- Kenya-Ethiopia Trade Relations: Legislators Advocate for Policy Alignment to Boost Ties

- Visualising the state of debt in Africa 2024

- Abu Dhabi radiates optimism as over 300 startups join AIM Congress 2024

- TLcom Capital Raises $154 million in Funding to Boost Its African Growth

- Africa’s $824Bn debt, resource-backed opaque loans slowing growth — AfDB

- LB Investment brings $1.2 trillion portfolio display to AIM Congress spotlight

- AmCham Summit kicks off, setting course for robust future of US-East Africa trade ties

- Why the UN is raising the red flag on the UK-Rwanda asylum treaty

Business

- In the past two years, short-term rentals in Nairobi have been the new trend.

- Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023.

- Trappler highlights that hospitality is a key economic driver, employment creator, and focal property type in regions throughout East Africa.

Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023. This resurgence is particularly notable in Nairobi, especially with the renewed demand for short-term rentals.

The strategic position of Kenya’s capital city serves as an East African hub for various industries, including corporate, government, MICE (Meetings, Incentives, Conferences, and Exhibitions), embassies, and tourism, which makes it an attractive destination for hospitality and residence brands.

The increasing and diversifying demand for accommodation creates meaningful opportunities for market expansion and business growth.…

- The partnership will enable Kenya and South Korea to strengthen legal services and networks for African companies.

- G&A has built a strong reputation in Africa, delivering on transformational projects like the recent Eurobond

- In February last year, the two countries pledged to continue to nurture and expand ties

A law firm in Nairobi is championing a plan to see Kenya and South Korea strengthen legal services for companies in Africa. Kenya’s G&A Advocates LLP has signed a partnership agreement with South Korea-based law firm Jipyong ahead of the Korea-African Summit. The partnership will enable Kenya and South Korea to strengthen legal services and networks for African companies.

The Korean African Summit is set to take place between June 4 and June 5 in Seoul, South Korea, under the theme: “The Future We Make Together, Shared Growth, Sustainability and Solidarity.”

The summit, which will be the first-ever, aims to strengthen the …

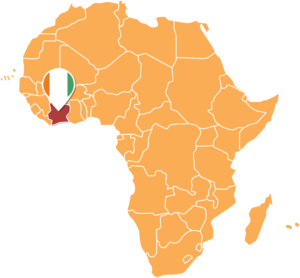

- The upcoming US-Africa green and sustainable financing forum in Côte d’Ivoire aims to mobilize funding for infrastructure projects across Africa.

- Set for March 19–20, the workshop will feature industry leaders, US technical experts, and key financiers.

- The event highlights the critical need for renewable energy funding models, financing mechanisms, and regulatory and policy reforms to facilitate the growth of green and sustainable infrastructure.

To foster sustainable development in Africa, the United States Trade and Development Agency (USTDA) is joining forces with the African Development Bank Group to host the US-Africa Green and Sustainable Financing Workshop.

Set to go down in Abidjan, Côte d’Ivoire, on March 19–20, 2024, this event is poised to bring to the forefront the pressing need for green and sustainable infrastructure projects across the continent.

The workshop, a convergence of industry leaders, explores innovative financing models that can support Africa’s journey towards a resilient and sustainable future.…

- In the three months to March 2023, Group’s total assets rose by 39.8 percent to close at $11.8 billion buoyed by DRC subsidiary TMB.

- Revenue increased by 26.9 percent to $267.4 million mainly driven by the non-funded income from customer transactions across the Group.

- This is the Group’s newest subsidiary in the Democratic Republic of Congo.

- It demonstrated the range and diversified income streams across the group’s businesses, adequate to cover the elevated operating and funding costs.

Regional lender KCB Group Plc posted $68.8 million in profit after tax for the first quarter 2023, a marginal drop attributable to acquisition and consolidation costs of its newest subsidiary, Trust Merchant Bank (TMB), in the Democratic Republic of Congo.

In the quarter, however, the Group recorded a strong balance sheet growth with total assets hitting $11.8 billion, with TMB contributing 14 percent to the Group’s total assets. The bank said this was …

-

Energy multinationals Shell, Equinor, and ExxonMobil have finalised vital talks on Tanzania’s $40 billion Liquified Natural Gas investment.

-

The move paves the way for final agreement on how to execute the long-delayed energy project that will significantly boost Tanzania’s revenues and create jobs.

-

President Samia Suluhu Hassan’s government expects the construction of the project to start in June 2025.

Tanzania is preparing the final deal to guide harnessing her $40 billion offshore gas reserves following the conclusion of talks with energy giants Shell, Equinor, and ExxonMobil. A final agreement on the $40 billion gas investment is in the works with signing expected in the coming weeks.

“The work is done… companies (IOCs) have gone to sit with their boards, and we are now awaiting the next steps. The government expects construction to start in June 2025” Managing Director of the Petroleum Upstream Regulatory Authority (PURA), Charles Sangweni, said the project’s …

- Infrastructure solutions provider, Africa Finance Corporation has signed a MoU with Morocco’s Ministry of Economy and Finance to fund project development.

- Deal targets in renewable energy, transport, natural resources, heavy industries, and telecommunications.

- The Agreement follows Morocco’s official entry as a member of the AFC in 2021. The agreement will facilitate Morocco’s domestic market competitiveness and the export capacity of her businesses.

Infrastructure solutions lender, Africa Finance Corporation has signed an agreement with Morocco to provide project development, structuring, and financing for key projects in renewable energy, transport, natural resources, heavy industries, and telecommunications sectors.

The deal follows Morocco’s official entry as a member of the AFC in 2021. AFC will provide innovative financing and pragmatic solutions to enhance the infrastructure and industrial base in Morocco. Consequently, such solutions will facilitate domestic market competitiveness and the export capacity of Moroccan businesses.

Morocco sees opportunities in Sub-Saharan Africa

In the last …

- East African Business Association objectives revolve around industry-specific training in healthcare, transportation, technology and retail.

- According to the African Development Bank, 22 percent of Africa’s working age are venturing into alternative business.

- According to EABA, the US-based community primarily originated from Somalia, Ethiopia, Eritrea, Djibouti, and Kenya.

Investors looking for opportunities in the region can bank on the East African Business Association (EABA) for an informed guidance on how to navigate the terrain in different economies. Already, the entity’s zeal, hard work, and willpower have positively impacted entrepreneurs of African origin from Minnesota seeking growth opportunities.

EABA is now gearing up to provide even better environment for Africans seeking to explore international business opportunities.

The journey of the East African Business Association

For decades, Africa has been known for having one of the most innovative and creative minds in various industries. The continent has the highest entrepreneurship rate setting the …

- Zanzibar has been grappling with extremely high energy costs, oftentimes costing 50 percent higher than mainland Tanzania.

- Zanzibar relies on a 125MW submarine grid line from mainland Tanzania for its growing electricity needs.

- Rostam Aziz solar investment in Zanzibar is part of his wide focus on big energy investment projects around East Africa. In February, Rostam launched a $130 million cooking gas project in Dongo Kundu, Mombasa, Kenya.

With a planned $140 million investment in a solar power project that could see Zanzibar Island achieve electricity independence, Tanzania tycoon Rostam Aziz is coming out as a man with an eye for energy deals. Rostam’s Taifa Energy is liaising with Mauritius-based Generation Capital Ltd and state-owned Zanzibar Electricity Corporation (ZECO), to set up the 180MW green energy field in Zanzibar.

Over the years, the island of Zanzibar has been grappling with extremely high energy costs, oftentimes costing 50 percent higher than …

- Africa is home to 65 percent of the world’s uncultivated fertile land, but millions sleep hungry daily.

- Amini Corp seeks to address the scarcity of data in Africa as well as facilitate capital investment.

- The scarcity of high-quality environmental data prevents others from building climate solutions such as farmer insurance schemes.

Amini Corp, a Kenyan-based climate tech startup, has raised $2 million in pre-seed funding which it plans to channel into developing an environmental data platform for Africa. The funding was secured through an oversubscribed round led by top European Climate Tech Fund, Pale Blue Dot.

Other investors in the venture are Superorganism, RaliCap, W3i, Emurgo Kepple Ventures and angel investors from the global tech community.

Amini Corp seeks to address the scarcity of data in Africa as well as facilitate capital investment. The company also promotes climate resilience, and helps accelerate economic development opportunities in the region.…