- Why Africa’s population explosion is a mixed bag of opportunities and challenges

- Africa’s capital market access is improving, and so is the appetite for Eurobonds

- From safari icons to status symbols: The dual fate of Tanzania’s black rhinos

- Tanzania taps $149 million IMF loan for budgetary support

- Africa poised for fastest growth in $8 trillion cooling systems market

- Rwanda-based Bboxx eyes generating $100M worth of carbon credits in Africa

- Telemedicine Services in Murang’a County: Kenya’s technological Initiative to Decentralize Healthcare

- The bitter pill of cocoa’s value chain in Ghana and Ivory Coast

Investing

- With its multiple technologies, Bboxx is trailblazing in the green energy space, scaling its operations across Africa and projecting to offset over 20 million tonnes of CO2.

- Bboxx has been awarded Gold Standard certification for carbon credit programs based on solar home systems, clean cooking alternatives, and solar-powered water pumps.

- Implementing carbon programs allows Bboxx to accelerate market growth potential by reaching over 4 million customers in five African countries.

Rwanda-based Bboxx plans to offset over 20 million tonnes of carbon and generate $100 million worth of carbon credits through clean energy projects in Africa.

In this initiative, Bboxx projects to positively impact the lives of over four million customers across Rwanda, Kenya, Nigeria, Togo, and the Democratic Republic of Congo (DRC).

These revelations follow Bboxx’s recognition with the Gold Standard certification for its continued rollout of clean energy projects in five African countries. This certification marks a vital moment …

- Kenya’s private equity deals size are expected to remain modest this year.

- However, despite the high optimism, deal sizes in East Africa are expected to remain modest.

- However, businesses are concerned that firms will be scouting for exits, too.

Kenya and its East Africa peers are confident that the fundraising environment for businesses will continue improving in the next 12 months even as the continent experiences mixed expectations.

New findings by Audit firm Deloitte show that while East and West Africans largely anticipate an improvement, opinions in North and Southern Africa are divided, with some expecting improvements, others predicting stagnation, and some foreseeing deterioration.

This outlook comes against the backdrop of persistent high interest rates, inflation, and geopolitical uncertainty, which led to a 9 per cent drop in finalized funds year-on-year in 2023.

The Deloitte Africa Private Equity Confidence Survey 2024, shows that in East Africa, optimism is on …

The opulent and contemporary Downtown Dubai is a global attraction for Vietnamese investors. It is a lively neighbourhood that was built by Emaar Properties and contains some of the most famous structures in the world such as Burj Khalifa and Dubai Mall; therefore, it is an ideal place for investing in property. In this article, we will look at different kinds of real estate in Downtown Dubai which are attractive to Vietnamese buyers.

Overview of Downtown Dubai

Situated between Sheikh Zayed Road and Financial Centre Road, the Downtown Dubai neighbourhood is a mixed-use development located at the centre of the city. This area contains everything; residential, commercial, and leisure spaces for both residents and visitors. The tall skyscrapers, luxury apartments, and top-notch facilities define this as among the best areas to invest in Dubai property-wise.

Types of Properties Available

Apartments

Downtown Dubai provides a broad choice of luxury apartments that …

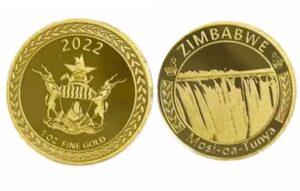

The central bank kept the policy rate at 200 per cent saying it would be reviewed in line with developments in monthly inflation. The high rate is to ensure that it is not viable to borrow local currency to speculate in the black market or even buy gold coins.

With foreign currency-denominated loans now constituting more than half of the total banking sector loans, with effect from September 1, statutory reserve requirements would be extended to forex deposits at rates of 5 per cent for call deposits and 2,5 per cent for time and savings deposits to ensure continued soundness of the banking sector.

Foreign exchange retention thresholds have been maintained at 75 per cent for agricultural exporters and 100 per cent for tourism, recovering from the effects of Covid-19.…

The Kenyan stock market resumed Wednesday following the general election break with a $268 million gain, as early results revealed a close contest involving Deputy President William Ruto and former Prime Minister Raila Odinga.…

- Kakuzi, a listed Kenyan agri-business, has partnered with marketing firm Driscoll’s to launch a blueberry export plan

- Under the deal, the two firms plan to grow the local and export volumes of blueberry in Kenya

- The blueberry venture, which has been undergoing production and commercial trials, is part of Kakuzi’s revenue diversification strategy

Kenya has announced plans to export blueberries into the international market, following a partnership between Kakuzi and Driscoll’s.

On August 12, 2022, the listed Kenyan business signed a deal with Driscoll’s, a global market leader in fresh strawberries, blueberries, raspberries and blackberries, to grow the local and export volumes of blueberry.

Kakuzi PLC Managing Director Chris Flowers said Driscoll’s market evaluation team conducted a fact-finding tour of the firm’s orchards in Makuyu, Murang’a county, prior to launching the blueberry export plan.

Driscoll’s team comprised 13 senior sourcing, Technical and market development executives led by Driscoll’s Vice President …

The underlying constituents of the new 1nvest ETF, which will track the MSCI World SRI Select Reduced Fossil Fuels Index, are companies that mitigate risks posed by climate change and exhibit high levels of the environment, and social, and governance (ESG) performance.

According to an article published by the JSE on July 28, 2022, to qualify for inclusion in the index, companies are required to have an MSCI ESG rating of ‘A’ or above.

The ETF has an investment mandate that excludes companies in industries related to goods and services such as nuclear weapons, tobacco, civilian firearms, conventional weapons, alcohol, gambling, adult entertainment, genetically modified organisms, thermal coal, and oil & gas.

Director of Capital Markets at the JSE, Valdene Reddy, said that the listing of the latest 1nvest ETF demonstrates the JSE’s commitment to remain a capital-raising platform of choice. As this segment grows, a listing on the JSE …

- Local Authorities Pension Fund (LAPF) Kenya has announced plans to construct a mixed-use facility at an estimated cost of KSh 10.0 billion ($83 million) in Nakuru County

- The mixed-use facility will comprise a shopping mall, a five-star hotel, a warehouse block, residential apartments, a kindergarten school, a petrol station, and an amusement park

- The facility’s construction, which will be done in phases for an undisclosed period, will add to the pension administrator’s investment assets, currently over KSh 51.6 billion

- A mixed-use building aims to combine three or more uses into one structure, such as residential, hotel, retail, parking, transportation, cultural, and entertainment

Local Authorities Pension Fund (LAPF) Kenya has announced plans to construct a mixed-use facility at an estimated cost of KSh 10.0 billion ($83 million) in Nakuru County.

The mixed-use facility will comprise a shopping mall, a five-star hotel, a warehouse block, residential apartments, a kindergarten school, a petrol …

-

National Bank of Kenya (NBK) has received $10 million from WaterEquity investment for onward lending to public and private water utility companies

-

The NBK, WaterEquity partnership will also benefit micro, small, and medium-sized enterprises (MSMEs) by boosting the KSh 5 Billion NBK Majikonnect programme

- NBK’s collaboration with WaterEquity is also expected to positively and significantly impact the country’s access to water, sanitation, and hygiene services and products

National Bank of Kenya (NBK) has partnered WaterEquity, a global impact investor, for onward lending to public and private water utility companies.

The NBK, WaterEquity partnership will also benefit micro, small, and medium-sized enterprises (MSMEs) by boosting the KSh 5 Billion NBK Majikonnect programme up to an additional USD 10 million.

Acting NBK Managing Director Peter Kioko reaffirmed the bank’s commitment to supporting last mile connectivity in the water sector through increased access to financing.

He described WaterEquity as an entity intentionally focused …