- Africa’s average GDP will stabilize at around 4 percent in the course of the next two years, notes AfDB.

- The continent needs alternative sources of imports and new export markets to counter disruptions caused by the war in Ukraine.

- Economists are urging African economies to look at expediting intra-African trade to stave off global shocks.

A significant number of African nations continue to show economic resilience in the face of tougher global challenges. The latest update by the African Development Bank (AfDB) on economic review says the continent has a stable outlook in the 2023-2024 financial year.

Africa’s Macroeconomic Performance and Outlook report provides an up-to-date assessment of the continent’s macroeconomic performance and a forecast of expected performance on the backdrop of global economic challenges.

Africa average GDP to stabilise at 4 percent

The lender estimates that Africa’s average GDP will stabilise at around 4 percent in the course of the next two years, being an improvement from 3.8 percent reported last year.

While presenting the report on the sidelines of the 36th African Union Assembly in Addis Ababa, the AfDB Chief Economist and Vice President Kevin Urama said Africa needs market access for its commodities in the face of changing geo-political stances and friend shoring.

The report warns that economies in Africa need to get alternative sources of imports and scout for new export markets as the world grapples with disruptions caused by the war in Ukraine. By tapping into new markets, the continent would significantly boost its economic resilience in times of turbulence.

The economist also cautioned that while the report shows Africa’s resilience, there is a growing need for higher growth rates and more inclusiveness if the continent was to stave off the ongoing external economic shocks.

“To meet the significant financing gaps in Africa, it is imperative to enact policies that can mobilize and leverage private financing for development in Africa,” AfDB Vice President Kevin Urama noted.

Significant financing gaps in Africa

The report further cautions that tightening global financial conditions only means that African countries must turn to increasing their own domestic revenue sources without compromising the population’s well-being.

Appreciating US dollar will and has already caused dire consequences for most African economies, the report notes. As a result, imports are becoming more expensive, even as expensive US dollar makes it increasingly harder for African countries to access international capital markets for new financing.

The new biannual report provides analysis based on regional and global macroeconomic developments that occur by the quarter.

Overall, African economies face a myriad of challenges in attaining economic resilience in the face of complex global risks, but AfDB is offering possible solutions.

This first edition of the report is titled The Macroeconomic Performance and Outlook (MEO) 2023 and advocates for bolder policy actions if African economies are to mitigate the global compounding risks.

Read also:: Key issues for a resilient post-pandemic recovery

“Most African currencies, especially in commodity-exporting countries, lost substantial value against the dollar in 2022 due to monetary policy tightening in the United States,” cites the report.

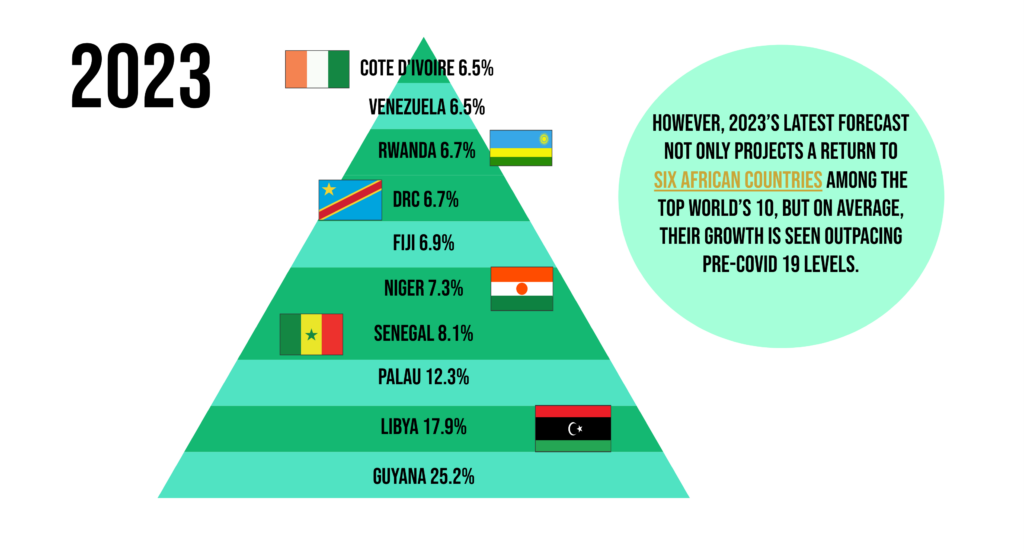

Five African economies to watch in 2023

AfDB economist Urama cautioned that currency weaknesses in Africa is threatening economic stability as king dollar strengthens. He cited the key causes of currency depreciation in Africa to be tightening global financial conditions and weak external demand. He also pointed to weak investment flows, and political risk aversion often associated with African countries’ election cycles.

The report shows that despite resilience, African countries are facing tough choices. Many economies were still smarting from Covid-19 global shocks only for the Russia-Ukraine war to complicate their recovery plan further.

“These conditions are pushing price stability beyond most central banks’ grasp,” the economist contends.

Read also: The Slowdown of the Global Economy: What it means for Africa’s Fragile Economies

According to the IMF’s World Economic Outlook, five of the world’s fastest-growing economies are Angola, Ethiopia, Nigeria, Kenya and South Africa.

The IMF predicts that Nigeria, Africa’s largest economy, will maintain its top spot in sub-Saharan Africa’s economic rankings. The country’s GDP will hit $574 billion this year keeping it ahead of the rest of the continent.

Even with massive power cuts, IMF notes South Africa will remain second-largest economy in sub-Saharan Africa. The country is projected to grow to $422 billion GDP this year. This is an impressive figure, and South Africa’s economy will likely continue to grow in the coming years.

Angola third largest economy in Africa

Further, riding on higher oil prices, Angola is expected to reclaim its place as the third-largest economy in sub-Saharan Africa. Across the continent, Angola is Africa’s second-largest oil producer after Nigeria. Other than oil, Angola is also powering its economy through trade in diamonds. The IMF expects Angola’s GDP to expand by 8.6 percent this year, reaching $135 billion.

Africa’s second-most populous country Ethiopia is next on the list and according to IMF. Addis Ababa has been tipped to displace Nairobi as the fourth-largest economy in sub-Saharan Africa. However, the IMF notes that this projection will only stand if there will be no resurgence of armed conflict. Additionally, policymakers in Ethiopia will have to maintain their current ambitious economic reforms to realise the growth. The IMF predicts Ethiopia’s GDP will hit $126.2 billion this year, expanding by 13.5 percent.

In Kenya, the IMF has revised the country’s 2023 economic growth forecast in 2023 to 5.3 percent. This is an upwards revision from 5.1 percent projected in October last year. Overall, Kenya’s GDP will reach $117.6 billion this year, just behind Angola and Ethiopia.