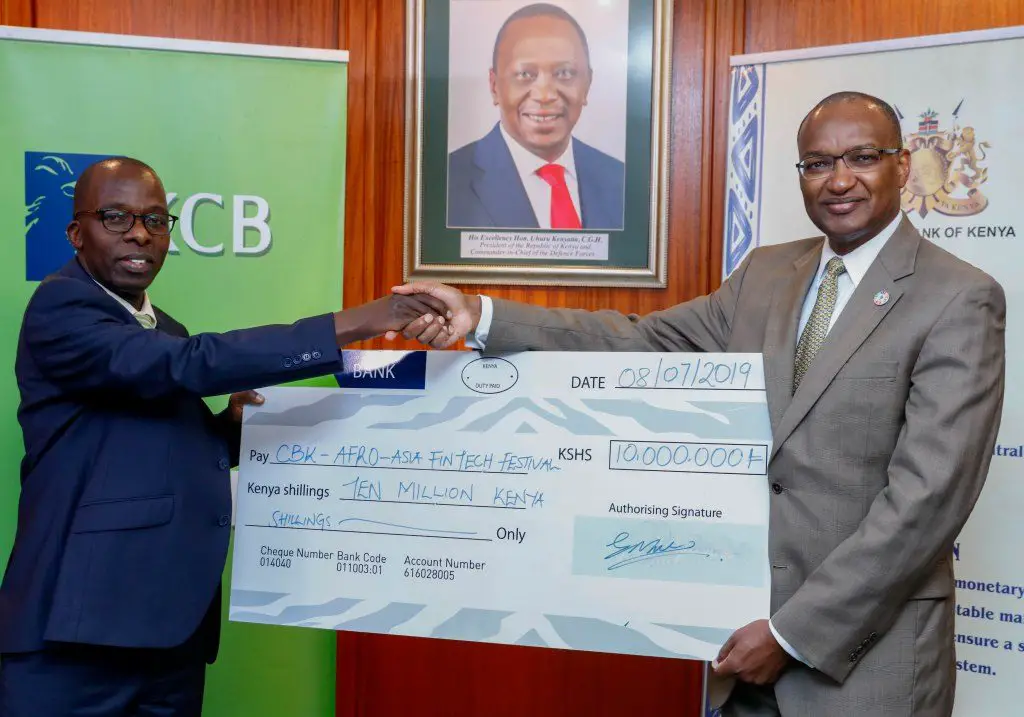

KCB Bank Kenya has committed Ksh10 million (US$97,448) to the Afro-Asia Fintech Festival 2019, a first of its kind in the region which will be held next week.

The funds will go into supporting the mega financial technology (Fintech) summit being hosted by the Central Bank of Kenya (CBK) and the Monetary Authority of Singapore.

The forum will take place between July 15–16 and is themed, ‘Fintech in Savannah’, modeled along the Singapore Fintech Festival.

KCB backing is informed by the need for Kenya to continue driving innovations in the banking sector to boost financial inclusion, the Nairobi Securities Exchange (NSE) listed lender has noted.

Speaking during the cheque handover to the CBK, KCB Group Chief Operating Officer Samuel Makome said: “For the past five years, we have made significant investments in financial technology in the realization that the future of banking is in digital finance. We will therefore remain innovative and relevant in fintech by continuously providing products and services that promote financial inclusion.”

For KCB, transactional activity continue to shift away from branches, with non-branch transactions, that is, mobile, agency banking, point of sale terminals and ATMs, standing at 88 per cent of total volumes, compared to 12 per cent handled at the branches.

Mobile banking products have grown in transaction numbers and volumes with loans of over Ksh54 billion (US$526.2million).

“Leapfrogging technology in the region is transforming millions of lives and is bringing the world closer together to enable seamless business transactions” said CBK Governor Patrick Njoroge.