- Saudi Islamic Development Bank to the rescue of Uganda with $295 million loan

- Reshaping the future of sustainable food systems in Africa

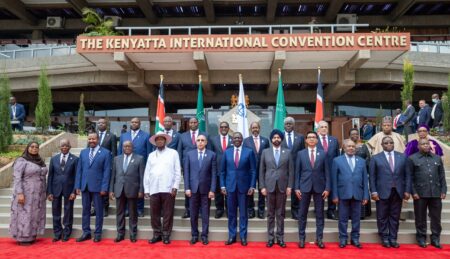

- African Heads of State call for tripling of World Bank’s concessional financing

- SpaceX offers Starlink kit at half price for first-time Kenyan customers

- Mobile Banking Reshaping the Gender Gap in Financial Inclusion

- Unleashing ideas: AIM Congress sets the stage for over 450 dialogue sessions

- Abu Dhabi welcomes over 330 partners for AIM Congress 2024

- Kenyan Farmers Receive $2M Boost from Africa Fertiliser Financing Mechanism

Africa

- The funding is designated for the construction of a bridge spanning the River Nile in northwest Uganda and the enhancement of roads stretching over 105 kilometers.

- Uganda has encountered obstacles in accessing financial support from international institutions like the World Bank, primarily due to policy differences.

- The loan holds the potential to stimulate job creation, foster entrepreneurship, and spur innovation

Uganda has finalized an agreement with the Saudi Islamic Development Bank (IDB), securing a $295 million loan to bolster infrastructure development, particularly road construction projects across the country. This landmark agreement, signed by Uganda’s Finance Minister, Matia Kasaija, and IDB President Muhammad Al Jassar in Riyadh, underscores Uganda’s strategic shift towards diversifying its sources of external funding amidst ongoing negotiations with traditional lenders such as the World Bank.

The financing agreement, which was formalized during Minister Kasaija’s attendance at the 2024 Islamic Development Bank Group Annual Meetings in Riyadh, marks …

- AfDB asks policymakers to put in place an orderly and predictable way of dealing with Africa’s $824Bn debt pile.

- According to AfDB, Africa’s ballooning external debt reached $824 billion in 2021.

- AfDB president says there is urgent need for increased concessional financing, particularly for low-income countries.

Africa’s immense economic potential is being undermined by non-transparent resource-backed loans that complicate debt resolution and compromise countries’ future growth, African Development Bank (AfDB) President Dr Akinwumi Adesina has said.

Adesina at the Semafor Africa Summit taking place on the sidelines of the International Monetary Fund and World Bank 2024 Spring Meetings, highlighted the challenges posed by Africa’s ballooning external debt, which reached $824 billion in 2021, with countries dedicating 65 per cent of their GDP to servicing these obligations.

He said the continent would pay $74 billion in debt service payments this year alone, a sharp increase from $17 billion in 2010. “I …

- Meg Whitman, US Ambassador to Kenya, highlights key investment opportunities in Kenya, particularly in the creative industry and clean energy.

- She noted that Kenya has the potential to become the Singapore of Africa through vertical business integration, job creation, innovation, and foreign direct investment.

- AmCham Business Summit 2024 seeks to strengthen bilateral trade and investment between the US, Kenya, and East Africa.

The fourth edition of the regional American Chamber of Commerce Kenya (AmCham) Business Summit, has officially kicked off in Nairobi, Kenya, under the theme, ‘Catalyzing The Future of US-East Africa Trade and Investment’.

This year’s forum underscores AmCham Business Summit as the premier platform for strengthening bilateral trade and investment between the United States, Kenya, and East Africa.

Hosted by the American Chamber of Commerce (AmCham), the two-day Summit has brought together delegates from the United States of America, East and Sub-Saharan Africa in efforts to deliberate and …

The top 10 banks in 2020 in Kenya accounted for 77.7 percent of industry assets, 80.7 percent of loans and 78.6 percent of deposits, with the proportions largely unchanged from their 2019 levels.

This is according to a new report by Kenya Bankers Association which reveals that over the same period, the bottom 10 banks accounted for 2.5 percent, 2.2 percent and 2.0 percent of industry assets, loans, and deposits, respectively.

During the period under review, banking sector total assets expanded in 2020 by 12.4 percent, ending the year at Sh5.4 trillion from Sh4.8 trillion in 2019, data from the Kenya Bankers Association has shown.

The 12.4 percent strong growth in assets, compared with 9.4 percent in 2019, was driven by a faster expansion in non-loan assets, mainly investments in government securities, which grew by 18.5 percent, compared to 6.7 percent growth in gross loans and advances.

British insurance company Prudential plc has submitted a letter of Intent to apply to join the newly established Nairobi International Financial Centre (NIFC).

In a statement, the company says the application will position it as one of the NIFC’s anchor clients and support the deepening of Kenya’s financial services landscape.

The letter was submitted at a high-level roundtable at The Mansion House in the City of London, attended by President Uhuru Kenyatta, UK Foreign Secretary Dominic Raab, Kenyan Treasury Cabinet Secretary Ukur Yatani Kanacho, UK Minister of State for Africa James Duddridge, the UK Economic Secretary to the Treasury John Glen, the Lord Mayor of the City of London William Russell and Chairs and CEOs of leading UK financial institutions.

Ukur Yatani, Cabinet Secretary National Treasury & Planning said through collaboration with partners like the CityUK, the NIFC will attract increased investment and financing into the country,

“This will not …

Covid-19 has hit small businesses hardest and around the world, many are either still struggling or they have already shut down almost two years after the pandemic started.

The pandemic has caused large-scale loss of life and severe human suffering globally and as the largest public health crisis in our time, the pandemic has also generated a major economic crisis. 2020 saw a halt in production in affected countries, a collapse in consumption and confidence, and stock exchanges responding negatively to heightened uncertainties.

In Africa, things are no different and despite the hit by the pandemic, a June 2021 African Development Bank (AfDB) White Paper, Entrepreneurship and Free Trade: Africa’s Catalysts for a New Era of Economic Prosperity, states that entrepreneurship must be at the heart of efforts to transform Africa’s economic prospects.

Read: Why Kenya’s small businesses are choking

The Covid-19 crisis has triggered shifts that open up …

This is the message being emphasised by Africa Centres for Disease Control and Prevention (Africa CDC) as the world pushes for continuous usage of masks in a bid to stop the spread of COVID-19.

“As the pandemic continues to spread, we must fight against pandemic fatigue and continue masking to protect our friends, our families, our communities, and the world,” reads a statement from Africa CDC.

According to the World Health Organisation (WHO) every three weeks, the new Delta variant cases keep doubling. This is not a good sign. WHO data shows that a third wave has now been reported in 16 countries. This includes nine countries that are currently experiencing surging cases.

The World Health Organisation has classified each emerging variant as either a Variant of Concern (VOC) or a Variant of Interest (VOI). The Alpha, Beta, Gamma and Delta variants fall under Variants of Concern. Whereas the Eta, …

Tanzania’s financial services sector, which contributed approximately 3.8 percent to the country’s total GDP on average over the past five years, was weighed down by subdued loan demand in 2020.

This is according to a report by Deloitte which indicates that the slowdown of the economy owing to the coronavirus pandemic as well as declining income levels also affected the sector.

According to the report, loans and advances to customers on the other hand increased by approximately 4.5 percent in 2020 compared to 13.6 percent in 2019 as people turned to credit for relief.

“Economic uncertainty coupled with contracting income levels in 2020 decreased loan demand, subsequently leading to a suppressed credit growth of 4.5 percent in 2020 compared to 13.6 percent in 2019,” the report says.

The report also reveals that the country’s banking sector assets accounted for about 13.8 percent of total GDP while customer deposits accounted for …

The public sector in many African countries continues to struggle to deliver healthcare.

This is according to data by Medical Credit Fund which indicates that more than fifty percent of Africans are forced to use private healthcare facilities as an alternative.

Medical Credit Fund is a not-for-profit initiative exclusively dedicated to financing small and medium-sized healthcare companies in Africa.

The Fund notes that many private healthcare facilities are mainly run as health small and medium sized healthcare companies and are the ones that serve the lower income groups.

These however have poor infrastructure and equipment and limited means to invest in quality improvement.

The Fund also reveals that commercial banks often shy away from health SMEs because they consider them to be too risky.

IMF approves $1b to Ghana to address COVID-19

Change of Tune

To grow this SME sector, those in business are now turning to credit.

According to …