- Kenya, Tanzania braces for torrential floods as Cyclone Hidaya approaches

- EAC monetary affairs committee to discuss single currency progress in Juba talks

- Transport and food prices drive down Kenya’s inflation to 5% in April

- Payment for ransomware attacks increase by 500 per cent in one year

- History beckons as push for Kenya’s President Ruto to address US Congress gathers pace

- IMF’s Sub-Saharan Africa economic forecast shows 1.2 percent GDP growth

- The US Congress proposes extending Agoa to 2041, covering all African countries

- Millions at risk of famine as fuel tax row halts UN aid operations in South Sudan

Business

- In the past two years, short-term rentals in Nairobi have been the new trend.

- Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023.

- Trappler highlights that hospitality is a key economic driver, employment creator, and focal property type in regions throughout East Africa.

Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023. This resurgence is particularly notable in Nairobi, especially with the renewed demand for short-term rentals.

The strategic position of Kenya’s capital city serves as an East African hub for various industries, including corporate, government, MICE (Meetings, Incentives, Conferences, and Exhibitions), embassies, and tourism, which makes it an attractive destination for hospitality and residence brands.

The increasing and diversifying demand for accommodation creates meaningful opportunities for market expansion and business growth.…

- The partnership will enable Kenya and South Korea to strengthen legal services and networks for African companies.

- G&A has built a strong reputation in Africa, delivering on transformational projects like the recent Eurobond

- In February last year, the two countries pledged to continue to nurture and expand ties

A law firm in Nairobi is championing a plan to see Kenya and South Korea strengthen legal services for companies in Africa. Kenya’s G&A Advocates LLP has signed a partnership agreement with South Korea-based law firm Jipyong ahead of the Korea-African Summit. The partnership will enable Kenya and South Korea to strengthen legal services and networks for African companies.

The Korean African Summit is set to take place between June 4 and June 5 in Seoul, South Korea, under the theme: “The Future We Make Together, Shared Growth, Sustainability and Solidarity.”

The summit, which will be the first-ever, aims to strengthen the …

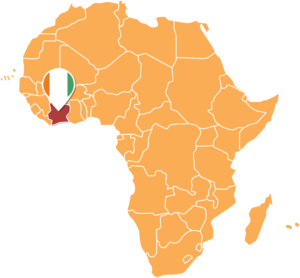

- The upcoming US-Africa green and sustainable financing forum in Côte d’Ivoire aims to mobilize funding for infrastructure projects across Africa.

- Set for March 19–20, the workshop will feature industry leaders, US technical experts, and key financiers.

- The event highlights the critical need for renewable energy funding models, financing mechanisms, and regulatory and policy reforms to facilitate the growth of green and sustainable infrastructure.

To foster sustainable development in Africa, the United States Trade and Development Agency (USTDA) is joining forces with the African Development Bank Group to host the US-Africa Green and Sustainable Financing Workshop.

Set to go down in Abidjan, Côte d’Ivoire, on March 19–20, 2024, this event is poised to bring to the forefront the pressing need for green and sustainable infrastructure projects across the continent.

The workshop, a convergence of industry leaders, explores innovative financing models that can support Africa’s journey towards a resilient and sustainable future.…

-

Glovo has launched the ‘Glovo Africa Graduate Programme,’ an initiative seeking to boost the potential of young Kenyan talent while extending it to other African countries.

-

The initiative is specifically tailored to recruit and develop promising Kenyan and African talent for the job market.

- Participants can explore roles in operations, quick-commerce, partners & brands, finance & strategy, and brand marketing services.

Glovo Africa Graduate Programme

Global technology platform for on-demand delivery, Glovo, has launched the ‘Glovo Africa Graduate Program’, an initiative seeking to boost the potential of young Kenyan talent while extending to other countries in Africa.

The announcement reiterated that the firm specifically targeted Kenyan graduates to bridge the gap between schooling and job market needs.

“In a move to harness the potential of young Kenyan professionals, we are thrilled to announce the commencement of our new graduate programme. The initiative is specifically tailored to recruit and develop …

- Africa’s low electricity access stresses the need to double more than the efforts to meet SGD 7.1 by 2030.

- In Kenya, data by the lender shows 71 per cent of the population had access to electricity in 2021, compared to about 14 per cent in 2000.

- World Bank further identifies a stark divide in global access to electricity between urban and rural areas.

Sub-Saharan African states have made tremendous progress in electricity access in the past two decades, with the access rate rising from 25 per cent in 2000 to 48 per cent in 2020.

However, according to the World Bank, countries must double their electrification efforts to bring electricity to all by 2030, meeting Sustainable Development Goal Seven.

“Global access to electricity is increasing at a slow pace, with the progress towards achieving universal access to electricity being slow over the last 20 years,” …

- Africa’s economic growth in 2024 is expected to be upward with the real GDP projected to grow by 3.2 per cent, up from 2.6 per cent in 2023.

- East Africa, encompassing Ethiopia, Kenya, Uganda, Rwanda, Tanzania, and the DRC, will again power the continent’s growth prospects.

- Despite the projected continental growth, the intelligence unit faces substantial risks, including security threats, political instability, and debt repayment burdens.

Africa’s economic growth 2024

According to the international research unit, Economic Intelligence, Africa is expected to grow at the second-fastest rate among major regions globally in 2024. The unit ranks behind Asia, which China and India will propel.

Except for Sudan and Equatorial Guinea, whose economies appear destined to decline this year, most African governments are predicted to report good growth stories.

The real African GDP is expected to rise by 3.2 per cent in 2024, up from 2.6 per cent in 2023, …

- Continuing from the discussion of evolving US-Africa trade relations, a key aspect of this dynamic is the strategic objective of countering Chinese influence on the continent.

- By 2024, Africa is poised to undergo a significant shift in geopolitical and economic dynamics, emerging as a crucial arena for global powers such as China and the US.

- The evolving focus on Africa is driven by its transforming economic landscape, marked by rapid growth, a youthful population, and abundant resources, attracting attention from major players seeking strategic advantages.

By 2024, Africa will have witnessed the beginning of a new age in the geopolitical and economic dynamics of the world. In recent years, the continent has shifted its focus from humanitarian issues and developmental assistance to becoming an important strategic arena for the world’s leading powers, particularly China and the US. Several elements are coming together to highlight Africa’s growing importance internationally, driving this …

- Maximizing rental income from investment properties in Kenya requires strategic planning and effective management.

- As a real estate investor in Kenya, it is important to focus on acquiring properties and have a well-thought-out exit strategy in mind.

- Real estate investment in Kenya can be rewarding if approached with knowledge and strategic planning.

Tips and strategies to maximise rental income in Kenya

Maximizing rental income from investment properties in Kenya requires strategic planning and effective management. By implementing the following tips and strategies, real estate investors can maximize their returns and ensure the financial success of their rental properties.

- Set Competitive Rental Rates

Determining the right rental rates for your properties is crucial. Conduct thorough market research to understand the rental prices in the specific location and consider factors such as property size, amenities, location, and market demand. Setting competitive and attractive rental rates will attract tenants and help maintain …

- Real estate investment in Kenya requires a comprehensive understanding of the legal factors and regulations that govern the industry.

- Conducting thorough research on real estate investment in Kenya is crucial to ensure your success.

- Considering all the legal implications before finalizing your property investment is also crucial.

Understanding real estate investment in Kenya

When embarking on real estate investment in Kenya, it is crucial to have a comprehensive understanding of the legal factors and regulations that govern the industry. By considering these considerations, investors can protect their investments and ensure compliance with the law. Here are some key legal aspects to consider:

- Land Ownership and Titles

Before investing in any property, verifying the land ownership and ensuring the title is legitimate is essential. Conduct thorough research and request official documentation from the relevant authorities to confirm ownership rights.

- Property Documentation and Contracts

Ensure all property transactions are backed by proper …