- Traders holding the Cardano token will obtain loans of up to 70 per cent of the ADA tokens they hold.

- The concept of decentralization and blockchain technology can replace traditional financial services such as commercial banks. Cryptocurrencies can also be used as an investment tool, and so can Cardano (ADA).

- The government of Ethiopia and Cardano Development had sealed an agreement to introduce 5 million secondary school students and 700,000 teachers on the Cardano blockchain app.

- The downside of taking loans on Cardano is that the borrowers will have to self-manage the risk of the fluctuating Cardano price.

Cardano (ADA) is proof to take blockchain led by Ethereum co-founder Charles Hoskinson. Charles initial purpose in designing the token Cardano was to create competition for the Ethereum token. Cardano launched on September 29, 2017, after two years of development.

Cardano combines pioneer technologies to provide unparalleled security and sustainability to decentralized systems, applications and societies. Cardano is fast establishing foot in Africa. One of the ways the platform is driving its influence is by providing loans with shallow interests and a higher tenor.

Cardano to Issue development-friendly loans.

Bitfinex, a digital token trading platform, has added Cardano (ADA) as collateral on Bitfinex Borrow (a P2P digital token loan portal.

Traders holding the Cardano token will obtain loans of up to 70 per cent of the ADA tokens they hold.

“We are pleased to add Cardano to our growing list of collateral options on Bitfinex Borrow,” said Paolo Ardoino, the chief technology officer at Bitfinex. “This will provide our users with another way to take out a personal loan from our highly liquid peer-to-peer lending markets.”

How to take a loan on Cardano

Borrowers select Cardano (ADA) from the currencies listed on the Bitfinex Borrow page. They then deposit sufficient collateral into their Margin wallet. The borrower can then choose between a fixed-rate loan and a variable interest rate based on the Flash Return Rate (FRR).

Read: Nigeria: Central Bank licenses lending apps to regulate borrowing

Borrowers are allowed to choose the tenor in which to repay the loan back. Fixed-rate loans offer a maximum of 120 days, after which the loan converts into a variable rate loan.

The loan taken will be credited to the borrowers’ Margin Wallet, where they can make full or partial repayments on the principal and interest of the loan. This is done by moving the value of their funds back to the Margin wallet, reducing the daily interest rates.

The downside of taking loans on Cardano is that the borrowers will have to self-manage the risk of the fluctuating Cardano price. The ADA loan option is attractive, and one may ask how one gets to navigate through the process to acquire the funds! Here is some feed.

How to buy Cardano

To acquire Cardano in your Margin wallet, you must first create a trading account of a crypto trading platform such as Binance, coinbase, eToro, SoFi Active investing, among several others.

Coinranking reports that ADA is the cheapest on the Binance platform and has the highest 24h trade volume (US$422.20 million as of February 17, 2022).

How to buy Cardano on Binance

Make sure you have USDT in your Binance account. If not, you can buy the token; On the display menu, click on trade, P2P. Choose fiat according to the national currency you are holding. Male payment to the listed sellers, and in less than 15 minutes, you will receive your USDT.

The binance display has a search panel on the right side. Search ADA and a buy option will appear at the bottom centre of the screen. Insert the Number of ADA tokens you want to buy with the value of the USDT that you currently hold. With that, you qualify to benefit from the loans offered by Cardano development.

Cardano Development is creating a Credit facility in Kenya.

Last year, InfraCo Africa, a member of the Private Infrastructure Development Group (PIDG), arrived at a mutual Joint Development Agreement (JDA) with Cardano Development, committing about US$1 million to the development of a credit enhancement facility in Kenya. InfraCo investment is backed by the United Kingdom’s Foreign Commonwealth and Development Office (FCDO). The facility aims at discovering and unlocking local currency investment from domestic private and institutional investors.

“Strong local capital markets serve to protect infrastructure projects from external shocks and currency volatility, giving investors’ confidence. The confidence is nurtured by credit enhancement facilities such as the one we are seeking to establish here in Kenya,” said Claire Jarret, the Chief Information Officer at InfraCo Africa. “The facilities have the potential to transform the infrastructure sector, driving economic development and unlocking new sources of long-term finance for the future.”

Read: Kenya: Central Bank calls for views on adopting digital currency

The CEO of Cardano, Joost Zuidberg, said that the company has a strong track record in establishing initiatives similar to the credit facility in Kenya. One of such initiatives is InfraZamin Pakistan which issues credit guarantees for debts directed towards infrastructure development. Based on this success, Joost believes that the partnership with InfraCo Africa and PIDG could develop a potential catalytic credit facility in East Africa, attracting private capital which would otherwise not participate in lending.

InfraCo Africa commits to Capital markets in Africa.

InfraCo Africa has shown commitment towards capital markets in Kenya through Acorn REITs, an investment designed to deliver affordable student accommodation in Africa. Education in Universities based in the capital city has always proven to be an uphill task due to expensive accommodation facilities, a situation that InfraCo intends to checkmate.

The company has also invested in InfaCredit Nigeria, a credit enhancement facility established in 2017 to support Nigeria’s infrastructure development. The credit facility to be developed in Kenya will borrow some principles from InfraCredit.

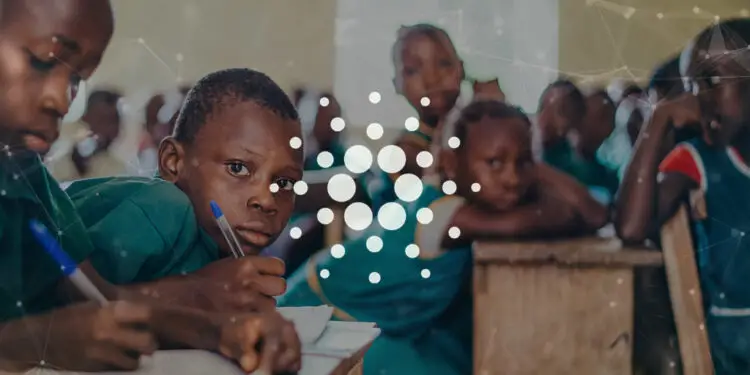

Cardano Development improves the Education system in Ethiopia

In an interview, the Minister of Education in Ethiopia, Getahun Mekuria, said that the government and Cardano development had sealed an agreement to introduce 5 million secondary school students and 700,000 teachers on the Cardano blockchain app.

The government said that Ethiopian schools would use the Cardano blockchain to track student performance.

The students registered on the Cardano development movement will be given a tablet with a dedicated network that will allow the teachers and the government to track the students’ performance.

USAID will fund the purchasing of tablets and build the inadequate infrastructure to facilitate the adoption of the project in the 3,500 schools in Ethiopia.

Input-Output Hong Kong (IOHK), the company behind the Cardano cryptocurrency, organized training with Ethiopia’s local tech community that taught female developers in the country to code in Haskel, Cardano’s programming language.

Currently, a more significant part of the information in Ethiopia is recorded on paper, which implies that the Ministry of Education in Ethiopia find it cumbersome to track information on the ground.

To implement the project in thousands of schools in Ethiopia, many partners need to be on board, including mobile network operators. Instead of hardcopy certificates, high school graduates will be issued near field communication (NFC) chips containing their educational credentials.

The technology will bring an entirely new way of evaluating a person’s intelligence, including their strengths and weaknesses.

The concept of decentralization and blockchain technology can replace traditional financial services such as commercial banks. Cryptocurrencies can also be used as an investment tool, and so can Cardano (ADA).

Cardano enabling the issuance of loans on a blockchain network is a hand on the neck for the regular banks. Cardano Development has had the advantage of being the first platform to popularize and capitalize the use of Point of Scale (PoS).

PoS is a platform where a trader conducts an online or in-person payment of goods and services and where sale taxes might become payable. Receipts from a PoS transaction are generated electronically or in print.

The Adoption of Cardano on the issuance of loans poses some threats. As much as there are personal details of traders in the crypto world, follow up in case of loan default would prove to be hectic and cost-ineffective. The creditor cannot easily decipher the borrower’s physical location, which creates a loophole in Cardano’s brilliant idea.

There is a lack of legal frameworks in most African countries to govern P2P crypto transactions, giving confidence to potential fraudsters on the Cardano network. Countries like Kenya and Nigeria are still reluctant to embrace cryptocurrencies. Maybe the governments feel that regulating and controlling these currencies will be a challenge?

Technological, infrastructural, and internet penetration are also proving to be a nut in the head for the expansion of cryptos. Ignorance of people in Africa over cryptos is another hindrance that will slow down the growth of Cardano in the continent.

Cardano holds an excellent vision for easing financial handling in the continent. It will be an exciting conversation that attracts a lot of interest to see how it will develop!

Read: Serena Williams help African crypto giant, Nestcoin, raise US$6.45 million