- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Business

- Office Occupancy Levels Across Africa increased by an average of 15 percent from 2022 numbers

- Knight Frank also points to rising investor interest in the continent’s manufacturing, mining, and energy sectors.

- In the retail market, there is a strong focus on enhancing consumer experiences across the continent.

Office occupancy levels across Africa’s office markets have recovered from 60 per cent in 2022 to 75 per cent this year, according to global property consultant, Knight Frank’s biennial 2024/25 Africa Report.

This notable improvement in office occupancy levels is largely attributed to the gradual return to the office following the disruption caused by the pandemic. For example, Kenya’s office occupancy rate now stands at 77 per cent, driven by the limited supply of prime offices – just 617,000 sqm is expected by the end of 2024, while take-up levels remain steady.

According to Mark Dunford, CEO, Knight Frank Kenya, there is …

- The firms exploit legal loopholes to steal, they exploiting gaps in beneficial ownership laws to repatriate billions of profits in the mining sector

- According to the report, Kenya’s mining industry has the potential to contribute 4-10 percent of the country’s gross domestic product.

- The country earned Sh300 billion from the mining sector last year.

Corrupt individuals in Kenya are exploiting gaps in beneficial ownership laws to repatriate billions of profits in the mining sector, limiting its contribution to the general economy.

A new report released by the Global Financial Integrity (GFI) dubbed ‘Illicit Financial Flows Related to Beneficial Ownership in the Mining Sector in Kenya’ regrets that several billions have been lost over the years.

According to the report, Kenya’s mining industry has the potential to contribute 4-10 percent of the country’s gross domestic product.

…“Unfortunately, the sector contributes less than a percentage of the country’s GDP which is significantly

- Kenya’s $168Bn plundered development loans were taken over 11 year period between 2010 and 2021

- In one instance, the OAG raised an issue with the missing drawdowns for three loans from BELFIUS Bank and Unicredit totaling €29,510,462 (Sh4.1billion).

- The audit examined how 39 commercial loans valued at $168billiom (Sh1.36 trillion) during the time were used, and whether they were borrowed legally.

The Office of the Auditor General has opened a can of worms on the possible diversion of loans and plunder of funds disbursed to Kenya for development over the past 10 years.

A Special Audit by Auditor General Nancy Gathungu, on loans Kenya took between 2010 & 2021 shows that the country received $ 167.7 billion (Sh1.13 trillion) in the consolidated funds accounts however, the accountability of the funds is in question.

The revelations come at a time when President William Ruto has already gazetted the Presidential Taskforce on …

- In the past two years, short-term rentals in Nairobi have been the new trend.

- Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023.

- Trappler highlights that hospitality is a key economic driver, employment creator, and focal property type in regions throughout East Africa.

Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023. This resurgence is particularly notable in Nairobi, especially with the renewed demand for short-term rentals.

The strategic position of Kenya’s capital city serves as an East African hub for various industries, including corporate, government, MICE (Meetings, Incentives, Conferences, and Exhibitions), embassies, and tourism, which makes it an attractive destination for hospitality and residence brands.

The increasing and diversifying demand for accommodation creates meaningful opportunities for market expansion and business growth.…

- The partnership will enable Kenya and South Korea to strengthen legal services and networks for African companies.

- G&A has built a strong reputation in Africa, delivering on transformational projects like the recent Eurobond

- In February last year, the two countries pledged to continue to nurture and expand ties

A law firm in Nairobi is championing a plan to see Kenya and South Korea strengthen legal services for companies in Africa. Kenya’s G&A Advocates LLP has signed a partnership agreement with South Korea-based law firm Jipyong ahead of the Korea-African Summit. The partnership will enable Kenya and South Korea to strengthen legal services and networks for African companies.

The Korean African Summit is set to take place between June 4 and June 5 in Seoul, South Korea, under the theme: “The Future We Make Together, Shared Growth, Sustainability and Solidarity.”

The summit, which will be the first-ever, aims to strengthen the …

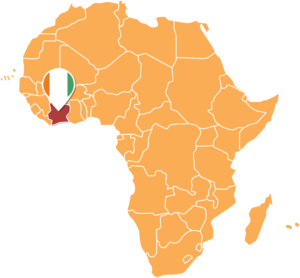

- The upcoming US-Africa green and sustainable financing forum in Côte d’Ivoire aims to mobilize funding for infrastructure projects across Africa.

- Set for March 19–20, the workshop will feature industry leaders, US technical experts, and key financiers.

- The event highlights the critical need for renewable energy funding models, financing mechanisms, and regulatory and policy reforms to facilitate the growth of green and sustainable infrastructure.

To foster sustainable development in Africa, the United States Trade and Development Agency (USTDA) is joining forces with the African Development Bank Group to host the US-Africa Green and Sustainable Financing Workshop.

Set to go down in Abidjan, Côte d’Ivoire, on March 19–20, 2024, this event is poised to bring to the forefront the pressing need for green and sustainable infrastructure projects across the continent.

The workshop, a convergence of industry leaders, explores innovative financing models that can support Africa’s journey towards a resilient and sustainable future.…

- The complex relationship between struggling African economies and the IMF revolves around the necessity of bailouts and structural reforms to address economic crises while balancing the need for sovereignty and social welfare.

- Conditions imposed by the IMF aim to promote fiscal discipline, enhance economic stability, and ensure sustainable growth.

- The ongoing engagement with the IMF highlights the broader quest for a more equitable global financial system.

The International Monetary Fund (IMF) and its relationship with struggling African economies has been intricate and multifaceted. Often characterized by a mixture of dependence and resistance, this partnership comes to the forefront during periods of economic distress.

African countries, facing challenges such as debt, the aftermath of COVID-19, and external pressures such as the Russia-Ukraine conflict, have found themselves turning to the IMF for bailout assistance.

This dynamic has reignited discussions around the IMF’s role in fostering economic stability and growth through financial support …

- The African Development Bank’s Affirmative Finance Action for Women in Africa (AFAWA) initiative aims to close the $42 billion financing gap faced by women entrepreneurs, demonstrating that investing in women fosters gender-inclusive economic growth.

- By securing over $1.5 billion in investments for women-led SMEs and providing gender-smart banking training, AFAWA is changing financial institutions’ perceptions and practices, demonstrating the viability and profitability of supporting women entrepreneurs.

- AFAWA’s partnerships and educational programs build a more inclusive financial ecosystem, showcasing the initiative’s commitment to empowering women entrepreneurs and driving sustainable, inclusive economic development across Africa.

The African Development Bank’s Affirmative Finance Action for Women in Africa (AFAWA) aims to invest in women and close the significant financing gap they face. Women entrepreneurs in Africa confront a daunting $42 billion disparity in financing compared to their male counterparts, largely due to misconceptions about their creditworthiness and a lack of collateral. Despite these challenges, …

- Submarine cable systems form the crucial infrastructure at the heart of the global network and internet connectivity.

- Seacom, a leading player in the submarine cable systems market, launched Africa’s first broadband submarine cable system in 2009.

- As Africa navigates digital infrastructure challenges, there’s hope on the horizon with several transformative internet projects poised to reshape the continent’s digital landscape.

The crucial role of submarine cable systems

The Internet is the backbone of modern communication, powering everything from global commerce to personal communications. At the heart of this global network lies a critical infrastructure often unseen and unthought of by the average user: submarine cable systems.

These undersea pathways are vital for international data exchange, carrying over 99 per cent of the world’s telecommunications traffic. A recent incident involving damage to Seacom’s cable in the Red Sea offers a stark reminder of the vulnerability of these underwater lifelines and the …