- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Author: Maingi Gichuku

Maingi Gichuku is passionate about helping African businesses grow by offering technology solutions. With a BSC in Zoology and biochemistry, Gichuku yearns for an Africa that can find solutions to its challenges. My drive is to see an economically dynamic Africa and embrace its populations by creating opportunities cutting across the social and economic strata.

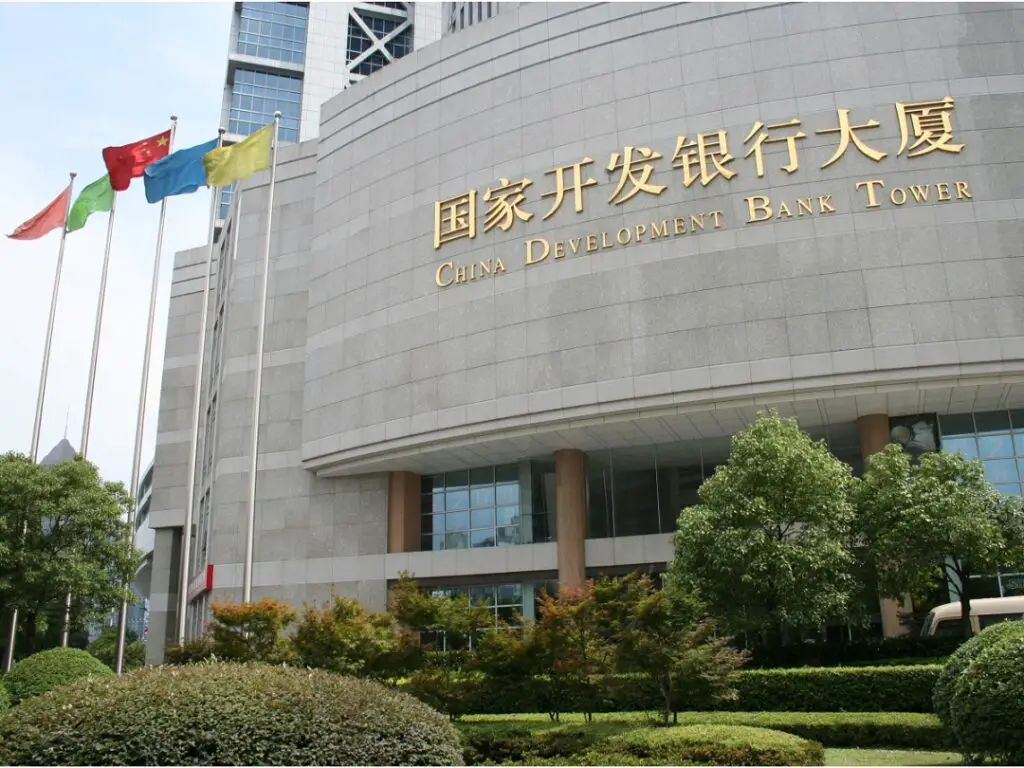

In a significant move to bolster Africa’s economic landscape, the China Development Bank (CDB) and the African Export-Import Bank (Afreximbank) have embarked on a collaborative journey in Cairo. The outcome of this partnership centers around a $400 million loan. The loan will catalyze the growth and prosperity of small and medium-sized enterprises (SMEs) across Africa.…

Indonesian businessman Iman Soerjasantosa, the manager of Búzi Hydrocarbons in Indonesia, has unveiled plans for $120 million investment in Mozambique. This investment is aimed at constructing a state-of-the-art Liquefied Natural Gas (LNG) plant.

Soerjasantosa says there is a strong willingness of Indonesian companies to invest in Mozambique, a nation that currently boasts a number of ongoing projects, including seismic studies and exploratory drilling, all designed to uncover and capitalize on additional natural gas deposits.…

- Talks between President William Ruto and TikTok’s CEO Shou Zi Chew will see the video sharing platform set up Kenya office to oversight Africa

- The move comes a week after a call to ban TikTok for sharing explicit content was tabled in Parliament.

Video sharing platform TikTok has agreed to establish a Kenyan office aimed at enhancing content moderation and operational efficiency across Africa. This decision comes against the backdrop of existing legal issues related to content moderation in Kenya.

Following discussions with President Ruto William, TikTok’s CEO, Shou Zi Chew, has made a commitment to set up a dedicated office in Kenya, responsible for coordinating TikTok’s activities across the African continent.

This meeting, held on August 24, 2023, gains significance in light of recent debates concerning the potential ban of TikTok due to sharing of explicit content in the country. The office’s establishment aligns with President William Ruto’s assertion

- Locals around Lake Albert alarmed by oil companies neglecting the essential rituals needed to preserve these places’ sanctity.

- TotalEnergies is encountering legal challenges and criticism for its environmental impact, including contributions to climate change.

- A key part of this effort is the $3.5 billion East African Crude Oil Pipeline. While it could bring economic gains and regional energy integration, it has climate and environmental concerns.

In a region where oil activities are expanding into sacred natural sites, a small Ugandan community is grappling with the encroachment on their spiritual spaces. According to AP, Alex Wakitinti, the chief custodian of these revered sites near Lake Albert, is concerned about the disregard shown by oil companies, including French giant TotalEnergies, for the significance of these locations. These sites are vital to the cultural and spiritual practices of the Bagungu community in the remote Buliisa district, adjacent to the Congo border.

Wakitinti …

Standard Bank, Africa’s largest lender by assets, reported a remarkable surge in interim profit, demonstrating resilience in the face of adversity. The bank’s prudent approach and high-interest rates acted as countermeasures against escalating bad loans, resulting in a notable boost in profitability.…

- d.light enters into $30 million securitization facility, supporting its plan to acquire up to $125 million in energy assets.

- This funding is a partnership with the Eastern and Southern African Trade and Development Bank Group (TDB Group).

- Last year d.light’s PAY-GO model impacted over 1.6 million people, creating 2,000 jobs.

Solar lighting equipment provider d.light has secured fresh financing to increase availability of energy devices in households across Tanzania. The deal, which is a partnership with the Eastern and Southern African Trade and Development Bank Group (TDB Group) will fortify d.light’s existing financing, allowing the company to amplify the reach of its transformative Pay-Go personal finance service.

The company seeks to make solar-powered household products accessible to individuals and households with modest incomes. By leveraging securitized financing, d.light seeks to expand the availability of its cost-effective solutions, which include solar energy, battery storage, and more. The move not only benefits …

- The World Bank Group has suspended new loans to Uganda in response to the country’s Anti-Homosexuality Act.

- Uganda’s anti-LGBTQ law, with its provisions carrying the death penalty for “aggravated homosexuality,” is sparking global concern.

- The World Bank provided $5.4 billion in International Development Association financing to Uganda by the end of 2022.

In a significant move, the World Bank announced on Tuesday its decision to suspend new lending to the Ugandan government. This decision comes in response to the Ugandan government’s enactment of an anti-LGBTQ law. The law is still garnering widespread condemnation from numerous countries and international organizations, including the United Nations. The bank’s stance is rooted in the belief that this law directly contradicts its core values and principles.

The World Bank’s social standards

Promptly after the anti-LGBTQ law was implemented in May, a World Bank team embarked on a fact-finding mission to Uganda. The team’s assessment concluded …

The African Continental Free Trade Area (AfCFTA) has presented a distinctive opportunity to bolster economic growth, alleviate poverty, and decrease Africa’s reliance on volatile commodity cycles. According to a World Bank report from 2020, the AfCFTA can increase the continent’s income by 7 per cent by 2035 and elevate around 40 million individuals out of extreme poverty. This positive impact is primarily attributed to the stimulation of intraregional trade, termed the “AfCFTA trade scenario” for this analysis.…

- South Africa has just 18 months to show that it has an effective anti-money laundering (AML) policy.

- The government estimates that between $2 billion and $8.3 billion is laundered annually through local financial institutions.

- Banks in South Africa must find a new way to prove identity to prevent money laundering and cyberattacks.

South Africa has just 18 months to show that it has an effective anti-money laundering (AML) policy, an undertaking that banks can help to rescue the country from the grey list. In January 2025, the global anti-money laundering watchdog, the Financial Action Task Force will review its decision to greylist South Africa. The agency will interrogate the public and private sector measures taken by the country to address its concerns.

The nation will have to present a workable, scalable plan to stop fraud, money laundering, and other financial crimes. Failure to do so will have severe negative economic …

The two-day Russia-Africa summit 2023, being held in St. Petersburg, is seen by Putin as a major event to bolster ties with Africa, a continent with 1.3 billion people that is increasingly assertive on the global stage. This marks the second Russia-Africa summit since 2019. However, the number of heads of state attending has significantly reduced, from 43 in the previous summit to only 17 now. The Kremlin attributes this decrease to crude Western pressure discouraging African nations from participating.…