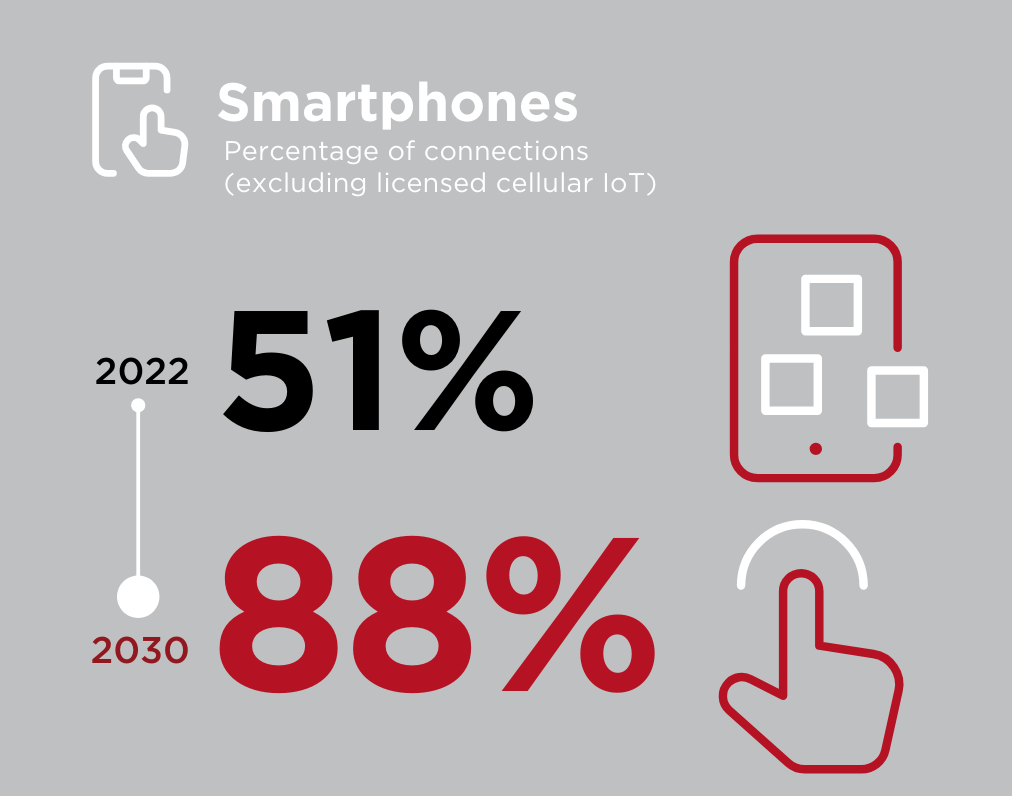

Despite the numerous advantages, there are challenges that need to be addressed to ensure the widespread adoption of WhatsApp chatbots. While smartphone usage is increasing, a significant portion of the population still lacks reliable internet access. According to data from GSMA, Africa also has the highest usage gap globally, with 680 million people unconnected. In addition, it also falls behind all regions globally, with only 25 per cent of its population connected its mobile broadband services. There is a need to improve digital literacy among users to ensure they can effectively utilize chatbot services. Robust technological infrastructure is required to support the seamless operation of chatbots.

Also Read: Zimbabwe: EcoCash introduces AI-powered bot to improve customer experience