- Kenya-Ethiopia Trade Relations: Legislators Advocate for Policy Alignment to Boost Ties

- Visualising the state of debt in Africa 2024

- Abu Dhabi radiates optimism as over 300 startups join AIM Congress 2024

- TLcom Capital Raises $154 million in Funding to Boost Its African Growth

- Africa’s $824Bn debt, resource-backed opaque loans slowing growth — AfDB

- LB Investment brings $1.2 trillion portfolio display to AIM Congress spotlight

- AmCham Summit kicks off, setting course for robust future of US-East Africa trade ties

- Why the UN is raising the red flag on the UK-Rwanda asylum treaty

Countries

- There is a debt crisis in Africa as countries struggle to repay international loans.

- According to the World Bank, nine African countries entered 2024 in debt distress, with another 15 at high risk of distress and 14 more categorised as moderate risk.

- According to the United Nations, Africa’s public debt will stay above pre-pandemic levels in 2024 and 2025.

At 4 per cent, Africa is projected to be the second fastest-growing economic region in the world in 2024, according to a report by the International Monetary Fund (IMF). However, behind the headline figure is a less optimistic reality.

Many African countries have suffered from slow post-COVID-19 recovery, climate change shocks, worsening food security situation, political instability, weak global growth, and high-interest rates. These economic shocks have pushed over 55 million people into poverty since 2020. The situation is increasingly alarming as more than half of the continent’s countries are in …

- UN faults UK-Rwanda asylum treaty citing concerns on potentially harmful impact on global responsibility-sharing, human rights, and refugee protection.

- Spearheaded by Prime Minister Rishi Sunak, the legislation mandates judges to deem Rwanda as a safe third country.

- With deportation flights slated to start in July, the move is sparking weighty debates over the ethical implications of outsourcing asylum responsibilities.

This week’s passage of the “Safety of Rwanda” Bill by the UK Parliament has triggered alarm bells within the United Nations (UN), with two prominent leaders, Filippo Grandi, the UN High Commissioner for Refugees, and Volker Türk, the UN High Commissioner for Human Rights, raising concerns over its potentially harmful impact on global responsibility-sharing, human rights, and refugee protection.

Spearheaded by Prime Minister Rishi Sunak, the legislation mandates judges to deem Rwanda as a safe third country, paving the way for the deportation of thousands of migrants who have sought refuge …

- Namibia’s Mopane field could hold up to 10 billion barrels of oil, Galp announces.

- Tests on Mopane-1X well in January and the Mopane-2X well in March gave highly promising findings.

- Exploration success in Namibia could pave the way for a new revenue stream for Galp.

Portuguese oil company Galp Energia has set the stage for a potential game-changer in the global energy industry with its announcement at the weekend regarding the Mopane field off the coast of Namibia.

Following the conclusion of the first phase of exploration, Galp projects that the Mopane field could hold up to 10 billion barrels of oil, marking a huge step in the evolving oil and gas industry in Namibia.

Gap noted that testing operations were undertaken at the Mopane-1X well in January and the Mopane-2X well in March gave highly promising findings. The company noted the discovery of significant light oil columns in …

- Tanzania’s agriculture sector holds one-third of the country’s GDP and employs 75 per cent of the population.

- The government target is to raise crop exports by 48 per cent to $3.5 billion by 2025 as food shipments rise to overtake the value that Tanzania earns from its traditional export crops.

- Tanzania earned over $1.2 billion with the export of agricultural commodities in 2020.

An outlook into Tanzania’s agriculture sector

Numbers show that farmers are Tanzania’s most essential workforce. Tanzania’s agriculture sector holds one-third of the country’s GDP and employs 75 per cent of the population.

Available data shows that approximately 80 per cent of Tanzania’s exports are agricultural products such as coffee, cotton, sisal, tea, cashew nuts and tobacco, to mention a few.

From 2014 to 2020, the above crops benefitted the nation’s export baskets. Tanzania earned over $1.2 billion with the export of agricultural commodities in 2020, according to …

- In Gambia, two opposing sides clash over whether to repeal or keep an existing FGM ban.

- This contest pits influential Muslim clerics, who are supporting a new bill seeking to repeal a 2015 law that banned FGM, against women rights activists.

- The Supreme Islamic Council of the Gambia has already issued a strong condemnation of anyone who denounces FGM.

The Gambia, one of the smallest countries in Africa, has been thrust into the global limelight as two opposing sides clash over whether to repeal or keep an existing FGM ban.

This contest pits influential Muslim clerics, who are supporting a new bill seeking to repeal a 2015 law that banned female genital mutilation (FGM) against women rights activists, who seek to have the law stay in place.

In the last week, supporters of the cut have thronged the country’s streets seeking the lifting FGM ban, which has been in place …

- Months after the Military takeover in Niger, the African Development Bank (AfDB) forecasts the country’s GDP to jump by 11.2 per cent in 2024, following growth of 4.3 per cent in 2023.

- Niger has removed its military support agreements with the French and the US, respectively.

- Niger becomes the third country, following Mali and Burkina Faso, to experience a military takeover.

Growth projections after the Military takeover in Niger

“Imperialist France”, “Down with France”, and “Chani (name of the Niger coup leader)” are a few energetic words chanted by the thousands of supporters and demonstrators who demanded the French troops leave Niger.

The latter reflects what is now referred to by the military regime as a people-led democracy. The question that then arises is; Could Africa be experiencing a withdrawal period from the grim historical chains of its colonial era, particularly the Francophone nations, Niger to be exact?

“I have …

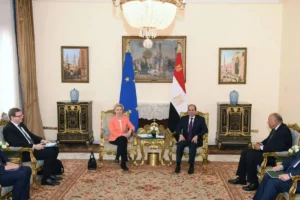

- The three-year EU-Egypt strategic partnership aims to facilitate economic reforms and avert a migration crisis within the region.

- The triennial agreement represents the latest endeavour by the bloc to prevent refugees from traversing the Mediterranean.

EU-Egypt strategic partnership

EU leaders have finalised a deal worth $7.4 billion with Egypt to bolster the nation’s struggling economy. This move seeks to foster stability within the “troubled” region and prevent a new European migration crisis.

The three-year EU-Egypt strategic partnership includes $5 billion in soft loans to facilitate economic reforms, $1.8 billion to encourage private sector investments, and $600 million in grants. Of these grants, $200 million is allocated for migration management.

Following months of intense and productive diplomatic engagement between the EU and Egypt, six EU leaders journeyed to Cairo on Sunday, as stated by Italian Prime Minister Giorgia Meloni.”

The visit occurred just days following allegations by members of the European …

- Over a decade since gaining independence, South Sudan continues to be affected by fragility, economic stagnation, and instability.

- South Sudan’s economy is clouded by production bottlenecks in the oil sector, with production dwindling in the face of limited new investment.

- The susceptibility of South Sudan to climate change and natural calamities exacerbates the nation’s economic challenges, threatening the progress of growth and development initiatives.

The Republic of South Sudan emerged as the world’s newest sovereign state and the 54th country in Africa on July 9, 2011. However, the progress of development post-independence was significantly hampered by civil war outbreaks in 2013 and 2016, which also aggravated the humanitarian crisis.

Over a decade since gaining independence, South Sudan continues to be affected by fragility, economic stagnation, and instability. Pervasive poverty is further intensified by ongoing conflict, displacement, and external shocks.

Crisis facing the oil and energy sector

Oil production is …

- Tanzania’s population is expected to reach 140 million people by 2050.

- The World Bank estimates that Tanzania’s population will double every 23 years.

- Tanzania set to become one of Africa’s and the world’s most populated countries.

Tanzania’s population is expected to reach 140 million people by 2050 given the current high fertility rate of 3.0 per cent. At this rate, the World Bank estimates that Tanzania’s population will double every 23 years henceforth.

In its latest Tanzania Economic Update that was launched in the country’s port city of Dar es Salaam this March, the World Bank says when it comes to population control, the East African country is facing a delicate balance act.

On the one hand, Tanzania has managed to lower its mortality rates and raise its life expectancy but as a result, it is now facing the effects of high birth rates and, they are not all good.…