- The Insurance Regulatory Authority has revealed that claims paid in the general insurance business hit KSh 16.85 billion ($142 million) in the first quarter of 2022

- The report further revealed that medical, motor private, and motor commercial had the highest amounts of paid claims at 46.3 per cent, 25.9 per cent and 19.5 per cent, respectively

- Claims incurred in the general insurance business amounted to KSh 18.43 billion during the period under review

- The high premium volume classes of the general insurance business – medical, motor private and motor commercial, contributed the largest proportions of incurred claims

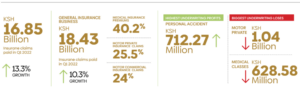

A new report by the Insurance Regulatory Authority has revealed that claims paid in the general insurance business hit KSh 16.85 billion in the first quarter of 2022, marking a 13.3 per cent increase compared to the same period last year when insurers paid claims worth KSh 14.88 billion.

The report further revealed that medical, motor private, and motor commercial had the highest amounts of paid claims at 46.3 per cent, 25.9 per cent and 19.5 per cent, respectively, of total industry paid claims under the general insurance business.

Further, claims incurred in the general insurance business amounted to KSh 18.43 billion during the period under review. This was an increase of 10.3 per cent from Sh16.72 billion reported in the previous year’s first quarter.

The high premium volume classes of the general insurance business contributed the largest proportions of incurred claims; medical (42.0%), motor private (25.5%) and motor commercial (24.0%).

Motor classes of insurance business incurred claims contributed 49.5% of total claims incurred compared to their contribution of 27.5% of the total premium under general insurance business.

The general reinsurers incurred KSh 4.55 billion in claims, a decrease of 3.8 per cent from the same period last year.

insurance business contributed the largest

proportions of incurred claims.

The General Insurance Business is headed for profitability as underwriting performance in the period improved to a loss of KSh 510.20 million from a loss of KSh 1.74 billion reported in the first quarter of 2021.

Kenya: Here’s how much Jubilee Holdings will pay in dividends

The personal accident class made the highest underwriting profit of KSh 712.27 million. In contrast, motor private and medical classes of general insurance business incurred the highest losses of KSh 1.04 billion and Sh628.58 million, respectively.

Insurance sector performance in Kenya recovers

As previously reported, IRA recently revealed that the insurance industry in Kenya continued to register improved performance in the first quarter of 2022 compared to previous quarters.

The data noted that gross written premiums among Kenyan insurance firms in the first quarter of 2022 went up by 11 % to KSh 88.43 billion from KSh 79.26 billion in a similar quarter in 2021.

During the quarter under review, general insurance premiums amounted to KSh 53.92 billion, while the premiums reported by the long-term insurers hit KSh 34.51 billion, a growth of 12.1% compared to a growth of 18.6% the previous year.

Medical and motor insurance classes maintained a leading position in terms of contribution in general insurance business premiums at 35.9% and 27.5%, respectively.

Aviation, theft, and miscellaneous classes are the only classes whose premiums decreased by 16.1%, 11.0%, and 10.6%, respectively.

Deposit Administration and Life Assurance classes remained the biggest contributors to the long-term insurance business accounting for 34.4% and 25.1%.

According to the report, the underwriting performance of the general insurance business was a loss of KSh 510.20 million, which was an improvement from a loss of KSh 1.74 billion reported in Q1 2021.

“The long-term insurers’ asset base grew by 12.9% in the period under review to KSh 580.21 billion and composed of income-generating investments of KSh 537.83 billion. Of the total assets, 9.5 % (KSh 55.17 billion) was funded through shareholders’ equity,” the report read.

The reinsurers’ business volume increased by 33.2% to Sh10.57 billion in the period under review compared to KSh7.94 billion same period last year, leading to an underwriting profit of Sh517.18 million from a loss of KSh 990.23 million in the first quarter of 2021.

The insurance industry asset base grew by 10.5% to Sh876.58 billion as of the end of Q1 2022 from KSh793.24 billion held at the end of Q1 2021.

A significant portion of total assets, KSh 753.70 billion (86.0%) was held in income-generating investments. Asset classes with the highest proportions of above 5% were; government securities (69.7%), investment property (11.2%) and term deposits (7.6%).