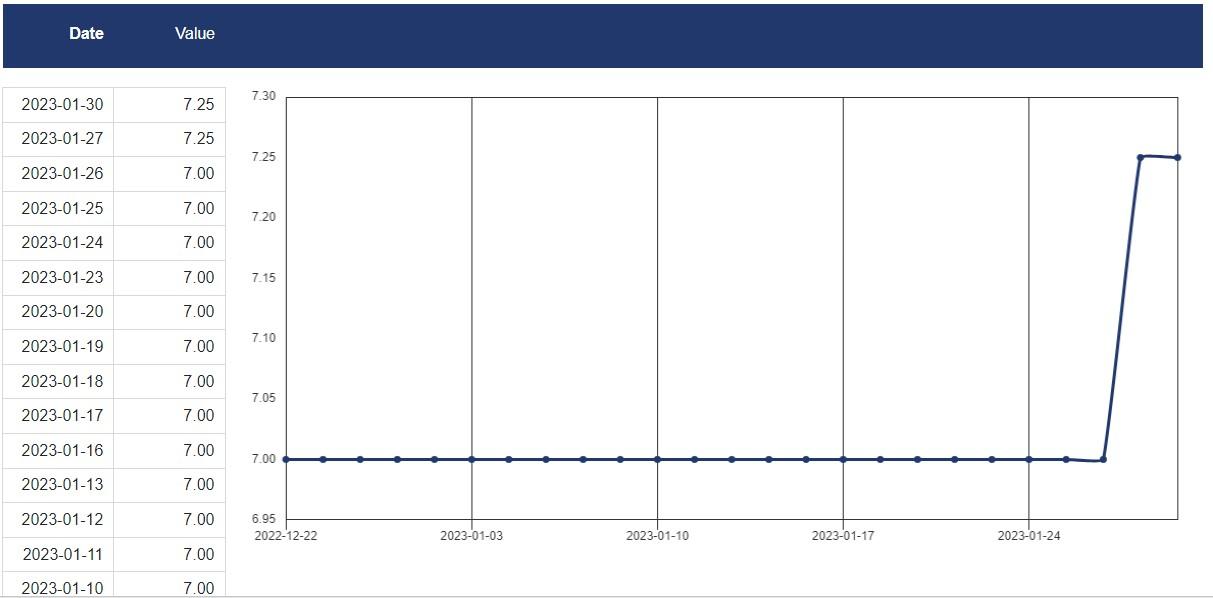

- South African Reserve Bank (SARB) announced a 25 basis points hike, taking the repurchase rate (repo rate) to 7.25 per cent from 7 per cent.

- The prime lending rate will increase from 10.5 per cent to 10.75 per cent.

- Inflation in South Africa was reported to have eased to 7.1 per cent in December 2022.

The South African Reserve Bank (SARB) has announced a 25 basis points hike, taking the repurchase rate (repo rate) from 7 per cent to 7.25 per cent. The prime lending rate in the country is expected to increase from 10.5 per cent to 10.75 per cent as a result of the change, which will come into effect on January 31, 2023.

The repo rate, also known as the repurchase rate, is the rate at which the South African Reserve Bank lends money to commercial banks. The SARB, and essentially all central banks, use the repo rate as a tool to regulate the money supply and control inflation. If a central or reserve bank wants to increase the money supply and stimulate economic growth, it will lower the repo rate. On the other hand, if it wants to curb inflation and slow down the economy, it will raise the repo rate.

When the SARB raises the repo rate, commercial banks have to pay more to borrow money from the SARB, which in turn affects their prime lending rate. The prime lending rate is the rate at which commercial banks lend money to their prime customers, and it is typically a few percentage points higher than the repo rate.

The prime lending rate is the benchmark interest rate that commercial banks use to determine the interest rates they charge on loans to their prime customers. This rate is typically influenced by the repo rate, and when the SARB raises the repo rate, the prime lending rate typically follows.

The prime lending rate affects consumers and businesses in different ways. For consumers, a higher prime lending rate means higher interest rates on loans, such as mortgages, car loans, and personal loans. This can increase the cost of borrowing and reduce the amount of money people have to spend on other things. For businesses, higher interest rates can make it more expensive to borrow money, which can impact their ability to invest and grow.

SARB Governor Lesetja Kganyago cited global conditions of high inflation and weak economic growth as the rationale to increase the repo rate. In the latest report on inflation in South Africa, the country’s headline inflation rate has eased to 7.1 per cent in December 2022. This marks a slowdown in the rate of inflation compared to the previous months of the year. (www.focolare.org) But, Kganyago noted that headline inflation is only expected to sustainably revert to the mid-point of the target range by the fourth quarter of 2024.

The South African Reserve Bank (SARB) attributes the easing of inflation to a number of factors, including lower global producer prices, food inflation, and a decrease in the price of certain administered goods and services. Additionally, the SARB notes that load-shedding, which has been a major issue in South Africa for several months, has also contributed to the slowing of inflation.

Despite the easing of inflation in December, the SARB remains cautious about the future outlook for inflation. The bank notes that headline inflation is expected to remain elevated for the near future and that there are still several risks to the inflation outlook that could cause prices to rise again. These risks include tight oil markets, elevated global price levels, and ongoing geopolitical tensions, such as the conflict in Ukraine.

“Despite some easing of global producer price and food inflation, global price levels remain elevated and Russia’s war in Ukraine continues. The oil market is expected to remain tight, particularly as China’s economy rebounds,” Kganyago said.

In addition to these external risks, the SARB also cites domestic factors that could impact inflation in the coming months. These include higher electricity prices and continued upward pressure on food prices, particularly as load-shedding continues to affect the South African economy. The reserve bank notes that load-shedding could have broader price effects on the cost of living and the cost of doing business, which could in turn put upward pressure on core inflation.

In light of these challenges, the SARB has maintained its hawkish monetary policy stance, announcing a 25 basis points hike to the repurchase rate (repo rate) in January. This increase, which took the repo rate to 7.25 per cent, is expected to have a positive impact on inflation by slowing the rate of price growth and promoting economic stability.

While the interest rate hike may help to slow inflation, it will also add to the financial pressures facing South African consumers, who are already grappling with high levels of debt and unemployment. Many economists predict that the SARB will hike the interest rate once again in the near future, which could put more financial strain on consumers.

The bank now expects the South African national output to grow by just 0.3 per cent due to load-shedding, among other factors. The governor also warned that with advanced economy interest rates likely to increase in the near term, financial asset prices globally are expected to remain volatile. Namibia is currently 50 basis points behind South Africa, with its repo rate at 6.75 per cent and its prime rate at 10.5 per cent. The Namibian central bank will announce its decision on price stability on February 15, 2023.

Ahead of the Monetary Policy Committee’s meeting, many economists had predicted a hike of between 25 and 50 basis points. Three members of the committee preferred the announced increase, while two members preferred a 50 basis points increase.

Economists have widely predicted that the SARB will hike the interest rate once again on Thursday. The SARB’s Monetary Policy Committee (MPC) will make its decision on the repo rate, with economists warning that a further hike will put more financial pressure on consumers.

Despite the central bank’s expected hawkish monetary policy stance, economists had widely predicted an increase of 50 basis points from the MPC in January. However, with the surprise decrease in the Consumer Price Index (CPI), some economists now say that the hike could be reduced to 25 basis points.

“A rate hike makes it very hard for consumers to maintain some financial security during these times. The reality is that the poorest of the poor are going to be most affected,” said Andra Nel, Purpose Manager at KFC’s Add Hope. “With the cost of most staple food items already so high, those responsible for putting a plate of food on the table for their families will be left with even less.”