- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Author: Laurence Sithole

I am a financial services professional with a strong background in diverse areas of banking. My skill set includes among others International Banking, Trade Finance, Commercial Lending, Customer Service, Finance, Banking, Corporate Finance, and Investment Banking. Africa is my home and I am passionate about its development,

- Zimbabwe is phasing out ZWL as it ushers a new gold-backed currency, ZiG, starting today, Monday, 8 April 2024.

- The ZiG is anchored by 2.5 tonnes of gold in the central bank’s vault and a basket of foreign currencies held as reserves.

- Zimbabwe’s new Central Bank Governor has announced sweeping reforms as the new currency enters everyday use.

Zimbabwe launched a new currency on Friday, 5 April 2024, called the Zimbabwe Gold or the ZiG. The launch of the new currency occurred during the announcement of the country’s latest Monetary Policy Statement (MPS) in an event presided over by newly appointed central bank governor John Mushayavanhu.

The MPS introduced measures and interventions to anchor the local currency and ensure exchange rate and price stability. The old currency, the ZWL, had depreciated to its lowest against the US dollar, roughly ZWL 32,000. It lost over 90 per cent of its …

- Glencore spin off of its coal business is the result of mounting pressure from its shareholders over Environmental Social and Governance (ESG) and climate concerns.

- The company resolved to spin off its coal activities after finalizing its acquisition of the coal assets belonging to Teck, a Canadian mining company.

- Glencore had initially sought to acquire Teck Resources entirely but was thwarted by the target company’s controlling shareholder.

- Shareholders in the company have since 2021 rejected the company’s climate report and its disclosures leading to the resolution to spin off its coal business.

Glencore spin off, the background

Glencore, one of the largest mining companies in the world, that is listed on the Johannesburg Securities Exchange and the London Stock Exchange announced that it would demerge its coal assets and list them as a separate business on the NYSE and JSE in two years’ time.

This follows pressure from shareholders that …

- Reduced commodity prices will hamper Zimbabwe’s economic growth aspirations in 2024. Commodities produced by Zimbabwe include platinum, gold, and diamonds.

- Over the last two years, the country earned record foreign exchange export receipts due to booming commodity prices. However, exports have started to slow and are expected to continue into 2024.

- Zimbabwe will face a perfect storm of economic headwinds, combining factors such as persistent soft commodity prices, anticipated El Nino conditions leading to reduced agricultural output, and lower power generation, all contributing to a reduction in economic growth.

Zimbabwe’s economic growth in 2024 will face challenges due to headwinds within its economy, compounded by external factors undermining its growth aspirations. Global commodity prices have recently decreased, posing a significant concern for countries dependent on producing these commodities for economic sustenance.

Over the last two decades, mining has increased significantly in Zimbabwe’s economy. While agriculture was once central to the …

- The Reserve Bank of Zimbabwe last month began to loosen the tight monetary policy it had in place over the last 2 years to act against inflation.

- The hawkish stance of the central bank began to change when the RBZ announced that it would reduce interest rates by 50% to 150%.

- Zimbabwe’s central bank’s hawkish stance has resulted in a weakening economy and rising unemployment.

The Reserve Bank of Zimbabwe held the global record for highest interest rates, reaching a staggering 200%. The central bank has lowered this to 150% on the grounds that the inflationary conditions that required the significant increase have subsided. As is typical with hawkish monetary policy approaches, Zimbabwe’s central bank’s hawkish stance has resulted in a weakening economy and rising unemployment.

On 3 February 2023, the Zimbabwean monetary authorities issued the country’s first Monetary Policy Statement via the central bank. Twice a year, the Reserve …

- The VFEX or Victoria Falls Stock Exchange is Zimbabwe’s exclusively United States dollar only stock market which was launched 3 years ago.

- The Zimbabwe Stock Exchange or ZSE’s main board has been shrinking because of companies migrating to the VFEX.

- Companies in Zimbabwe constantly experience a shortage of foreign exchange to support their increasingly import reliant businesses.

The number of companies that are delisting from the main board of the Zimbabwe Stock Exchange, often known as the ZSE, and moving their operations to the ZSE’s hard currency equivalent, the Victoria Falls Stock Exchange (VFEX), has been growing. When the central bank eliminated the favorable foreign exchange retention levels that had been the primary draw of the VFEX, it is anticipated that the outflow from the ZSE will slow down in 2023. This comes after the central bank eliminated the foreign exchange retention thresholds.

- The capitalist class consists of less than 1% of the richest individuals in the world.

- These members of the capitalist class are worth a collective US$ 12 trillion. This is according to Forbes magazine which profiles the members of this exclusive club.

Less than 1% of the global population consists of the world’s wealthiest individuals. In 2022, there were fewer billionaires than in the previous year. When compared to the rest of the globe, Africa’s list of billionaires is relatively static. It is economically advantageous to have more billionaires than none. An economy is seen to be progressing if there are more billionaires than before.

- It is desirable for a country to have a growing number of members of the capitalist class among its population.

- It is a positive sign of economic growth when the number of billionaires are increasing in a country.

- To be a member of the capitalist

The two south American nations are exploring methods to increase bilateral commerce and wean themselves off the mighty US currency. Its announcement has been widely criticized since they are not a natural fit for a single currency. This is due to one country’s relative economic prosperity and the other’s economic upheaval. This experience between Brazil and Argentina is instructive and illustrative for African nations with comparable aspirations to develop a single currency.

- Brazil and Argentina announced early last month that they would create a joint currency to increase trade and political relations.

- Similarly Africa has expressed the same ambitions at different times. The advent of AfCFTA gives further impetus to the concept that Brazil and Argentina has reignited.

- Brazil and Argentina first came up with the idea of a joint currency in the 1980s but it never took off because economic fundamentals.

- The joint currency experiment by Brazil and Argentina

- Zimbabwe’s banking and financial industry reflects the overall health of the economy.

- The country has broadly experienced capital flight and negligible foreign direct investment during the last 2 decades.

- Policy inconsistency has undermined Zimbabwe’s banking and financial industry together with its capital account.

Thungela Resources set to diversify beyond coal in South Africa

Zimbabwe has been dubbed the sick man of southern Africa for the past 25 years. The country has seen capital flight and an outflow of foreign investment. There are numerous causes for this result. The primary cause has been policy blunders and so-called “flip-flopping” by government gatekeepers.

Like to the rest of the world, Zimbabwe’s banking system reflects the activity of the actual economy. Banks and other financial services institutions serve as financial mediators for real economy players. This indicates that banks serve as a vital link between surplus and deficit units.

In economic terms, this means …

- Thungela Resources Limited has been busy with mergers and acquisitions to grow its geographic footprint and diversify from its pure play coal business.

- The JSE listed miner recently made the news when it agreed to purchase an Australian coal miner called Ensham.

- The acquisition of Ensham is an all cash transaction wherein Thungela is taking a 65% interest.

The Johannesburg Stock Exchange (JSE) listed pure play coal mining company which was created from the demerger of Anglo American’s coal assets has been on a mergers and acquisitions spree. Thungela announced earlier this month that it had acquired an Australian coal mine. This move has been read by market analysts as a risk mitigation move by diversifying away from South Africa. It also bought out its Black Empowerment partners in a US$ 60 million transaction.

Green Bonds: A possible solution to the Zimbabwe power crisis

On the M&A front, Thungela bought …

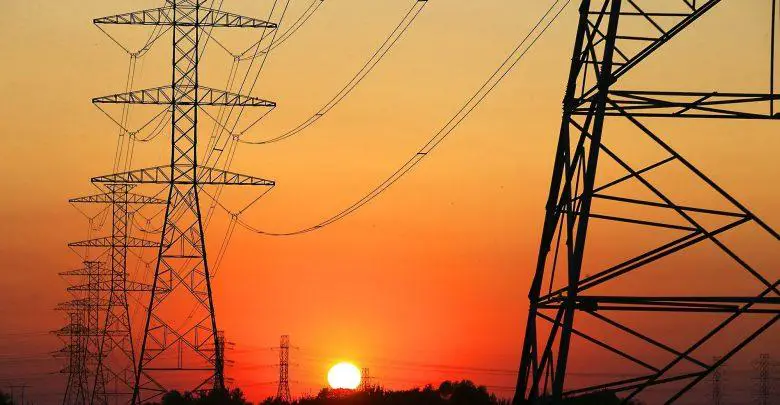

- Zimbabwe is experiencing crippling power outages characterized by black-outs that can extend to as much as 19 hours a day.

- The electricity shortage is now common place with South Africa recently announcing Stage 6 power cuts.

- The debt capital markets, specifically the issuance of green bonds is a possible solution to rolling black-outs.

Zimbabwe is in the middle of a power crisis that can be attributed to the low water levels at the country’s Kariba Dam which has in times past been used to supplement the country’s power needs. Power outages are a part of every day living in the country.

However, the latest power crisis seems to be more intense threatening to scupper economic growth. Businesses and citizens have had to adjust to erratic power supply schedules. It is now commonplace for people to wake up at midnight to iron their clothes and use their electric appliances as this …