- Uncertainty over Agoa adds to a growing list of strained trade relations between Africa and Washington D.C., since Trump 2.0 that has been marked by aid cuts, immigration crackdown, visa denials, and punitive trade tariffs.

- Agoa is a landmark trade agreement that has been in operation for the last 25 years, allowing economies in Africa to ship goods into the U.S. market duty free.

- The end of Agoa could spell doom, shattering income streams and careers while throwing livelihoods into poverty.

As September 30th, 2025 winds down, policymakers across Africa are searching for the fine print of a Trump White House latest communique that indicates his administration is in support of a one-year extension of the African Growth and Opportunity Act (Agoa).

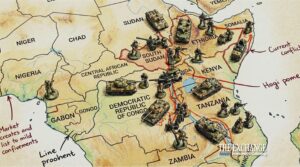

For Africa, the trade relation with Washington has been strained since Trump 2.0 with aid cuts, immigration crackdown, outright visa denials, punitive trade tariffs and now Agoa, perhaps the last leverage that saw economies across the continent trade with the U.S. is on the chopping board.

Donald Trump administration is yet to announce its support of extending Agoa, a landmark trade agreement that has been in operation for the last 25 years, allowing economies in Africa to ship goods into the U.S. market duty free.

With this uncertainty, hundreds of thousands of workers in Kenya, South Africa, Lesotho are looking at gloomy future, unaware what the future holds. The end of Agoa could spell doom, shattering income streams and careers while throwing livelihoods into poverty.

Jobs, livelihoods, economies on edge as Agoa ends

Last year, Kenya shipped $470 million worth of goods into the U.S. via Agoa, an undertaking that supports about 66,000 direct jobs, mainly women who are employed in clothing factories spread across Export Processing Zones around the capital Nairobi. As uncertainty grips the sector, across Africa, the relationship between countries and the U.S. have strained with Trump’s introduction of tariffs as high as 30 per cent for Botswana and 10 per cent for Kenya.

According to the United Nations Trade and Development (UNCTAD), sudden freeze of Agoa post September 30th could further worsen market access to the U.S. for over 31 countries in Africa, which in 2023 recorded about $10 billion in shipments to buyers in America.

Since 2000, sub-Saharan countries have enjoyed duty-free access to the U.S. for an estimated 1,800 products made in the continent. So far, the continent’s most advanced economy, South Africa, is the largest exporter of goods to the U.S. under the decades old plan. Without Agoa, the economy stares at hemorrhaging over 35,000 jobs in the agribusiness value chain alone, while Madagascar will grapple with 47 percent duty on U.S. bound vanilla and textile exports.

Agoa key driver of U.S. investments in Africa

Other than clothing, African countries have also been exporting fuels, and metals under Agoa, an initiative that has enhanced foreign direct investment by U.S. firms on African soil. For policymakers in Africa, the Trump administration has been showing little regard to Agoa, especially with the introduction of sweeping trade tariffs in May that saw shipments into the U.S. attract increased duties regardless of preferential status under Agoa treaty.

With the end of the trade treaty on September 30, many countries will revert to meeting country-specific, sector-specific tariffs, further compounding the impact, and potentially reducing earnings for countries on U.S. bound exports.

For Kenya, without the trade program apparel exporters could see a near triple rise in duties from 10 per cent to 28 per cent, UNCTAD states, while Madagascar is likely to start paying double or 28 per cent in duty on U.S. bound shipments.

“Without AGOA’s renewal, Africa’s export competitiveness in the US market could quickly erode at a time when competition for alternative export markets intensifies globally. Accelerating the implementation of the African Continental Free Trade Area could help mitigate this situation, but such a readjustment would be challenging and require considerable time,” UNCTAD notes in an update.

Read also: AGOA’s Crossroads: The Future of US-Africa Trade Relations

Diversification needed to counter global turbulence

In recent years, the African Union (AU) has been calling on nations across the continent to firm up their support for the African Continental Free Trade Area (AfCFTA), a trade blueprint that could usher the zone of 1.3 billion people to economic independence in the face of global turbulence.

As Agoa wobbles, AfCFTA, a bloc that brings together 54 countries, could now become more attractive proposition for policymakers as the continent explores alternative trade routes. At the same time, China, which continues to make inroads across Africa building key infrastructure is likely to emerge as a preferred destination for African goods.

In the wake of Donald Trump’s tariffs, Beijing abolished export duty for up to 33 African countries, positioning itself as a worthy choice over the U.S. Data from Chinese authorities shows that trade between China and Africa expanded by 4.8 per cent to $295 billion last year.

Other strong players in the international trade ecosystem including Japan, the UAE, Turkey, Russia, Malaysia, Brazil, are also strategically offering themselves as preferred alternatives to countries in Africa scouting for trade avenues.

Read also: The US Congress proposes extending Agoa to 2041, covering all African countries