- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Author: Alex

Corporate announcements have been salient in the bourse in the review period. To be exact, the price action at the bourse has been weighed down by COVID-19 headwinds and corporate announcements have injected some freshness. We highlight some of them in this article.

Carbacid Investments Plc served BOC Kenya Plc late November with a notice of intention to acquire all the ordinary shares of the latter at a price of KES63.50 per share. Due to the fact that BOC Kenya owns 14.85Mn shares in BOC Kenya (representing an ownership stake of 5.83%) and to be in compliance with Section 108 of the Companies Act, 2015, Carbacid’s acquisition offer is a joint affair together with Aksaya Investments.

BOC Holdings, which has a 65.38% ownership stake in BOC Kenya, issued an irrevocable undertaking to the co-offerors to accept the acquisition offer albeit with certain conditions. That means that the shares to be …

Recruitment in any industry requires due diligence and fact-finding so that a firm ends up with a suitable or better candidate than the previous one if recruiting for a vacated position.

There are various ways to recruit including LinkedIn profiles, employee referrals, industry networking events, college recruitment fairs and the most popular one in Kenya, recruitment agencies.

We will look at the last one because it seems to be the one tasked in recruitment by almost all insurance companies in this country. When these agencies get to work, they will of course look at previous experience for the position they are supposed to fill, and if it is a CEO’s job they will look at someone who has held that position before or a position very close to that. That is exactly where the problem starts.

Most of these recruitment agencies are not specialists in insurance matters and most do …

Many of our clients and most of our fund partners are based in Europe – we help our African investors to access opportunities outside Africa and so to diversify their investment portfolios. Europe and America have definitely been harder hit by Covid-19 than Africa and whilst the investments that we promote have fared well in the financial storm, the last 12 months have therefore been challenging in terms of contact-ability and administration.

The UK, for example, has just entered its third lockdown; ninety percent of the financial community is working from home, and the banks are only open for three hours a day! During this period of endless, temporary, irritating, enjoyable, frustrating, life-affirming incarceration I have often had far too much time on my hands which is both brilliant and horrible! It does mean that I have been able to do a lot of thinking. …

The year has begun on a cautiously positive tone with market generally on the uptrend; activity gradually picking up following the end of the Christmas and New Year holidays. The NSE-ASI and NSE-20 are up 1.2% and 1.8%, so far this year respectively. The prospects of improvement in business environment from the depths of 2020, investors are cautiously looking at the attractive valuations in the markets although inherent risks including economic recovery, cashflow constraints and heightened political activity with the likely upcoming referendum. …

The New Year 2021 has begun on a high note with the reality of the coronavirus vaccine shining across the globe. The year 2020 will certainly be etched in the minds of many people across the world for the wrong reasons. It is the year that the coronavirus caused death, illness and economic despair across the world.

In Africa, the COVID-19 pandemic has hugely torpedoed the continent’s war against poverty. According to the IMF, developed economies will shrink by around 6% in 2020 while emerging markets and developing ones will shrink by 1%. With more people living close to the international poverty line in developing nations, it is imperative to note that low and middle income countries will suffer the greatest repercussions in terms of extreme poverty.

Also Read:BUSARA CENTER AIMS AT POVERTY ALLEVIATION

The definition of poverty entails more than just the lack of income and productive resources …

In the words of Charles Dickens these are “the best of times and the worst of times” – the financial world is suffering severe labour pains but is also pregnant with possibilities. It appears that the East African business world is breaking early for Christmas but I am sure that all of us are desperately trying to predict the future for both our local economies and the world in general. Here in Uganda we are seeing a significant increase in Covid-19 cases which is, of course, in no way linked to the frantic and socially un-distanced political campaigns currently taking place!! Frankly nothing is certain except considerable uncertainty.

So if there aren´t any certainties then what are the likely economic and consumer trends for 2021?

Economic Trends

It is inarguable that a world economy that was already approaching its peak pre-Covid-19 period has moved rapidly into recession. The effects …

According to Wiktionary, to claw back is to recover or retake with great effort something that was lost.

In the insurance industry the words “claw back” are used in relation to insurance commissions that are deemed payable to insurance agents or brokers. The implication of these two words is that commissions paid up to the intermediary are forcibly taken away from them at a future time from other commissions payable for business delivered. The biggest question from this practice is: how legal is this?

The Eleventh Schedule of the Insurance Act Cap 487 of the Laws of Kenya spells out maximum brokerage, commission or other procuration fees payable after a business is introduced into the insurance company by an intermediary. It is worthy to note that a commission is payable after the company is satisfied that the business so brought has met all the underwriting guidelines and has therefore been …

In the affairs of conducting business – whether it is a single, family-owned venture or a large multinational conglomerate – capital is at the crux of the undertaking.

In this edition, The Exchange brings to you Part 2 of a two-part series on Patient Capital and how Africa can reap the tremendous value of philanthropy in business.

Patient Capital: An Instrument for Financing Development

Over the last decade, a new breed of investors focused on financial returns with a strong social and environmental value proposition have emerged in Africa. These “impact investors” seek to consolidate financial returns with social impact by utilizing the apparatus of venture capital to make principal investments in private, high-growth companies/organizations that have the potential to deliver some quantifiable social or environmental benefits.

Patient capital is an emerging investment instrument that generally falls under a broad category of vehicles for financing social change and economic …

As 2020 finally crawled to a close, uncertainty still overhangs the general market with recent quarters recording subdued market activity and marginal price movements on majority of key index counters. This entrenches 2020’s bearish sentiment with both the NSE All Share Index and NSE 20 Share Index down 11.6% and 32.4% year-to-date (YTD), respectively. Despite the improvement in business environment from the steep dip of 2Q20, markets are now grappling with inherent risks of slower economic recovery, the second wave of the Covid-19 pandemic and heightened political activity heading into 2021.

Also Read: Is Integration the Solution to Africa’s Stock Exchanges?

So far during the year just ended, there have been notable out-performers across the market. Carbacid Investments (+47.5%), Kenya Airways (+46.3%) and Absa NewGold Exchange Traded Fund, ETF (+30.8%) gave investors the best returns during the year. Both Carbacid and Kenya Airways rallied on significant …

By June Njoroge

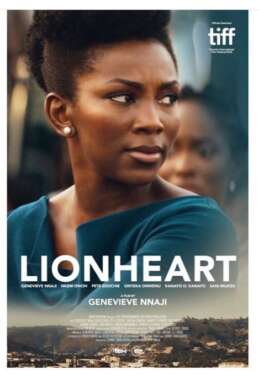

The snowballing of African cinema over the past several years has illuminated, thereby catapulting the supposed ‘dark continent’s’ dynamic industry onto mainstream international market; with both production houses and freelance film–makers keen to cash in on the burgeoning demand for African films. African-made releases have evidently driven growth in key markets. The continent boasts of the second largest industry, Nollywood, which generates $590 million, annually and makes for the second largest employer in Nigeria, generating well over one million jobs. South Africa comes in second, with the industry’s worth estimated at R3.5 billion, annually. According to a 2018 report, ‘Framing the Shot-Key Trends in African Film,’ by Dayo Ogunyemi’s 234 Media house, in partnership with the Goethe-Institut; the two largest film industries in Africa contribute a total of $1 billion to the continent’s annual GDP.

A report from PwC on the …