- Kenya is among countries that are heavily indebted with the loan stock at staggering 67.3 per cent of GDP.

- Total debt stood at $67.7 billion (Ksh9.6 trillion) as of April, Central Bank of Kenya data shows.

- This comprised $35.9 billion external debt and $24.6 billion borrowed from the domestic market.

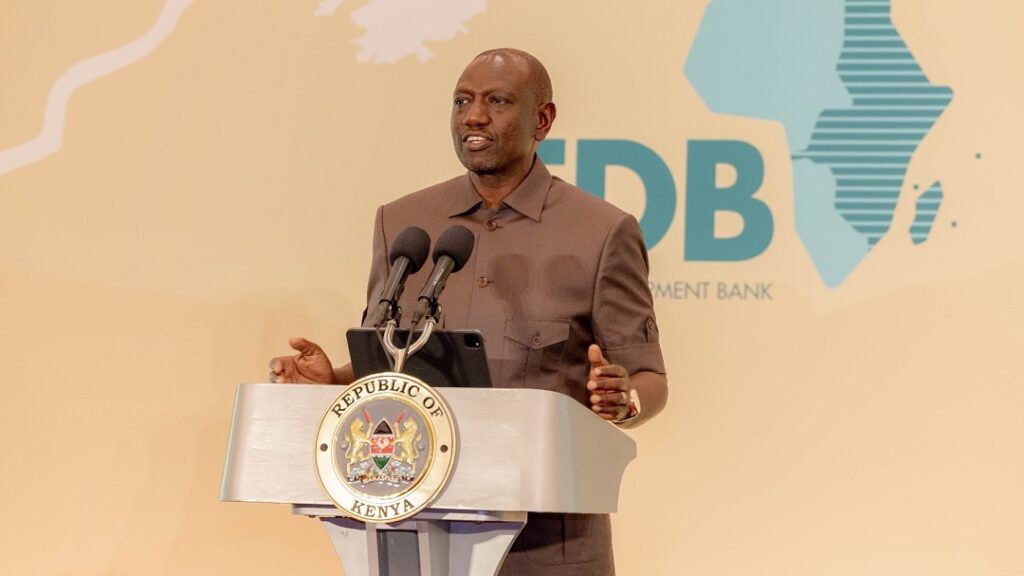

President William Ruto is calling for “urgent” redesigning of global financial institutions to ensure fairness in financing of economies, as he continues to lash out at the West over debt traps in poor states.

In what seems to be a swing at the International Monetary Fund and the World Bank, Dr Ruto is pointing to a post-colonial Africa where development has stalled due to limited resources to liberate economies.

Lenders placing debt traps in poor States

This is from what Dr Ruto terms institutions that were extractive by design; only placing debt traps in poor states. Over the years, Kenya’s President said, low industrial capacity has ensured that raw materials were mainly exported. What’s more, African economies have experienced minimal economic diversity and political instability.

“Efforts to acquire resources to break out of a vicious cycle of underdevelopment and poverty only plunged many of our economies into an inescapable debt trap, which reduced resources available to initiate progressive programmes,” Dr Ruto said on Thursday.

For instance at the IMF, European nations took $160 billion of the 2021 issue of the special drawing rights, Ruto noted. In comparison, African countries’ only accessed cumulative amount of $34 billion. “An institutional blueprint which administers development financing this way must be changed urgently,” he said.

The President was speaking during the 39th Annual General Meeting of the Trade and Development Bank Group, in Nairobi. Formerly the PTA Bank, TDB is a trade and development financial institution operating in eastern and southern Africa. It is the financial arm of the Common Market for Eastern and Southern Africa, although membership is open to non-Comesa states and other institutional shareholders.

Economies in tight fiscal space

According to the Head of State, there is need to “design and implement a wholly new global green bank to mobilise resources globally and administer them in a truly inclusive, representative, democratic and equitable manner.”

He said currently, African countries keen on growing economies by increasing wealth, creating jobs, eradicating poverty and reducing inequality have to confront the fundamental challenge of an increasingly tight fiscal space. There is also the emergence of rapidly mutating and highly complicated new threats.

“The nomenclature of economic classification and development categories is quite telling, with least developed countries and heavily indebted poor countries, becoming normalized methods of describing post-colonial African and other states of the global south,” Ruto said.

His sentiments come as Kenya, along with other African counties continue to struggle with rising debt. Astronomical debt is undermining investments in other key sectors of development such as health and education.

Debt traps in poor states have left them borrowing at expensive loan rates to fund infrastructure development. Currently, funding healthcare, education and social development remains a headache for the poor countries. While economies are yielding substantial revenues, debt repayment struggles often gobble up substantial resources.

Kenya is among countries that are heavily indebted with the debt stock at 67.3 per cent of GDP. Total debt stood at $67.7 billion (Ksh9.6 trillion) as of April, the Central Bank of Kenya data shows. This comprised $35.9 billion external debt and $24.6 billion borrowed from the domestic market.

Africa’s rising debt level

The African Development Bank (AfDB) is warning that Africa’s total external debt will rise to $1.13 trillion this year, from $1.1 trillion in 2022. Tightening monetary policies in the US and Europe will trigger spillover effect into African markets. Across the continent, central banks are increasing interest rates leading to rising costs of servicing debt.

These combined effects have led to 25 countries in Africa falling under the risk of high debt distress or in debt distress. As a result, the external debt service payments due for 16 African countries will hit $22.3 billion in 2023 from rise from $21.2 billion in 2022, AfDB President Dr. Akinwumi Adesina said.

The growth in the continent loan obligations has been blamed on the carry-over effects of the Covid-19 pandemic on economies. The fiscal strain has seen downgrades across several countries. Piling pressure is the rising costs of energy and food due to the Russian-Ukraine war and economic hit caused by climate change.

The portion of bilateral debt has declined from 52 per cent in 2000 to about 25 per cent as commercial debt’s share of total loans jumped from 17 per cent to 43 per cent.

Poor countries too vulnerable to shocks

President Ruto noted that recent high-profile events have demonstrated that global economy is generally vulnerable to shocks and disruptions. This is due to growing economic interdependence and globalisation.

At the same time, they also underscored that advanced economies have greater capacity to invest in measures to improve recovery. Such measures in rich countries are, however, taken at the expense of poor countries.

“Volatility in global commodity prices has always exposed the vulnerability of many economies,” said Ruto, who has been a strong proponent of Pan-Africanism, since assuming power in September 2022.

He said, quite often, the prices of raw material from the African economies collapses drastically. At the same time, however, the cost of essential imports such as petroleum goes up steeply.

“Every episode of such crises sink our economies deeper into difficulty, weakening currencies, raising interest rates and increasing inflation,” said Ruto. “The post-pandemic situation has been difficult, to say the least.”

African countries are still on a recovery path, rebuilding after the devastation of tourism, transport and export sectors. Inevitably, the continent has taken a massive hit in terms of worsening fiscal imbalance and deeper debt. This challenge has been compounded by the roiling high-interest environment globally.

“The geopolitical tensions that exploded into open conflict in Ukraine have only intensified this difficult situation,” Ruto explained.

Climate change unraveling on grand scale

Meanwhile, the leader of East Africa’s biggest economy said the continent is experiencing extreme weather events of unprecedented variety, frequency and magnitude. Flooding, landslides, droughts, cyclones and other disasters are inflicting dire toll on communities across Africa.

The Sahel, West Africa, Central Africa, the Horn of Africa, East and Southern Africa have all been affected by these calamities. “Human life, damage to property and the destruction of infrastructure have not only worsened suffering for the vulnerable, but also dampened economic prospects,” he said.

According to Ruto, it has become inescapably clear that adverse climatic events are actively threatening the continent’s hard-won development gains. Some of the areas experiencing drawbacks are the provision of public services like health, education, and security. Further, investments in national infrastructures such as transport and communication networks have been affected.

“Reflection on these matters have also defined a critical weakness in the prevailing thinking in development and climate action, which treats the two imperatives as separate unrelated undertakings,” Ruto said.