- The South African Reserve Bank has established South Africa’s first deposit insurance body, the Corporation for Deposit Insurance (CODI) to protect bank depositors and bring confidence to a resilient financial sector.

- The CODI became a legal entity as of March 24, 2023, as set out in the commencement schedule published by Finance Minister Enoch Godongwana.

- CODI’s primary responsibilities are to establish, maintain and administer a deposit insurance fund.

South Africa’s first deposit insurance institution, the Corporation for Deposit Insurance (CODI), has been established by the South African Reserve Bank. This move aims to protect bank depositors and increase confidence in the country’s financial sector, especially in the aftermath of the Silicon Valley Bank collapse in the United States of America, which caused a financial crisis due to liquidity risk. As a result, more regulators have moved to secure depositors’ money.

The CODI has been tasked with establishing, maintaining, and managing a deposit insurance fund that will protect the bank’s covered depositors. Additionally, it will educate depositors about the fund’s benefits and limitations in the event that a bank is placed into resolution.

The CODI became a legal entity as of March 24, 2023, as set out in the commencement schedule published by Finance Minister Enoch Godongwana. The commencement schedule outlined the dates at which the resolution and deposit insurance provisions in the Financial Sector Laws Amendment Act 23 of 2021 (FSLAA) come into operation. The FSLAA was signed into law by President Cyril Ramaphosa in 2022.

“Towards the end of March 2023, the Minister of Finance signed the commencement schedule for deposit insurance. From the 1st of April 2024, South African depositors will be protected by what we call the corporation for deposit insurance (CODI). CODI is an entity that is located within the South African Reserve Bank. With CODI, depositors should be able to receive their money in 2 to 3 weeks. This adds to the resilience of the financial service,” said Kuben Naidoo who is the deputy Governor of the South African Reserve Bank.

According to a media statement from the apex bank, CODI is developing secondary legislation which specifies the cover limit for depositors. The secondary legislation will be passed through a Parliamentary process and published by National Treasury in 2023. The legislation is required for CODI to become operational in 2024 and provide the necessary protection for depositors.

While CODI is a statutory body and a subsidiary of the SARB, it has an independent board which will manage and oversee its affairs. CODI has been collaborating with South African financial institutions and other stakeholders, including the World Bank, to ensure a smooth implementation of the deposit insurance scheme.

The statement further stressed that CODI is part of the Twin Peaks regulatory reforms following the 2008/09 global financial crisis. Its establishment supports the SARB’s mandate of protecting and enhancing financial stability by monitoring the financial environment and mitigating systemic risks that might disrupt the financial system.

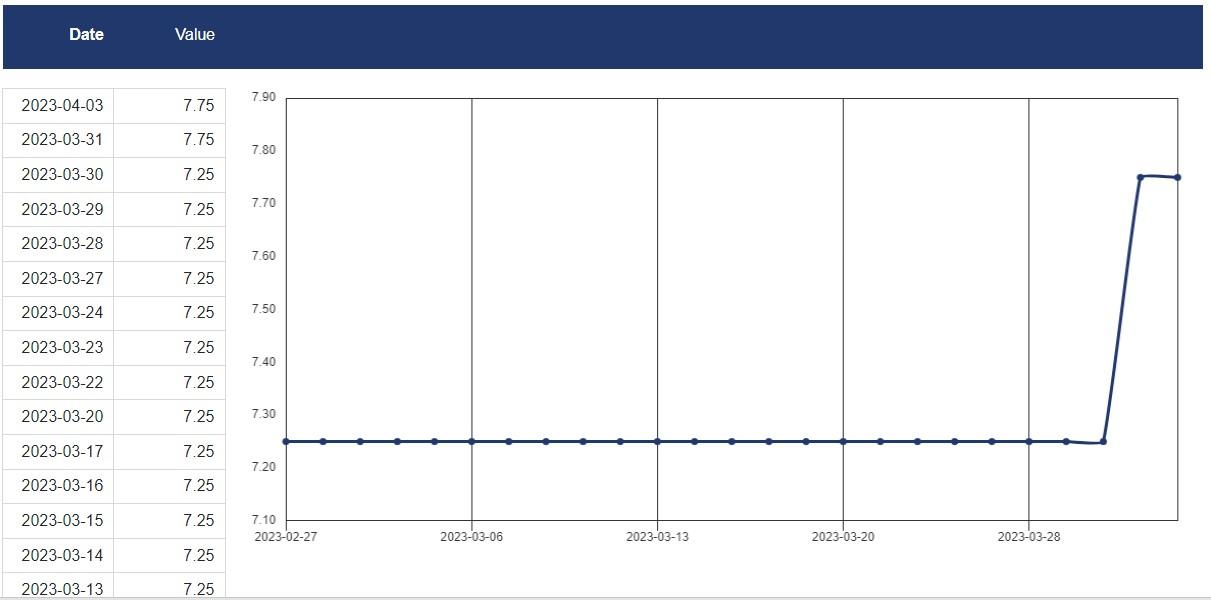

The rate hike was double the 25 basis point increase expected by the majority of economists polled by Reuters. It triggered a jump in the rand, which extended its earlier gains and gained almost 2 per cent against the dollar.

The South African Reserve Bank has now raised interest rates for the ninth straight month, increasing the repo rate by a total of 425 basis points since it began tightening policy in November 2021.

Consumer inflation in South Africa rose to 7.0 per cent year-on-year in February from 6.9 per cent in January, according to data released last week, suggesting nationwide power outages could add to price pressures.

The central bank is targeting an inflation rate between 3 per cent and 6 per cent.

The five-member Monetary Policy Committee was split 3-2 in its decision, with 3 members favouring a 50 basis point hike and 2 members favouring a 25 basis point hike

According to an article published by Reuters on March 30, 2023, the governor of the Central Bank, Lesetja Kganyago, said that the risks to the inflation outlook were assessed as rather positive.

Kganyago said the increase in South Africa’s headline inflation rate was primarily driven by fuel, electricity and food price inflation.

“Despite some moderation in producer price and food inflation, the global price level remains elevated,” he told a media conference.

“Electricity prices and other administered prices continue to pose clear short- and medium-term risks.”

Given the near-term rise in core goods and food prices, headline inflation for 2023 has been revised up significantly from 5.4 per cent to 6.0 per cent, he said.

Nevertheless, food and fuel inflation is expected to decline, leading to an overall inflation forecast of 4.9 per cent for 2024 and 4.5 per cent for 2025.

He said economic growth “has been “volatile for some time and the growth outlook seems even more uncertain than usual”.

“The South African Reserve Bank has surprised the markets,” said Razia Khan, Managing Director and Chief Economist at the South African Reserve Bank in London for Africa and Middle East at Standard Chartered said.

Shaun Murison, senior market analyst at IG in Gauteng, South Africa, said “a revised (higher) outlook towards food and core goods inflation has seen the SARB moving decidedly more hawkishly than markets had expected”.

South Africa based FNB Chief Economist, Mamello Matikinca-Ngwenya said “ahead of this decision, the consensus view was that today’s move would mark the end of the hiking cycle, but the road ahead is precarious”.

The SARB also revised down its economic growth forecasts for this year and next. The bank now expects Africa’s most-developed economy to grow just 0.2 per cent this year, down from its January forecast of a 0.3 per cent expansion, with SARB Governor Lesetja Kganyago saying that extensive rolling electricity blackouts and logistical constraints are expected to reduce growth by as much as 2 per cent this year.

In 2024, the SARB expects growth of 1 per cent, up from a 0.7 per cent forecast in January, thanks to expectations for positive private sector investment. The growth estimate for 2022 was lowered to 2 per cent from 2.5 per cent, due to lower-than-expected growth in the fourth quarter.