- Why Africa’s population explosion is a mixed bag of opportunities and challenges

- Africa’s capital market access is improving, and so is the appetite for Eurobonds

- From safari icons to status symbols: The dual fate of Tanzania’s black rhinos

- Tanzania taps $149 million IMF loan for budgetary support

- Africa poised for fastest growth in $8 trillion cooling systems market

- Rwanda-based Bboxx eyes generating $100M worth of carbon credits in Africa

- Telemedicine Services in Murang’a County: Kenya’s technological Initiative to Decentralize Healthcare

- The bitter pill of cocoa’s value chain in Ghana and Ivory Coast

Investing

- With its multiple technologies, Bboxx is trailblazing in the green energy space, scaling its operations across Africa and projecting to offset over 20 million tonnes of CO2.

- Bboxx has been awarded Gold Standard certification for carbon credit programs based on solar home systems, clean cooking alternatives, and solar-powered water pumps.

- Implementing carbon programs allows Bboxx to accelerate market growth potential by reaching over 4 million customers in five African countries.

Rwanda-based Bboxx plans to offset over 20 million tonnes of carbon and generate $100 million worth of carbon credits through clean energy projects in Africa.

In this initiative, Bboxx projects to positively impact the lives of over four million customers across Rwanda, Kenya, Nigeria, Togo, and the Democratic Republic of Congo (DRC).

These revelations follow Bboxx’s recognition with the Gold Standard certification for its continued rollout of clean energy projects in five African countries. This certification marks a vital moment …

- Kenya’s private equity deals size are expected to remain modest this year.

- However, despite the high optimism, deal sizes in East Africa are expected to remain modest.

- However, businesses are concerned that firms will be scouting for exits, too.

Kenya and its East Africa peers are confident that the fundraising environment for businesses will continue improving in the next 12 months even as the continent experiences mixed expectations.

New findings by Audit firm Deloitte show that while East and West Africans largely anticipate an improvement, opinions in North and Southern Africa are divided, with some expecting improvements, others predicting stagnation, and some foreseeing deterioration.

This outlook comes against the backdrop of persistent high interest rates, inflation, and geopolitical uncertainty, which led to a 9 per cent drop in finalized funds year-on-year in 2023.

The Deloitte Africa Private Equity Confidence Survey 2024, shows that in East Africa, optimism is on …

The opulent and contemporary Downtown Dubai is a global attraction for Vietnamese investors. It is a lively neighbourhood that was built by Emaar Properties and contains some of the most famous structures in the world such as Burj Khalifa and Dubai Mall; therefore, it is an ideal place for investing in property. In this article, we will look at different kinds of real estate in Downtown Dubai which are attractive to Vietnamese buyers.

Overview of Downtown Dubai

Situated between Sheikh Zayed Road and Financial Centre Road, the Downtown Dubai neighbourhood is a mixed-use development located at the centre of the city. This area contains everything; residential, commercial, and leisure spaces for both residents and visitors. The tall skyscrapers, luxury apartments, and top-notch facilities define this as among the best areas to invest in Dubai property-wise.

Types of Properties Available

Apartments

Downtown Dubai provides a broad choice of luxury apartments that …

- Thungela Resources Limited has been busy with mergers and acquisitions to grow its geographic footprint and diversify from its pure play coal business.

- The JSE listed miner recently made the news when it agreed to purchase an Australian coal miner called Ensham.

- The acquisition of Ensham is an all cash transaction wherein Thungela is taking a 65% interest.

The Johannesburg Stock Exchange (JSE) listed pure play coal mining company which was created from the demerger of Anglo American’s coal assets has been on a mergers and acquisitions spree. Thungela announced earlier this month that it had acquired an Australian coal mine. This move has been read by market analysts as a risk mitigation move by diversifying away from South Africa. It also bought out its Black Empowerment partners in a US$ 60 million transaction.

Green Bonds: A possible solution to the Zimbabwe power crisis

On the M&A front, Thungela bought …

- Jubilee Insurance has allocated KSh 40 million over the next four years to support 168 students in accessing high school education

- The scholarship, funded by Jubilee Children’s Fund, covers full high school education and supplementary needs such as school uniforms

- The Jubilee Children’s Fund has enrolled 85 additional students in 2023, while the first cohort of beneficiaries will sit for the national secondary examinations this year

Jubilee Insurance has allocated KSh 40 million over the next four years to support 168 students in accessing high school education.

The scholarship, funded by Jubilee Children’s Fund, covers full high school education and supplementary needs such as school uniforms.

The Jubilee Children’s Fund has enrolled 85 additional students in 2023, while the first cohort of beneficiaries will sit for the national secondary examinations this year.

Challenges facing access to secondary education in Kenya

Access to education is a basic human right. However, many …

- TransCentury Plc’s right issue is set to be reopened following approval from the Capital Markets Authority (CMA) after the initial issue failed to hit a 50 per cent threshold.

- Unfortunately, the rights issue performed below expectations, and as a result, CMA has invoked its powers under Section 14 of the Public Offers and Listings Regulations to allow TransCentury to reopen the issue.

- The rights’ issue will be open from March 20 -30 this year with additional information provided in the secondary prospectus to be issued by March 17 as the firm seeks shareholders’ approval to enable the conversion of shareholder loans to ordinary shares as a mode of payment for rights.

TransCentury Plc’s right issue is set to be reopened following approval from the Capital Markets Authority (CMA) after the initial issue failed to hit a 50 per cent threshold.

TC shareholders had until January 23, 2023 to take …

- WorkPay has received KSh 341.3 million (US$2.7 million) from international investors to expand in Africa

- The Kenyan HR and payroll solution said the pre-series A round was led by several companies including Acadian Ventures, Fondation Botnar, P1 Ventures, and Kara Ventures

- The funding will assist WorkPay to expand in 40 countries in Africa

WorkPay, a Kenyan human resource (HR) and payroll solution startup WorkPay, has received KSh 341.3 million from international investors to expand in Africa. The startup offers cloud-based human resources management and payroll solution for small and medium-sized businesses (SMBs) in Africa.

On February 22, 2023, WorkPay announced that the investment, a pre-series A round, was led by several companies including Acadian Ventures, Fondation Botnar, P1 Ventures, and Kara Ventures.

The funding will assist WorkPay to expand in 40 countries in Africa.

Commenting on the funding, WorkPay CEO and Co-Founder Paul Kimani told TechCrunch that the company has …

- In 2015, BFA Global launched the Catalyst Fund to support and manage early-stage inclusive fintech startups.

- Assuraf is an African startup that attempts to deal with the harmful norms of insurance coverage within the content.

- Located in Kenya, Octavia is one of the twenty companies building DAC technology globally.

Catalyst Fund, a pre-seed VC fund and a startup accelerator in Africa, recently announced that 10 African startups had been accepted within their program. The Fund has announced a $2 million investment in the startups that are building and improving Africa’s ecosystem.

BFA Global launched the Catalyst Fund in 2015 to support early-stage inclusive fintech startups. The Fund offers affordable, accessible and appropriate digital financial solutions.

Despite focusing its reach among African innovators, it still has a global viewpoint. Initially, the Bill & Melinda Gates Foundation, JPMorgan Chase & Co., and fiscal sponsorship from Rockefeller Philanthropy Advisors baked up the pre-seed …

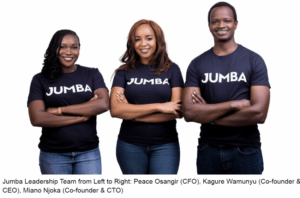

- Kenya’s construction tech startup Jumba, has announced it has raised a $4.5 million seed round.

- The funds will be used to further develop their tech and extend their growth in East Africa and beyond.

- Jumba simplifies the sourcing of construction materials through a common marketplace for retailers and developers.

Kenya’s construction tech startup Jumba, has announced it has raised a $4.5 million seed round. The funds will be used to further develop their tech and extend their growth in East Africa and beyond.

Jumba launched its marketplace in April 2022 and already serves customers in over 60 percent of the counties in Kenya.

The company creates efficiencies in the construction materials supply chain by offering digital transactions and transparent pricing for manufacturers, hardware stores and construction sites. Hardware store owners use Jumba’s platform as a one stop shop for all construction materials, benefiting from pricing and supply visibility as well …