- Market size of Africa’s digital economy could reach $712 billion by 2050.

- In 2022 only 36 percent of the African population had access to broadband internet.

- Mobile Network Operators (MNOs) are streamlining adoption of 5G services.

Africa is on the verge of an economic revolution. From the north to the southern part of the Saharan desert, nations are striving to eliminate poverty and gain a strong foothold in global markets.

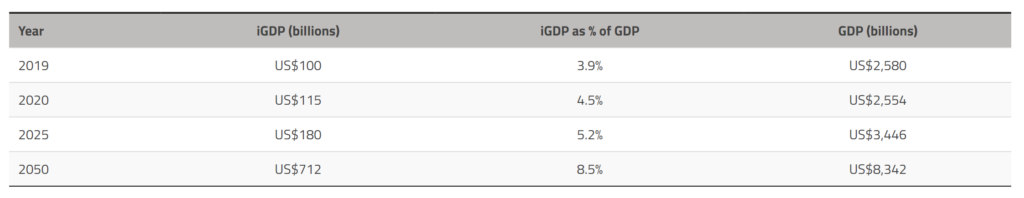

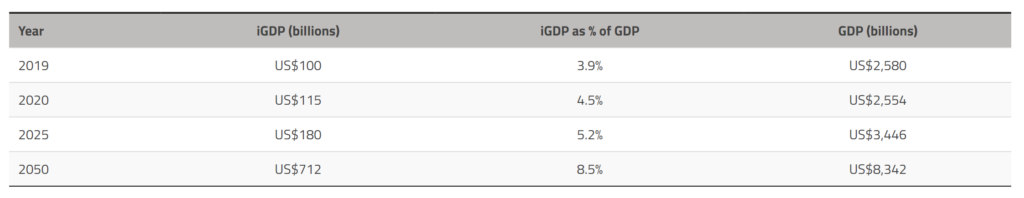

In the same vein, the continent is banking on the potential held by the digital economy. Reports ping the sector to higher standards, including a report from non-profit Endeavor predicting that the market size of Africa’s digital economy could reach $712 billion by 2050.

The growth is propelled by the massive engagement of the continent’s younger population, rising smartphone adoption and increasing internet penetration.

Read also: World Bank backs Smart Africa’s Digital Academy with $20M grant

Digital economy in Africa

Africa’s digital economy, already valued at $115 billion, is still in a nascent phase, with only 33 per cent of the population using the internet. However, Endeavor’s analysis shows rapid growth. Further, Africa’s GDP is expanding at a compound annual growth rate (CAGR) of 4 per cent, comparing favourably to Europe and Latin America’s 1.7 per cent. The population is simultaneously becoming much more prosperous, with consumer spending growing at 9.4 per cent CAGR.

African developers are creating more open-source repositories on the Github software engineering marketplace than any other continent globally, and investment in African start-ups is growing twice as fast as other global markets.

Another statistic demonstrates the scale of change. According to the United Nations, Africa is the fastest urbanising continent in the world, forecast to hit 60 per cent by 2050. The state of the African digital economy is interesting. According to a report from the Diplo a non-profit foundation, despite the improved internet access and the presence of vibrant startup ecosystems to improvement, disparities exist.

“There are disparities between countries. For instance, when it comes to e-commerce readiness, South Africa scored 56.5 points in UNCTAD’s 2020 index, compared to only 5.6 for Niger” the report said in part.

In 2012, Africa’s digital economy was estimated at roughly 1.1 percent, or $30 billion of its GDP. In 2020, estimates indicated a contribution of 4.5 per cent, or $115 billion. This growth is expected to continue in the coming years. A 2020 study by Google and the International Finance Corporation (IFC) found that the digital economy could contribute $180 billion (5.2 per cent) to the continent’s GDP by 2025, and $712 (8.5 per cent) billion by 2050.

Reasons behind this estimated growth include better quality internet connectivity and improved access, vibrant startup ecosystems, growing tech talent pools, and improvements in policy and regulatory frameworks (including the launch of the African Continental Free Trade Area).

Further down the line, there are some countries on a rapid trajectory, for example, by 2025, the share of the economy powered by the Internet in Kenya, Morocco, Senegal, and South Africa will be between 7 per cent and 9 per cent.

Fortunately, the region’s assets such as e-commerce, fintech, health tech, and media and entertainment are among the sectors that drive the growth of Africa’s digital economy and the continent’s digital transformation.

Read also: Blockchain for Employment: Africa’s Leap into the Gig Economy

E-commerce full of contradictions

On the other end, research materials pin the region’s e-commerce on a rather different trajectory. For instance, Diplo finds the e-commerce landscape to be full of contradictions.

“On the one hand, the e-commerce industry has grown considerably in the past decade, due to a combination of factors, such as growing internet penetration rates, the spread of mobile telephony and mobile money services, and increased use of credit cards and access to bank accounts. On the other hand, the average index of e-commerce readiness of African countries is still low compared to other developing regions and developed countries” Diplo report stated in part.

According to a study by the GSMA most micro-enterprises who make up a significant portion of African businesses are not fully immersed in online platforms as other regions. Egypt, Ethiopia, Kenya, Ghana, Nigeria and South Africa – were studied by the

GSMA Mobile for Development team on 1,500 MSMEs and found online channels helped businesses expand operations, by slashing barrier to entry with little cost.

GSMA Mobile for Development team on 1,500 MSMEs and found online channels helped businesses expand operations, by slashing barrier to entry with little cost.

However, African MSMEs haven’t adopted the latter fully as the opportunities aren’t exploited. With growth in the use of social media platforms such as Whatsapp Messenger, Instagram and Facebook for e-commerce, Africa’s e-commerce landscape seems to shift.

The shift is due to a higher sense of trust and confidence on the business owner’s side. The social platforms allow interactivity directly with customers to negotiate pricing, logistical support and flexibility.

Meanwhile, Diplo finds access to infrastructure, cybersecurity and capacity development on digital issues as setbacks to e-commerce growth. However, for the latter to be a reality certain things must be put in place to enable digital transformation is achieved in Africa.

Digital transformation in Africa

The World Bank finds the current younger population to be an asset in propelling the pathways for rapid economic growth within digital means.

Despite of the underlying challenges such as digital divide and increased cyber risks – there is potential in coordinate regional efforts to mitigate the latter.

According to data from the World Bank, only 36 percent of Africa’s population had broadband internet access in 2022. Despite mobile internet availability has increased in the continent, broadband infrastructure reach and the quality of available services still lag other regions.

However, bolstering access, affordability, usage and competitiveness is essential to foster rigid digital infrastructure. According to Brookings, African countries lag behind G20 countries on indicators related to digital infrastructure.

Investment in digital structure is of paramount importance. Just like the way how mobile networks have championed for 5G infrastructures, policymakers in Africa ought to expand fixed broadband.

The broadband will ensure high-speed internet becomes more accessible and affordable as the latter remains expensive in terms of connectivity in many countries.

“To address affordability, policymakers can consider cross-subsidization by regulating prices for lifeline packages, increasing competition between ICT firms by auctioning spectrum licenses, and aggregating demand from public buyers to encourage network expansion” the Brookings report stated in part.

With the expansion in the establishment of tech start ups especially in growing economies such as Kenya and Tanzania, investment in digital skills development is essential. Accelerating skilling, upskilling and reskilling for the future work is at the core of sustainable digital economy transformation.

The report pointed out that, every African country with sufficient data lags behind the G20. At a time when demand for foundational digital skills is increasing (projected to account for 70 percent of the total demand for digital skills by 2030), African countries need to prioritize strategies to enhance the digital skills of a country’s population at the basic, intermediate, and advanced levels.

At the end of the day Africa holds massive potential and has demonstrated to be capable of developing pathways to harness the benefits of the digital economy.