- Kenya Apparel Exports Targetting $1 Billion by 2025

- Inaction On SDGs to Cost Global Economy an Extra $38 Trillion

- Pullman Hotel Nairobi: French hospitality firm Accor to Open 1st Premium Brand in Kenya

- Investors tip Abu Dhabi as the next tech powerhouse globally

- Unlocking global investment potential: ministerial roundtable insights at AIM Congress 2024

- UN Tourism empowers women entrepreneurs at AIM 2024

- Kenya’s business conditions stabilised in April but heavy rains a concern for Q2

- Floods Sweep Away Billions in Economic Gains in Kenya and Tanzania

Year: 2019

Money Market Funds remain the largest Unit Trust Fund

Unit trust fund investments in Kenya recorded a 4.3 per cent growth in 2018, latest industry data shows, as investors moved to deepen the capital markets and provide alternative funding for businesses.

During the year, Total Assets Under Management (“AUM”) held by Unit Trust Fund Managers grew to Ksh58.0 billion (US$574.8 million) up from Ksh55.6 billion (US$551 million) recorded in 2017.

This came as the money market funds continued to be the most popular product with the AUM held by Money Market Funds, having grown by 8.9 per cent to Ksh48.5 billion (US$ 480.6 million) in 2018

This was up from Ksh44.5 billion (US$441 million) recorded in 2017, a report by investment firm-Cytonn shows, indicating that Money Market Funds are growing faster than the overall market.

CIC Asset Managers recorded the strongest growth in AUM of 36.3 per cent to Ksh20.3 …

Coverage of retirement schemes in Kenya remains below 50%

Majority of Kenyans securing their old age by saving under retirement schemes are still exposed to tough times during sunset years, a survey has revealed.

The study by pension fund administrator Zamara Group has revealed that though pension’s legislation in the country has improved the governance and operations of the retirement funds, it has done little to improve the coverage and adequacy of retirement benefits to individuals.

Coverage of retirement schemes in Kenya has remained relatively low with less than 50 per cent of the formal sector covered and coverage of the much larger informal sector virtually non-existent.

According to Zamara Group CEO Sundeep Raichura, even those who are saving under retirement schemes have insufficient coverage to provide an adequate income when they retire.

The study which covered 65,000 retirement scheme members, spread across more than 200 retirement funds in the …

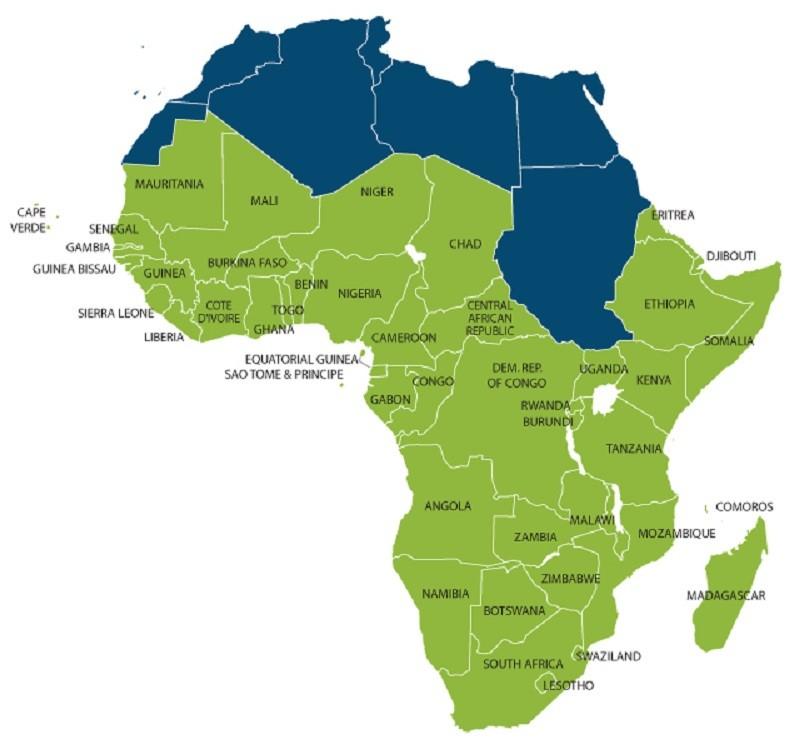

Jiji – the largest classifieds marketplace in Nigeria – has reached an agreement to redirect OLX users in Nigeria to Jiji and to acquire OLX businesses in four other countries, building a leading pan-African classifieds business

OLX, online classfied portal has been a major player in the African market for almost a decade even from its original name Dealfish. However, things have not been going well for the online platform as new entrants including Jumia has pushed it to the blink.

And now Nigerians have come to the rescue in the name of Jiji.

Jiji and OLX have announced that both companies have reached an agreement under which Jiji will acquire OLX businesses in Ghana, Kenya, Tanzania, and Uganda, pending certain regulatory approvals, and OLX users in Nigeria will be redirected to Jiji. The transaction is backed by one of Jiji’s cornerstone investors, Digital Spring Ventures.

Joining Jiji’s family will …

The third edition of the China Trade Week (CTW), a “One Belt, One Road” initiative inspired event will take place in Ethiopia from May 2 to 4 at the Millennium Hall in Addis Ababa.

MIE Groups, the founder of the conference will host the three-day event in collaboration with the Ethiopian Prana Events.

Established in 2013, China Trade Week had its first event in the United Arab Emirates (UAE) which was warmly welcomed by the local business community, it was followed by the first African event in Kenya in 2015 which had an even bigger response. It later debuted in Ethiopia in 2017.

The trade fair seeks to pull over 100 investors and exhibitors from sectors including construction materials and machinery, lighting and energy, clothing and textiles, electrical goods and electronics, automotive parts and accessories, health and beauty, print, packaging and plastic, baby and infant products and food and beverage.…

In a recent statement by the Tanzania Coffee Board (TCB), Tanzania earned Tshs.180 billion ($79 million) from the sale of over 65,000 tonnes of coffee collected in the 2018/2019 crop season.

The board Director General, Primus Kimaryo said 40,940 tonnes of coffee were sold through the TCB Coffee Exchange, with the remaining 24,583 sold through Direct Coffee Export. Robusta dominated the direct export with 19,399 tonnes constituting 78.9 per cent while 5,183 tonnes of Arabica coffee made 21.1 per cent of the consignment.

Mr. Kimaryo said that although coffee production during the 2018/2019 season was 65,000 tonnes, an increase of 30 per cent from the previous year`s 50,000 tonnes, prices in the world market were not favourable to farmers.

He challenged farmers from across the country to put more emphasis on the production of high quality coffee to fetch good prices on the world market in the future seasons.

Outlining …

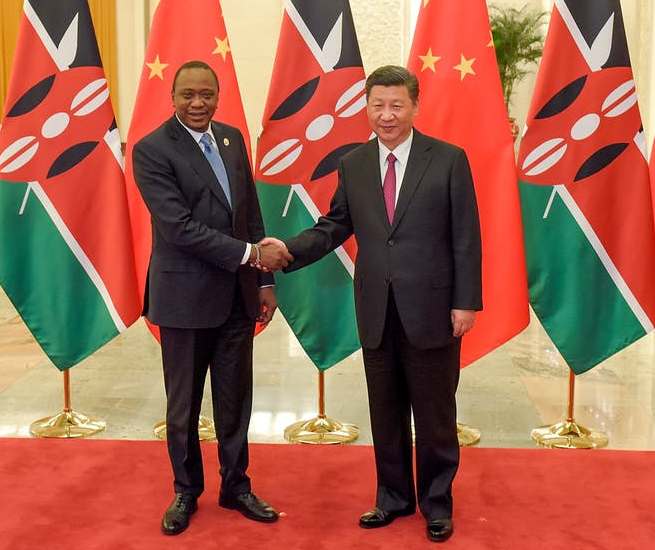

Loans from China hit a high of US$6.2 billion last year

The Chinese government has dismissed claims that it’s continued heavy lending to Kenya in the financing of mega infrastructure projects is a ‘ debt trap’, even as loans from Beijing hit a high of ShUS$6.2 billion(Sh625.9 billion) in December last year.

This is up from US$5.3 billion (Sh535 billion) a year earlier with a lion share going towards the construction of the multi-billion Standard Gauge Railway (SGR).

“We are not putting Kenya into a debt trap. China-Africa corporation cannot put Africa into a trap but booming economic growth,” China’s Charge’ D’affaires (Nairobi) LI Xuhang said during a meeting in Nairobi on the update on the SGR and China-Kenya relations.

“Kenya can decide on who they want to partner with. Kenyan people are wise enough to choose their trade and corporation partners. They can decide who benefits them more,” Xuhang …

Emerging markets aviation services provider National Aviation Services says it will offer comprehensive ground handling and cargo services in Mozambique from July.

This will cover ramp, passenger and engineering services and include check-in, boarding, ramp handling, maintenance, cleaning as well as import and export cargo handling and storage for scheduled and ad-hoc airlines at all airports in Mozambique.

“Airline traffic is growing steadily in Mozambique. Coupled with the developing oil and gas, and mining sectors, there is a huge demand for air transport related goods and services for both cargo and passenger operations,” group CEO Hassan El Houry said in a statement.

“This requires heavy investment in the latest equipment, technologies and processes at the different airports in Mozambique, all of which NAS can provide easily. We look forward to utilizing our global experience and expertise to modernize operations and drive efficiency using the latest technologies and operational practices.”

NAS …

Sub-Saharan Africa’s economic growth slowed to 2.3 per cent in 2018 from 2.5 per cent in 2017, remaining below population growth for the fourth consecutive year, the World Bank has said.

In the April 2019 issue of Africa’s Pulse, its bi-annual analysis of the state of African economies published on Monday, the bank said regional growth was expected to recover to 2.8 per cent in 2019, staying below three per cent as it has been since 2015.

The slow growth reflects ongoing global uncertainty but increasingly comes from domestic macroeconomic instability including poorly managed debt, inflation, and deficits; political and regulatory uncertainty; and fragility that is having visible negative impacts on some African economies.

It also belies stronger performance in several smaller economies that continue to grow steadily, the bank said.

It noted that Nigeria’s growth rose to 1.9 per cent in 2018 from 0.8 per cent in 2017, reflecting …

Three years past the crisis period, economies are still performing poorly

The growth story in Sub-Saharan Africa in the past few years has been one of faltering recovery from the worst economic crisis of the past two decades.

This remains the case according to the World Bank’s April 2019, 19th edition of Africa’s Pulse, which estimates GDP growth in 2018 at a lower-than-expected 2.3 per cent, with a forecast to 2.8 per cent in 2019.

“Three years past the crisis period, we should be seeing a more widespread pickup in growth; instead we have downgraded our estimates again for 2018,” said Gerard Kambou, World Bank Senior Economist for Africa, “Leaders in Sub-Saharan Africa have the opportunity to build stronger domestic policies to withstand global volatility – and now is the time to act.”

The report notes that the three largest African economies—Nigeria, Angola and South Africa—play a big role …

Mobile subscription in the country grew 6.2 per cent in the second quarter of 2018

A proliferation of mobile applications on popular online stores is exposing Kenyans to increased cyber attacks and fraud, a latest sector statistics report by the Communications Authority of Kenya (CA) has revealed.

This comes in the wake of a fast growing mobile subscription in the country which grew 6.2 per cent in the second quarter of 2018(October-December).

According to CA’s sector statistics report for the financial year 2018-2019, mobile subscriptions in Q2 grew to 49.5 million up from 46.6 million in the first quarter(July-September).

Data subscription during the period increased to 45.7 million from 42.2 million in the previous quarter, meaning Kenyans are increasingly getting connected to the internet.

This has created a field day for fraudsters who are taking advantage of innocent members of the public with little knowledge on cyber attacks.

The report …