- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: African Continental Free Trade Area

- Kenya’s tea exports increase on the reopening of the Tanzanian market

- Kenya had earlier in the month unveiled the China-Kenya Tea Trade Centre in Fujian province to distribute Kenyan tea in China.

- Kenya’s export value for the first time in history hit Sh1trillion in 2023, according to the 2024 economic survey by KNBS.

The volume of Kenya’s tea exports increased by 19 per cent in the first quarter of 2024, boosted by increased shipment to key markets, according to a communication from the Tea Board of Kenya (TBK).

The exports rose to 155.8 million kilograms, up from 131.1 million kgs posted in January-March 2023, the TBK said in a report released in Nairobi. The TBK attributed the surge to rising demand in traditional and emerging markets.

In the period under review Tanzania had reversed its decision to suspend imports of tea, that presented a window for Kenyan traders to …

- Market size of Africa’s digital economy could reach $712 billion by 2050.

- In 2022 only 36 percent of the African population had access to broadband internet.

- Mobile Network Operators (MNOs) are streamlining adoption of 5G services.

Africa is on the verge of an economic revolution. From the north to the southern part of the Saharan desert, nations are striving to eliminate poverty and gain a strong foothold in global markets.

In the same vein, the continent is banking on the potential held by the digital economy. Reports ping the sector to higher standards, including a report from non-profit Endeavor predicting that the market size of Africa’s digital economy could reach $712 billion by 2050.

The growth is propelled by the massive engagement of the continent’s younger population, rising smartphone adoption and increasing internet penetration.

Read also: World Bank backs Smart Africa’s Digital Academy with $20M grant

Digital economy in

…- Intra-African Payment Systems is expected to simplify trade among member states on the platform.

- In West Africa Nigeria, Ghana, Guinea, Gambia, Liberia, and Sierra Leone have joined the Intra-African Payment Systems.

- 3 Countries in East Africa, Kenya, Rwanda, and Djibouti are among the early members of Intra-African Payment Systems.

The push for a single trading platform for African countries is gathering pace after tnike air max 90 futura jordan max aura 4 custom maple leafs jersey dallas cowboys slippers mens blundstone uomo yeezy boost 350 v2 hyperspace custom stitched nfl jersey jordan proto max 720 custom kings jersey dallas cowboys slippers mens penn state jersey deuce vaughn jersey air jordan 1 low flyease luvme human hair wigs sac eastpak he Pan African Payment and Settlement System (PAPSS) enrolled the Central Bank of Tunisia (Banque Centrale de Tunisie) as its thirteenth Central Bank member.

The move is seen as a …

- President Sisi says Africa’s vast natural resources and its agricultural, educational, and mineral potential should be leveraged to drive intra-African trade.

- We in Egypt should always build, develop, rebuild, and cooperate in these fields, and nothing less: President Sisi.

- At the ongoing IATF2023, in Cairo, Sisi notes that there is a need for African nations to cooperate positively towards mutual growth.

President Abdel Fattah al-Sisi of Egypt, while participating in the third Intra-African Trade Fair (IATF2023) in Cairo, called on countries across the continent to consolidate their efforts and promote intra-African trade.

In an address at the Presidential Summit of the trade fair, Sisi stated that Africa’s vast natural resources and its agricultural, educational, and mineral potential should be leveraged to drive intra-African trade. He added that there is a need for African nations to cooperate positively towards mutual growth.

Intra-African trade fostering regional partnerships

“As you can see, the …

The African Continental Free Trade Area (AfCFTA) is now widely touted as the African Union’s (AU) most audacious project. The framework ties together the most significant number of member countries of any trade agreement since the World Trade Organisation (WTO) in 1995.

The AfCFTA had become topical even before its formal launch. Members of the business community eagerly awaited the full implementation of the AfCFTA. But two years since its formal launch, how far has the AfCFTA ushered in the ‘new era’ of African integration it promised?…

- An infusion of new investments and regulatory transformations is shaping financial interactions and digital payments in Africa.

- Africa’s digital payments operations produced around $24 billion in revenue in 2020, comprising domestic and cross-border payments.

- For Africa’s digital transition to run smoothly, a cohesive environment that ensures investment and funding remains necessary.

Human commerce constantly seeks more efficient exchange mediums, and this innovation is currently intensifying. Consequently, how individuals pay for products and services has changed dramatically in the 21st century. Digital payments in Africa are gradually replacing cash, and cryptocurrencies and virtual currencies have lately emerged as substitutes for conventional money concepts.

Africa has kept up with, and in some instances led, technological advancement. An infusion of new investments and regulatory transformations is shaping financial interactions and digital payments in Africa. Cash remains king in Africa. However, research indicates that its dominance may be challenged in the future years as …

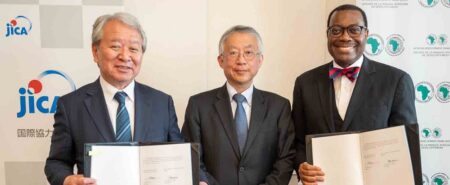

- African Development Bank tells Japanese investors putting their money in the continent is profitable.

- Japan’s Foreign Direct Investments in Africa declined from $10 billion in 2016 to just $4.7 billion in 2020 during Covid-19, before picking up to $6 billion in 2021.

- According to AfDB, Africa accounts for only 0.003 percent of Japan’s $2 trillion global Foreign Direct Investments.

- Japan’s Prime Minister Fumio Kishida announced during the TICAD 8 Summit in Tunis last year $30 billion for Africa, including support for startups.

Africa is keen to increase Japanese investment in the continent, the African Development Bank (AfDB) has indicated amid growing interest from other countries including China, Europe and the US.

The move comes after a slump in Japan’s Foreign Direct Investments (FDIs) in Africa, which declined from $10 billion in 2016 to just $4.7 billion in 2020 during Covid-19, before picking to $6 billion in 2021.

According to AfDB, …

The rising commodity prices, surging inflationary pressures, and the contracting global financial situation have risked African trade and production capabilities. Moreover, the rising threat of sovereign defaults poses a severe risk to the growth of African trade. Thus, African trade prospects remain unclear, considering the challenging global economic scenario.

The Covid-19, energy and food shortages have hit with the countries having minimal or no policy space to respond. As a result, African countries have fallen into a real risk of debt distress and even possibilities for sovereign debt default.…

For historic reasons, bilateral and regional trade in Africa has been hampered by trade routes designed for export away from the continent rather than for facilitating intra-Africa trade. Obstacles include long distances, inadequate transport services, and inefficient institutional and transit regimes.

In many landlocked African countries, economic centres are located several hundred kilometres away from the closest seaport. Overcoming geographic constraints or the lack of economies of scale caused by small transportation volumes is key for all countries, particularly transit countries. A renewed focus on the efficiency of transport and logistics services is long overdue, given that many countries retain policies that favour closed, small, and inefficient services markets.

By committing to no new barriers to services trade during the progressive liberalization process, at least in the five priority sectors—business, communication, financial, transport, and tourism services, and with declining trade costs—the transport sector is bound to expand.…

The African passport is a common passport document that is set to replace the existing nationally issued AU member states’ passport, and exempt bearers from having to obtain any visas for all 55 states in Africa. The three types of AU passports that are to be issued include the Ordinary Passport which is 32 pages and valid for five years, that will be issued to citizens and is intended for occasional travel such as business trips and vacations. The Official or Service passport will be issued to officials attached to government institutions, who have to travel on official business.

Finally, the diplomatic passport will be issued to diplomats and consuls for work-related travel and to their accompanying dependents. The passport has inscriptions in English, Swahili, Arabic, French and Portuguese.

The initiative aims at transforming Africa’s laws, which remain generally restrictive on the movement of people. This, despite political commitments, to …