Airtel Uganda and KCB Bank Uganda announced a partnership to introduce a variety of mobile loans and savings solutions in Uganda.

From the partnership, its customers will earn interest on savings of five percent per annum on regular savings and 9 percent per annum on fixed deposits.

The automated digital products include Regular Savings, Instant Unsecured Mobile Loans and Fixed Deposit Savings Accounts that will allow its customers to borrow mobile loans from as low as UGX300 (KSH 9.15). Airtel Money Agents will be able to get unsecured loans at UGX300 interest only while KCB and Airtel customers can earn up to 9 percent interest on mobile savings.

The partnership is set to revolutionize savings in Uganda by providing the best interest rate in the market.

“Most of our customers are unbanked with limited or no access to financial products especially saving deposits. By offering competitive interest rates in an extremely simple product, we are attempting to democratize savings and contribute to building a savings culture in Uganda.” Said Mr Manoj Murali, Airtel Uganda Managing Director.

He also added that the telco believes that the loan products are an ideal approach to reach the unbanked population in Uganda and the rest of Africa.

“Digital financial services through mobile commerce rely on a network of agents who need to have sufficient balances of e-money or physical cash on hand, known as ‘float’ to meet the needs of their customers to cash in or cash out e-money. The loan product will deliver an affordable loan product guaranteeing the agents a better livelihood,” said Manoj.

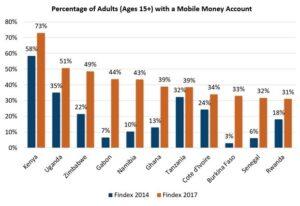

According to the Uganda Communication Commission (UCC), between January and December Uganda registered growth in new mobile money accounts with 2.6 million new accounts registered in the Q4 market Report of 2020.

In the quarter ending December 2020, the total active mobile money accounts stood at 22.5 million up from 20.9 million in the first quarter.

“As a bank, our commitment is to enable our customers to Go Ahead by leading in innovation and technology-driven banking services delivered through alternative banking platforms, real-time banking options and cashless transactions. We strongly believe this is now the ideal approach to deepen financial inclusion as well as reach the unbanked population in Uganda and the rest of Africa.” Said Edgar Byamah, Managing Director, KCB Bank Uganda.

He also added that the rise in mobile money transactions and the increase in the usage of digital solutions over the years has demonstrated that digital banking has and is still playing a key role in improving financial inclusion efforts. He also said that through the partnership they foresee the growth of businesses and individuals as well as the ease of financial solutions.

The loans and savings products are in line with Uganda’s government agenda to deepen financial and digital inclusion in the country by 2040.

Products launched include KCB Airtel Agent Float Financing and Airtel Money Supersaver. In July, they will launch their third product, a Fixed Savings Account to its portfolio which will enable mobile money customers to make deposits from $70.67 (UGX250,000).

The customer can commit to 3, 6 and 12 months investment period and earn 8 percent, 8.5 percent and 9 percent respectively. Withdrawal fees and deposit won’t be charged on this product making it very competitive in the market.

Airtel customers will be able to save using Airtel Money through Airtel Money Supersaver. There will be no charges on the set-up, deposits and withdrawals as well as a minimum balance. Through the product, customer can save from as low as UGX500 at an interest rate of 5 percent per year.

With KCB Airtel Agent Float Financing product, Airtel and KCB will give short term unsecured float loans to Agent and the loan will be instantly credited to the customer’s Airtel Wallet.

Last month, Airtel Uganda won the 2021 FinTech Innovation Award at the prestigious 18th Annual East Africa Com Virtual Awards for its continuous innovation under the Airtel Money services that has accelerated financial inclusion in Uganda.

In Uganda, Airtel is one of the top financial inclusion that enables mobile phone users in financially underserved population to transact in the digital economy.

“As Airtel Uganda, we pride in being a financial service partner our customers can trust as they send and receive money using safe, secure and affordable Airtel money services.” Said Amit Kapur, the Chief Commercial Officer of Airtel Uganda.