- Zanzibar’s growing bet on seaweed: A fix for the island’s economic diversification?

- Africa-Indonesia investment forum poised to yield $3.5Bn worth of deals

- Can Africa’s fragmented voice find unity at COP29 climate finance talks?

- Relief for DRC: 100,000 mpox vaccines to shield at-risk populations

- Inside the multibillion-dollar pacts African leaders inked with China

- Abu Dhabi gears up for AIM Congress 2025, projects to host over 25,000 participants

- New era in Nigeria energy sector as $20Bn Dangote refinery starts petrol production

- Base Titanium’s December exit: A body blow to Kenya’s struggling mining sector?

Author: Martin Mwita

Martin Mwita is a business reporter based in Kenya. He covers equities, capital markets, trade and the East African Cooperation markets.

Diaspora transaction volumes rose to Ksh107 billion in 2018

Equity Bank’s Fintech innovation and digitization has powered rapid growth of Diaspora banking boosting the total revenue income by 38 per cent.

Diaspora transaction volumes grew by 196 per cent to Ksh107 billion (US$1.06 billion) while the commissions recorded a 169 per cent rise from Ksh279 million (US$2.76 million) in 2017 to Ksh751 million (US$7.43 million) after the same period last year.

The results came in the backdrop of a unique business model and strategy that creates resilience while managing headwinds of interest rate capping and challenging macroeconomic and business environment.

Speaking during the release of the 2018 full year results, Equity Group CEO & MD Dr. James Mwangi noted that, remittances have taken a significant market share moving from Ksh36 billion(US$356.1 million) to Ksh107 billion(US$1.06 billion) and hopefully this year surpassing Ksh200 billion (US$1.98 billion) in diaspora remittances processing simply …

Private capital remains an important driver of investment activity in much of Africa

Office yields remained largely stable in most African markets over the past two years, anchored by patient domestic capital as local investors assume a longer-term perspective, a new analysis by Knight Frank shows.

The analysis, published in a new Knight Frank report dubbed Africa Horizons, shows that of the 35 office markets covered, yield remained stable in 16 locations in the two years to 2018 and rose in six, while 13 markets recorded declines.

Africa Horizons provides a unique guide to real estate investment opportunities on the continent, examining developments in agriculture, hospitality, healthcare, occupier services (office), capital markets, residential and logistics property sectors.

“By taking a longer-term perspective, and in some cases a lower return profile, local investors have remained more active than headline figures suggest. This explains how yields in most major markets have remained …

Money Market Funds remain the largest Unit Trust Fund

Unit trust fund investments in Kenya recorded a 4.3 per cent growth in 2018, latest industry data shows, as investors moved to deepen the capital markets and provide alternative funding for businesses.

During the year, Total Assets Under Management (“AUM”) held by Unit Trust Fund Managers grew to Ksh58.0 billion (US$574.8 million) up from Ksh55.6 billion (US$551 million) recorded in 2017.

This came as the money market funds continued to be the most popular product with the AUM held by Money Market Funds, having grown by 8.9 per cent to Ksh48.5 billion (US$ 480.6 million) in 2018

This was up from Ksh44.5 billion (US$441 million) recorded in 2017, a report by investment firm-Cytonn shows, indicating that Money Market Funds are growing faster than the overall market.

CIC Asset Managers recorded the strongest growth in AUM of 36.3 per cent to Ksh20.3 …

Coverage of retirement schemes in Kenya remains below 50%

Majority of Kenyans securing their old age by saving under retirement schemes are still exposed to tough times during sunset years, a survey has revealed.

The study by pension fund administrator Zamara Group has revealed that though pension’s legislation in the country has improved the governance and operations of the retirement funds, it has done little to improve the coverage and adequacy of retirement benefits to individuals.

Coverage of retirement schemes in Kenya has remained relatively low with less than 50 per cent of the formal sector covered and coverage of the much larger informal sector virtually non-existent.

According to Zamara Group CEO Sundeep Raichura, even those who are saving under retirement schemes have insufficient coverage to provide an adequate income when they retire.

The study which covered 65,000 retirement scheme members, spread across more than 200 retirement funds in the …

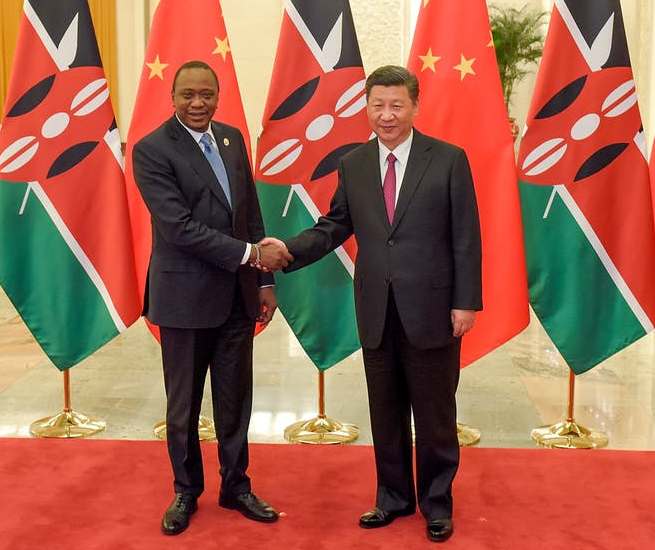

Loans from China hit a high of US$6.2 billion last year

The Chinese government has dismissed claims that it’s continued heavy lending to Kenya in the financing of mega infrastructure projects is a ‘ debt trap’, even as loans from Beijing hit a high of ShUS$6.2 billion(Sh625.9 billion) in December last year.

This is up from US$5.3 billion (Sh535 billion) a year earlier with a lion share going towards the construction of the multi-billion Standard Gauge Railway (SGR).

“We are not putting Kenya into a debt trap. China-Africa corporation cannot put Africa into a trap but booming economic growth,” China’s Charge’ D’affaires (Nairobi) LI Xuhang said during a meeting in Nairobi on the update on the SGR and China-Kenya relations.

“Kenya can decide on who they want to partner with. Kenyan people are wise enough to choose their trade and corporation partners. They can decide who benefits them more,” Xuhang …

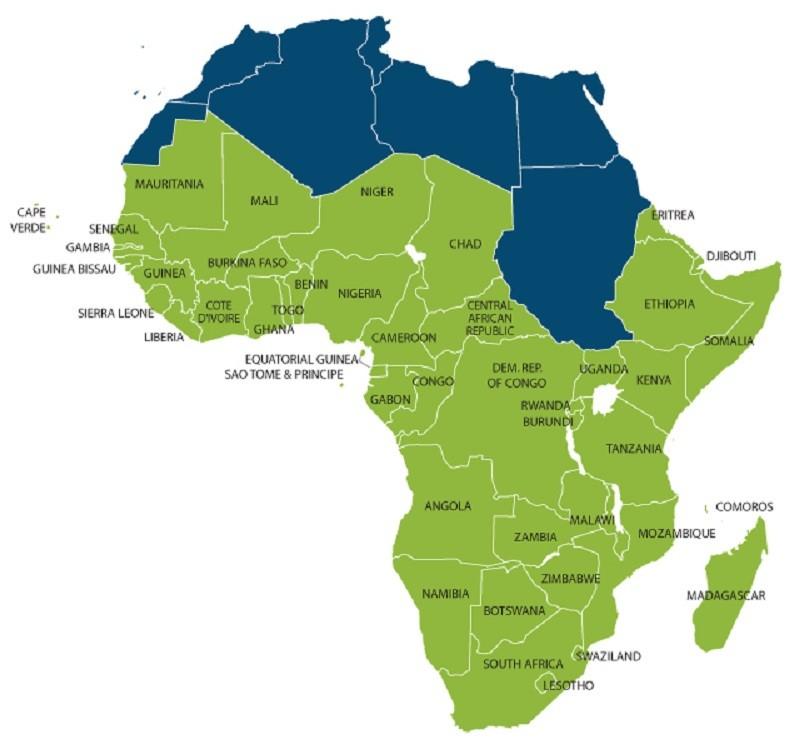

Three years past the crisis period, economies are still performing poorly

The growth story in Sub-Saharan Africa in the past few years has been one of faltering recovery from the worst economic crisis of the past two decades.

This remains the case according to the World Bank’s April 2019, 19th edition of Africa’s Pulse, which estimates GDP growth in 2018 at a lower-than-expected 2.3 per cent, with a forecast to 2.8 per cent in 2019.

“Three years past the crisis period, we should be seeing a more widespread pickup in growth; instead we have downgraded our estimates again for 2018,” said Gerard Kambou, World Bank Senior Economist for Africa, “Leaders in Sub-Saharan Africa have the opportunity to build stronger domestic policies to withstand global volatility – and now is the time to act.”

The report notes that the three largest African economies—Nigeria, Angola and South Africa—play a big role …

Mobile subscription in the country grew 6.2 per cent in the second quarter of 2018

A proliferation of mobile applications on popular online stores is exposing Kenyans to increased cyber attacks and fraud, a latest sector statistics report by the Communications Authority of Kenya (CA) has revealed.

This comes in the wake of a fast growing mobile subscription in the country which grew 6.2 per cent in the second quarter of 2018(October-December).

According to CA’s sector statistics report for the financial year 2018-2019, mobile subscriptions in Q2 grew to 49.5 million up from 46.6 million in the first quarter(July-September).

Data subscription during the period increased to 45.7 million from 42.2 million in the previous quarter, meaning Kenyans are increasingly getting connected to the internet.

This has created a field day for fraudsters who are taking advantage of innocent members of the public with little knowledge on cyber attacks.

The report …