- Kenyans have reacted to the news that Safaricom would restructure its popular Fuliza overdraft facility

- Under the deal, customers will be able to borrow less than KSh 1,000 and not pay a maintenance fee for the first three days

- Safaricom and its partners, KCB Group and NCBA Group said the move would benefit more than 80% of M-Pesa customers who seek to complete their payment transactions with Fuliza credit

Kenyans have reacted to the news that Safaricom would restructure its popular Fuliza overdraft facility, allowing customers borrowing less than KSh 1,000 not to pay a maintenance fee for the first three days.

On September 28, 2022, Safaricom and its partners, KCB Group and NCBA Group, said the move would benefit more than 80% of M-Pesa customers who seek to complete their payment transactions with Fuliza credit.

Safaricom also said customers who borrow above KSh 1,000 would also get a 10 – 20% discount on their Daily Maintenance Fee.

However, the one-off Access fee levied when customers access Fuliza remained unchanged at 1%, establishing Fuliza as the country’s most accessible and affordable credit facility.

The new discounted rates will be effective on October 1, 2022.

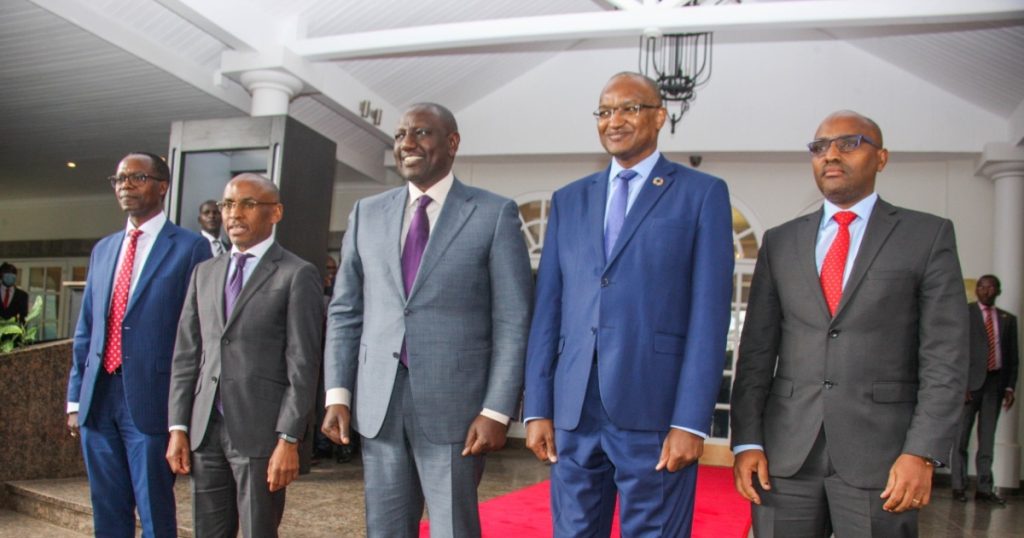

President William Ruto lauded the move, saying, “we will work with lenders to develop a financial product that will allow Mama Mboga to access credit at a single-digit interest rate the same way big firms do.”

Safaricom CEO Peter Ndegwa said that the move was in line with their purpose of transforming lives.

“We have introduced a free daily maintenance fee period for Fuliza transactions of KSh. 1,000 that repay within the first three days. This simple change will reset the use of the Fuliza service to its intended purpose,” he said.

Commenting on the development, the Central Bank of Kenya Governor Patrick Njoroge said it welcomes the restructuring of the product, including the pricing changes.

“In our view, this is a first step in ensuring more Kenyans can access financial services,” Njoroge said.

Kenyans also took to social media to comment on the development.

John Tez, reacting on Facebook, said: “Their interest was so high. How can you borrow 100bob and end up paying 172 bob?.”

“Now hustlers,mama mboga and boda boda men and women can continue to borrow,” Jacob Mititito said on Facebook.

Others condemned the move, saying it would make them remain slaves to borrowing.

“I want nothing to do with fuliza ever again, nikama bondage,” Betty okach said.

Additionally, Safaricom and its partners have announced their commitment to support government efforts concerning Kenyans who are negatively listed in Credit Reference Bureaus. To this end, Safaricom, KCB and NCBA will execute a credit repair mechanism that will see customers who have defaulted on KCB M-PESA, M-Shwari and Fuliza enlist for a credit repair scheme. This will result in the delisting of over four million digital loan defaulters who are negatively listed on CRBs and restore their ability to access formal, regulated credit.

Ndegwa added that the move would reinforce the original purpose of Fuliza – a short-term overdraft facility for 4 to 7 days.

However, Ndegwa said that, from the data they had collected, the original intent for Fuliza to be a short-term credit facility has evolved. He added that since the COVID-19 pandemic, many customer M-Pesa wallets are now remaining overdrawn for 14-19 days but said they would address it by implementing the move.

The CEO said they intend to work with their partners and other industry stakeholders to rethink the credit information-sharing framework that underpins CRB to enable Kenyans, especially the Kenyan entrepreneur, to access credit more seamlessly.

“The specific Fuliza is a revolutionary M-PESA innovation and is the first solution in the world to enable mobile money customers to complete a transaction when they have insufficient funds.”

Fuliza was launched in January 2019 and was especially instrumental at the height of the COVID pandemic, as many customers and businesses switched to cashless transactions.

Commenting on the same, Paul Russo, CEO of KCB Group, said that they were taking additional deliberate steps to provide affordable credit to Kenyans in their contribution to driving up economic activity and recovery.

“We will anchor this on strong partnerships with various stakeholders while deploying innovative digital capabilities to enhance financial access and inclusion,” he said.

Fuliza is a product of M-PESA, the world’s leading mobile money solution and Africa’s largest FinTech empowering over 30 million customers in Kenya access a variety of previously unavailable financial services.