- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Money Deals

- Within the financial history of Africa, the last 10 years have witnessed a notable surge in the acceptance of Forex CFD trading.

- Technological advancements have become the unsung stars of the Forex CFD trading story in Africa.

- If you wish to get started with Forex CFD trading in Africa – you need a trusted broker with a reputable trading app.

Within the huge financial spectacle, Forex CFD trading is a gripping protagonist that draws traders into its complicated storylines of profit and risk, all set against the dramatic backdrop of a Shakespearean tragedy. With 2024 drawing to a close, it is wise for us to examine critically the story of Forex CFD trading in Africa. Like a rollercoaster journey over the wild landscape of the stock market, each turn offers a unique combination of opportunity and difficulty.

The Rise of Forex CFD Trading in Africa

Within the financial history …

Thanks to virtual dollar cards, residents of African countries find it significantly easier to conduct online transactions on popular digital services and shop on international platforms.

In our article, we explore the top 5 virtual cards on the continent. All of them are characterized by seamless online transactions and enhanced security features. They are easy to use and simple to obtain.

1. PSTNET

FinTech service PSTNET introduces virtual cards compatible with Visa and Mastercard, offering unrestricted global usage. These cards are versatile, catering to various needs. Specialized cards are available, such as those for managing payments for Facebook Ads or Google Ads.

We will focus on the service’s most popular card – Ultima.

Ultima is a 3D Secure virtual dollar card, ensuring all transactions are securely protected. It can be used for payments on platforms like PayPal, Steam, Spotify, Netflix, Patreon, Unity 3D, and app stores such as Google …

- A key component of successful cryptocurrency investment is utilizing cryptocurrency exchanges effectively.

- The USDT/SOL exchange pair refers to the trading of Tether (USDT) against Solana (SOL) on a cryptocurrency exchange.

- Solana, on the other hand, is a blockchain platform designed for decentralized applications and crypto-native projects.

Cryptocurrency investments have gained significant popularity in recent years, providing individuals with opportunities to grow their capital in the digital asset space. One of the key components of successful cryptocurrency investment is utilizing cryptocurrency exchanges effectively. In this blog, we will explore the concept of using exchanges to grow your capital, with a specific focus on the USDT/SOL exchange pair.

What is the USDT/SOL exchange pair?

The USDT/SOL exchange pair refers to the trading of Tether (USDT) against Solana (SOL) on a cryptocurrency exchange. Tether is a stablecoin pegged to the value of the US dollar, providing investors with a stable and reliable cryptocurrency …

- Africa continues to grapple with food insecurity exacerbated by climate change and inadequate access to financing for both startups and food producers alike.

- In response, innovators and bold entrepreneurs are going digital, devising modern solutions to enhance food production.

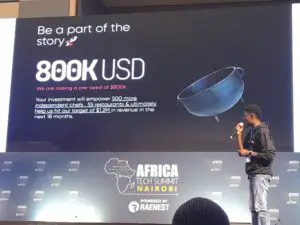

- At the Africa Tech Summit in Nairobi, agri-innovation startups Homemade by Dropp, Koolboks, Samalife, BWS, Hello Tractor, Seabex and ReNile shared their entrepreneurial journey and reasons why they need financing to create value for farmers and consumers.

A number of startups with a focus on digital agricultural innovation in Africa are seeking fresh financing to scale and accelerate their growth across the continent, which is currently under pressure to feed a rising population.

These startups are eyeing opportunities in climate smart agriculture in Africa, the new frontier for business expansion globally.

Currently, agriculture remains the continent’s largest industry and employer. The industry is, however, facing significant challenges across the value chain, …

- Kenya’s Eurobond will positively impact the exchange, inflation, and interest rates.

- Diamond Trust Bank revealed that Kenya’s $1.5 billion Eurobond attracted more than $6 billion in demand.

- Kenya’s $1.5 Billion Eurobond will also be used to offset $2billion Eurobond maturing in June.

The issuance of Kenya’s $1.5 Billion Eurobond is likely to ease concerns about the debt situation and lift the overall outlook for the country, one of the country’s banking industry players has said.

Diamond Trust Bank revealed that the new $1.5 billion Eurobond, which attracted demand of more than $6 billion, is likely to positively affect the exchange rate, inflation, interest rates, and government spending in the payment of debts and development.

Speaking at DTB’s Economic and Sustainability Forum, the bank’s Group CEO and Managing Director Nasim Devji said the recovery will be felt more in the second half of the year, and the economy will grow …

- Non-performing loans in Kenya surged to a 16-year high of 15 per cent in August 2023.

- The Kenya Bankers Association had called for further monetary policy tightening by the CBK, terming it a cure to elevated non-performing loans.

- According to the CBK data, forex pressure cut lending to the private sector to 8.3 per cent during the review period.

The banking sector regulator has said that Kenya’s private sector players resorted to alternative funding sources to avoid the high lending rates, leading to a drop in non-performing loans during the holiday season.

The continued surge in bank interest rates has hit individuals and businesses hard on the back of the Central Bank of Kenya’s (CBK) elevated benchmark interest rate. This has happened thrice since Governor Kamau Thugge took office, citing the need to support the country’s struggling shilling.

On Tuesday this week, the Central Bank of Kenya increased the benchmark …

- Italy’s initial pledge of €5.5 billion ($5.95 billion) also includes guarantees, according to Italian Prime Minister Georgia Meloni.

- AU Commission Chairperson Moussa Faki welcomed the pledge, while noting that prior consultation on the Mattei plan with the African continent would have been desirable.

- The plan was named after Eni’s founder, Enrico Mattei, the initiative which seemed to be aimed at encouraging a holistic approach to dealing with African countries of interest to Italy.

Italy has unveiled a close to $6 billion funding plan to support African development, a move geared towards strengthening bilateral ties. The Italian government noted that the funding would go a long way to curb African emigration to Europe.

The funding was unveiled during the one-day Italy-Africa summit that took place in Rome, Italy, bringing together several African heads of state and high-profile global leaders in the development space.

The initial pledge of €5.5 billion ($5.95 billion), …

- Cameroon is highly vulnerable to climate change, with risks from recurrent droughts, floods, landslides, and coastal erosion.

- The funding will play an important role to support the country’s efforts to adapt to and mitigate the impact of climate change and replace more expensive financing.

- The reform measures under the RSF are also expected to reinforce the growing engagement of development partners and other stakeholders

The International Monetary Fund (IMF) has approved an 18-month arrangement worth $183.4 million for Cameroon under the fund’s Resilience and Sustainability Facility.

The allocation is equivalent to 50 per cent of quota, with disbursements to start when the first review of the arrangement is completed.

IMF highlights Cameroon as highly vulnerable to climate change, with risks from recurrent droughts, floods, landslides, and coastal erosion.

It however says the funding will play an important role to support the country’s efforts to adapt to and mitigate the impact …

- The IMF anticipates a peak in interest rates at the beginning of 2024, following a slower climb in 2023 across major economies.

- This will likely exert pressure on already struggling currencies across Africa.

- Notably, the US Federal Reserve is expected to witness interest rates reaching around 5.4%, with plans for rate cuts in Third Quarter.

Pressure on the weakening local currencies in African economies may persist for much of this year, with further depreciation against major currencies anticipated until the third quarter.

According to the International Monetary Fund (IMF), their latest interest rates forecast update for major economies covering the period from 2024 to 2028 projects a peak in interest rates at the beginning of 2024. This comes after rates continued to climb at a slower pace late last year.

US Federal Reserve interest rate

For instance, the US Federal Reserve is expected to witness interest rates peaking around 5.4 …