- Amazon is expanding its global reach and now eyes launching an e-commerce platform in South Africa by 2024.

- Africa’s e-commerce industry showcased an annual growth rate of 13.11% between 2023-2027, resulting in a projected market volume of $59.18 billion by 2027.

- Naspers-owned Takealot currently dominates the SA’s online retail market, with a gross merchandise value of $1.4 billion.

Africa’s e-commerce industry is among the fastest and most lucrative economic activity in the last decade. This billion-dollar franchise has showcased the continent’s potential amid this digital era, stringing in plenty of investors.

Vital figureheads in the tech world like Microsoft, Uber, Apple, and others have taken time to invest in and support Africa’s growing digital ecosystem. This wave soon reached Amazon, the world’s top e-commerce platform, as it set its sights on penetrating South Africa’s digital market. This new milestone will open more opportunities for Amazon and expand Africa’s e-commerce industry.

Amazon intends to overhaul Africa’s e-commerce industry

The fourth industrial revolution has brought about significant change in several regions, but all are incomparable to Africa. In a decade, Africa has managed to overhaul its digital transformation significantly. Crucial economies like Kenya, Nigeria, South Africa, and Egypt have showcased the prowess of Africa’s digital transformation.

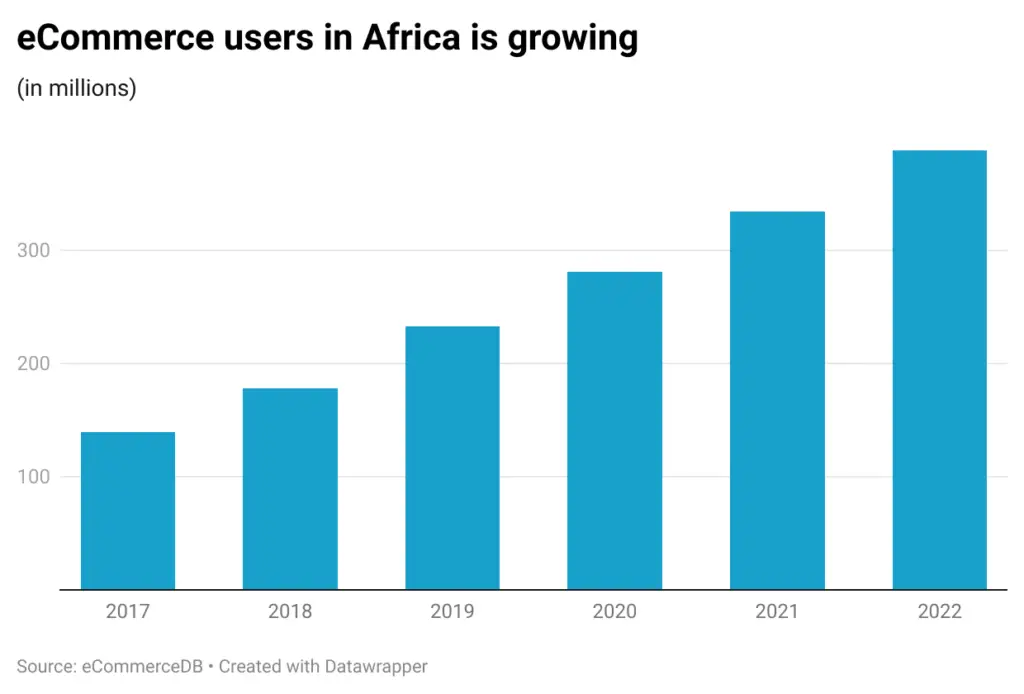

From blockchain-based systems to fintech and e-commerce, these emerging markets highlight the significance of Africa. Africa’s e-commerce industry was among the first great breakthroughs the region had. During Covid-19, many businesses turned to the Internet to broaden their marketing strategies amid the global lockdown. Through this initiative, the industry’s valuation skyrocketed in under two years, with Africa hogging a significant portion of the market. This valuation caught the eye of numerous investors seeking to penetrate the continent’s market.

This drive soon led Amazon toward South Africa’s digital market. The global e-commerce platform recently announced its intent to launch an e-commerce platform in South Africa by 2024. According to the announcement, the new Amazon e-commerce platform will reside on Amazon.co.za, broadening the franchise’s reach.

In addition, the e-commerce platform allows independent sellers in South Africa to register their businesses on sell.amazon.com/south-Africa. Robert Koen, general manager of the Sub-Saharan Africa region for Amazon, said, “We look forward to launching Amazon.co.za in South Africa, providing local sellers, brand owners, and entrepreneurs — small and large — the opportunity to grow their business with Amazon, and deliver great value and a convenient shopping experience for customers across South Africa.“

Hurdles before the launch

The new Amazon e-commerce platform is no new news, as the franchise announced its intent to penetrate Africa’s e-commerce industry in early 2022. Unfortunately, regulatory-based issues and South Africa’s internal turmoil hindered progress for some time now.

This initially forced Amazon to postpone the launch of the e-commerce platform from February to August 2023. Over the last month, the company has hired several locals, signaling its imminent arrival. Currently, Amazon has placed several merchants and software developers, including operation managers to ensure the smooth registration of local businesses.

Despite this development, Amazon still faces significant competition within South Africa’s digital market. For instance, Naspers-owned Takealot currently dominates the region’s online retail market. It has a gross merchandise value of $1.4 billion.

Other competitors include Massmart-owned Makro, Checkers Sixty60, and Mr Price, creating a stiff competitive atmosphere within the region. Fortunately, Amazon’s wide array of networks, businesses, services, and payment services provides the franchise the edge it requires to bulldoze over its competitors.

Read also: The rise of e-commerce in Africa: Why Amazon joined the party

Africa’s e-commerce industry dominates the franchise

According to Statista, Africa’s e-commerce industry will reach a valuation of $36.15 billion by the end of the year. The industry has showcased an annual growth rate of 13.11% between 2023-2027, resulting in a projected market volume of $59.18 billion by 2027.

Titans like Jumia are among its top benefactors. Jumia dominates Africa’s e-commerce industry, attracting an average of 32 million visitors monthly. South Africa’s Takealo and Egypt’s Souq follow suit with 10 million visitors monthly, showcasing the industry’s lucrative nature.

Through the industry, businesses have expanded their services beyond their borders, significantly affecting other industries. For instance, Africa’s e-commerce industry has affected its mobile and fintech industry. Today, online shopping is an everyday activity for most locals, increasing the need for smartphones across the continent. Due to e-commerce’s scalability, online payments have become stricter, allowing users to buy products unavailable in local shops or kiosks.

The rapid growth of these three industries has overhauled the need for better e-commerce platforms to address specific needs. As a result, investors and innovators have collaborated to create better e-commerce platforms, each striving to provide better or unique services. Africa’s e-commerce industry takes many shapes, from direct sales on company websites to informal social commercial models. This diverse approach to online shopping is another vital reason why Amazon has set its sites on the continent.

Read also: Amazon expands operations in Africa, and introduces new cloud infrastructure

South Africa’s digital markets

Despite these feats, South Africa’s digital market still heavily lags. The country’s slow growth, high unemployment, power supply, and transportation problems still heavily weigh down its progress. According to Alec Abraham, Sasfin Wealth senior equity analyst, Amazon’s move to South Africa will not significantly impact its development. The competition may stiffen, but the reality is that the consumer pie in South Africa is not growing.

Despite these comments, Abraham believes if South Africa wishes to dominate Africa’s e-commerce industry, it must first address its numerous internal strife. Only then can the Southern country truly benefit from Amazon’s e-commerce platform.