The European Union included four African countries in its list of countries that it says pose significant threats to the financial system of the union. Uganda stayed put on the list while Ethiopia and Tunisia were dropped because of reforms they have made in tackling money laundering and terrorist funding.

The list which was published earlier this year came into effect on the 1st of October. Included on the list are Botswana, Ghana, Zimbabwe, and Mauritius. These jurisdictions fall under the category of high-risk countries that’s show “strategic deficiencies” in their anti-money laundering and counter-terrorist financing framework.

Spotlight on Mauritius

Notable on this list is Mauritius which is a vibrant International Financial Center and has been considered the best jurisdiction to direct investments into Africa. Mauritius has tax treaties with about 18 countries on the continent

The EU acting on the findings of the Financial Action Task Force found Mauritius deficient in the following areas.

- Deficiencies in demonstrating that the supervisors of its global financial sector implement risk-based supervision,

- Failure to demonstrate that law enforcement authorities have the capacity to conduct complex money laundering investigations,

- Failure to ensure access to accurate beneficial ownership information by competent authorities in a timely manner,

- Failure to implement a risk-based approach for the supervision of its not profit sector,

- Failure to demonstrate the adequate implementation of targeted financial sanctions through outreach and supervision.

What does an EU Blacklist mean?

The list was instituted for the safeguarding of the EU’s financial system in order to prevent illicit activity in the financial system.

Once a country receives an EU blacklists it falls under the purview of intensified checks and balances. All suspicious money flows will be heavily scrutinized.

In addition, the blacklist creates an impression of a badly managed financial system, investors and partners will likely flee to other safer havens.

It will also make it difficult to obtain new business and to a country whose financial sector makes up a sizable part of its economic activity, the blacklist will be a heavy blow on the economy.

How did Mauritius respond?

The government issued a communique in the wake of the initial greylisting stating that the decision, “ is contrary to the spirit of dialogue and partnership which binds Mauritius and the EU.”

The response further highlighted the failure by the EU to conduct its own independent assessments, which it says would have revealed how Mauritius was making strides to remedy most of the issues highlighted by the FATF.

Mauritius said that it has made a commitment to address the deficiencies identified by the FATF so as to maintain its image as a safe haven.

Previously implicated

A report by the International Consortium of Investigative Journalism dubbed the Mauritius leaks revealed hundreds and thousands of confidential files. The leaks allege the knowing involvement of Mauritius in tax evasion by companies operating on African soil.

According to the papers, Mauritius touts itself as a gateway for corporations into the developing world.

The report also alleges that Mauritius signed several tax treaties with African countries which allow corporations to create shell companies in Mauritius to avoid paying taxes in the countries in which they operate.

Mauritius responded to these claims by highlighting the illegal channels used to obtain the information in question as well as the unfounded nature of the claims.

Why the implications for illicit financial flows?

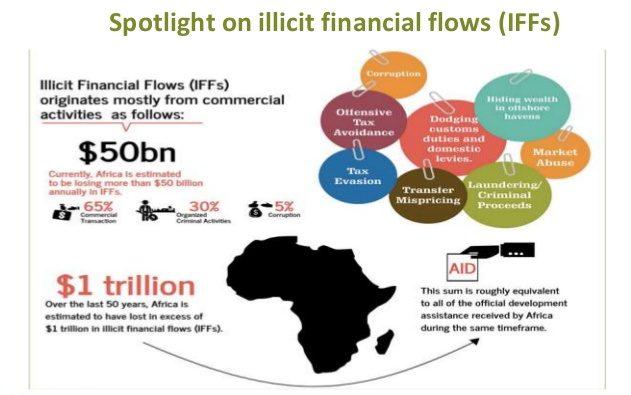

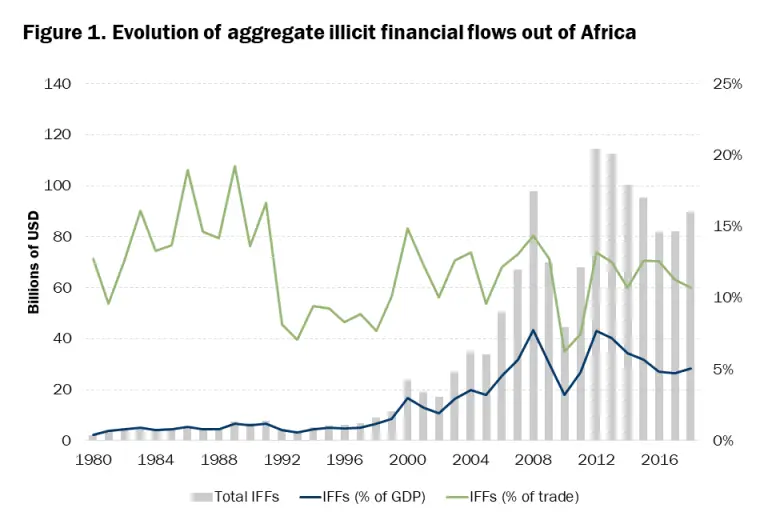

The Report of the AU/UNECA High-Level Panel on Illicit Financial Flows from Africa notes that Illicit Financial flows from Africa siphon $34 to $60 billion each year. Analysts have noted that these financial outflows could cover Africa’s debts with global financial lenders.

Totalled out, illicit Financial flows out of Africa amount to over 1.4 trillion. While some of these outflows may stem from illegal activities, the rest find their way out through trade mispricing and tax evasion. Which is why Mauritius fell under scrutiny as a potential tax haven.

Read also: Africa could gain 89bn annually by curbing illicit financial flows

Tax treaties brought into question

Some African countries have challenged double tax treaties with Mauritius. Senegal went on to sever ties on its double tax treaties citing the lopsided nature of the treaties which it says were not mutually beneficial.

Read also: Tax Treaties Should be Revoked by Governments