- Equity Group anticipates regulatory changes, currency fluctuations, and the broader economic repercussions of global events as obstacles in the future.

- However, the regional lender looks well-positioned to overcome these obstacles due to its robust capital base, diversified business model, and continuous digital transformation.

- Analysis shows that industry-specific factors, market sentiment, and macroeconomic conditions may be exerting an impact on the stock’s performance.

Amidst the ongoing repercussions of the pandemic and geopolitical unrest on a global scale, Equity Group Kenya, arguably the largest financial institution in East Africa, has exhibited exceptional fortitude and expansion during the three months ending September 30, 2023.

In spite of the tough economic climate characterized by inflationary forces and disruptions in the supply chain, Equity Group has disclosed a consistent upward trend in its fundamental financial indicators. An important growth driver has been the bank’s emphasis on digital innovation and customer-centric services, which have significantly increased its deposit and lending portfolios and attracted a substantial number of new customers.

“We grew our loan book by 26 per cent despite the uncertainty of difficult economic times to ensure our customers continued to fund their dreams while keeping the lights of the economy on. We did not hesitate in making this strategic decision to focus on supporting our customers to navigate and survive the difficult and challenging microeconomic environment as this aligns to our true north, our purpose to change lives, give dignity and expand opportunities for wealth creation. It was an easy strategic choice to focus on the long-term resilience of our customers’ success,” remarked Equity Group CEO Dr. James Mwangi during the release of the lender’s third quarter results.

Equity Group saw 5 percent rise in net earnings to US$237.6 million (Kes36.2 billion) for the quarter ended September attributable to an impressive performance from the lender’s subsidiaries in the Democratic Republic of Congo, Rwanda, Uganda, Tanzania and South Sudan.

Analyst Estimates and Financial Outlook for Equity Group

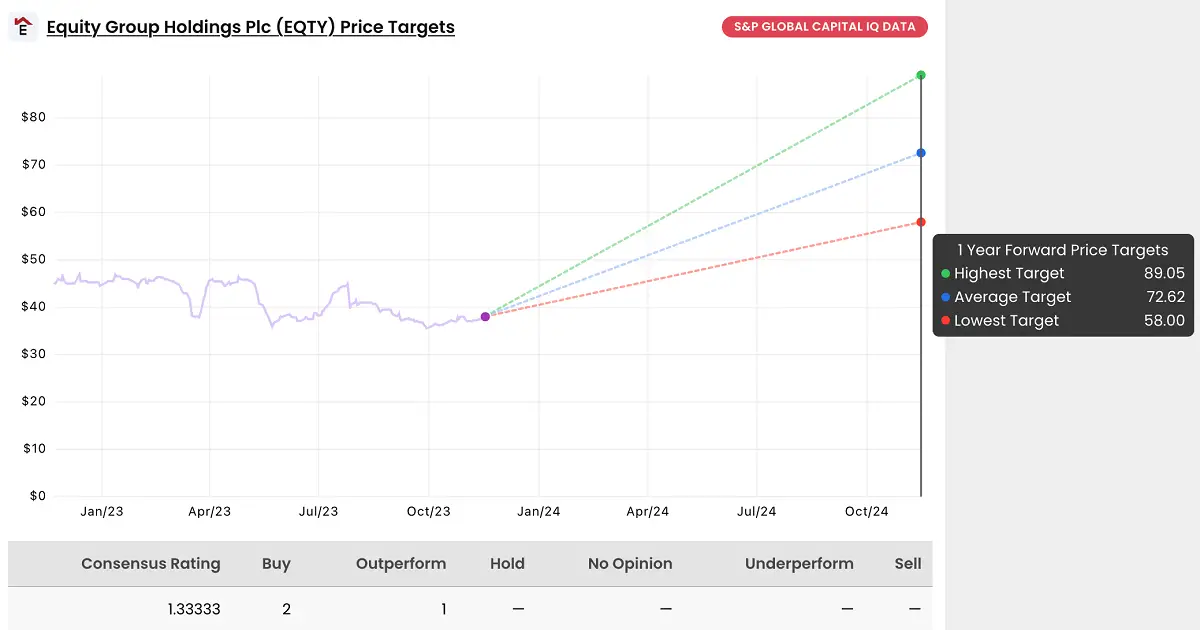

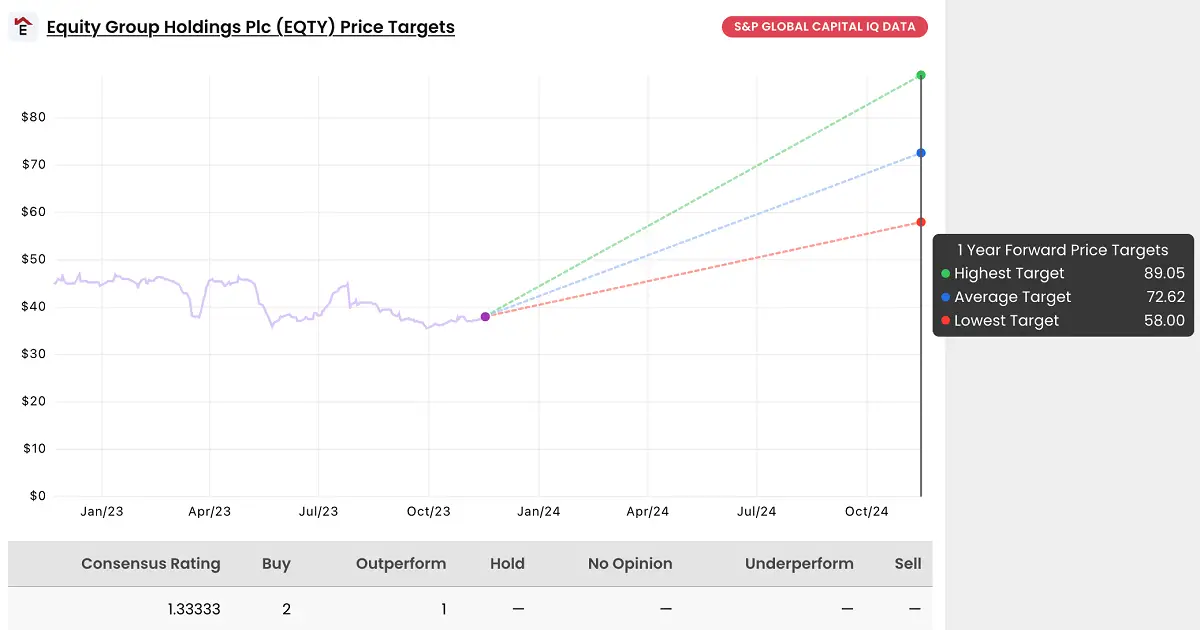

During the initial three quarters of 2023, Equity Group Kenya exhibited favourable indications of expansion. The average target price predicted by analysts is KES72.62 (about US$0.48), which reflects the optimistic outlook that analysts hold.

- The average target price among analysts is KES72.62 (approximately $0.48 USD), suggesting a bullish sentiment.

Revenue Projections:

- KES162.8 billion (approximately US$1.07 billion) in 2023

- KES195.29 billion (approximately US$1.29 billion) in 2024

- KES232.15 billion (approximately US$1.53 billion) in 2025

Estimations of EPS (Earnings Per Share):

- KES13.94 (approximately US$0.092) in 2023

- KES17.28 (approximately US$0.114) in 2024

- KES21.36 (approximately US$0.141) in 2025

Estimates of EBIT (Earnings Before Interest and Taxes):

- KES79.6 billion (approximately US$0.525 billion) in 2023

- KES99.3 billion (approximately US$0.655 billion) in 2024

- KES125.47 billion (approximately US$0.828 billion) in 2025

The decline in Equity Group Kenya’s share price can be ascribed to the recent adverse total returns. The stock is currently trading at KES38, a decrease of -19.06 percent from its 52-week high of KES46.95, as of the latest available data.

Additionally, the YTD total return is -5.84 per cent, and the one-year total return is -7.38 per cent. These negative returns may have contributed to the falling share price. It’s important to consider the overall market conditions and any specific company-related factors that may be impacting the stock price.

Despite positive growth potential and bullish analyst estimates, the negative total returns of -5.84 per cent YTD and -7.38 per cent one-year total return may be contributing to the decline in share price.

A reaction from investors to the stock’s recent performance could result in selling pressure and a decline in the share price. In addition, industry-specific factors, market sentiment, and macroeconomic conditions may be exerting an impact on the stock’s performance.

It is critical to closely monitor the market dynamics and the company’s financial performance in order to determine the cause of the falling share price.

The Impact of Digital Banking on the Game

A considerable increase in digital transactions has resulted from Equity Group’s astute investment in digital banking platforms. By implementing this change, the bank was able to expand its service to remote and underserved areas, thereby expanding its operational expenses and advancing its objective of financial inclusion.

A nonperforming loan ratio below the industry average indicates that the bank’s assets have maintained a solid quality. Its diversified loan portfolio and prudent credit risk management have contributed to this result. As a result, Equity Group has experienced noteworthy expansion in its profitability indicators, such as return on equity and net interest income.

Read also: African risk is not fairly priced, governments should take advantage

Equity Group: Expansion and Diversification of Regions

By expanding into neighbouring countries, Equity Group has reduced its dependence on the Kenyan market and diversified its revenue streams. The bank’s financial position has been further strengthened by its access to cross-border trade financing and remittances, which have been made possible by its regional presence. Incorporating expansions from Tanzania, the DRC, and Uganda will undoubtedly contribute to the company’s future development.

Equity Group anticipates regulatory changes, currency fluctuations, and the broader economic repercussions of global events as obstacles in the future. In contrast, the organisation is well-positioned to overcome these obstacles due to its robust capital base, diversified business model, and continuous digital transformation.

The Investor’s Perspective

In the eyes of investors, Equity Group makes a persuasive case. The organization’s enduring performance, despite challenging economic conditions, underscores its robustness and capacity for sustained expansion. Nonetheless, investors ought to maintain awareness of the inherent risks associated with the banking sector in the region, which encompass political instability and regulatory uncertainties.

In summary, the performance of Equity Group Kenya during the initial three quarters of 2023 substantiates its position as a formidable participant in the banking industry of East Africa. By maintaining a steadfast commitment to risk management, regional expansion, and digital innovation, the bank is strategically positioned to sustain its upward growth trajectory and serve as a steadfast symbol of stability amidst an unpredictable economic environment.