- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: Mobile money

- Small businesses struggle for credit as lenders channel 80 percent to Medium Sized Enterprises

- High collateral requirements and unfavourable interest rates have been found to disadvantage MSMEs

- Only 16 percent of businesses are reaping from Kenya’s formal MSMEs financing market valued at $45.4 billion (Sh5.9 trillion).

Only 1.1 million micro, small, and medium enterprises in Kenya have access to formal credit out of the total 7.4 million MSMEs in the country.

This equals only 16 percent of businesses reaping from Kenya’s formal MSMEs financing market valued at $45.4 billion (Sh5.9 trillion).

According to a new finding by pan African market insights firm Stears, despite MSMEs accounting for over 98 percent of businesses and contributing a substantial 40 percent to GDP formal financing is still small.

…“Despite their outsized economic impact, only 16 per cent of these vital enterprises currently access formal credit. With most MSMEs dependent on informal and

- Registered customers for M-Pesa Ethiopia rose to 3.1 million from 1.2 million as of half the Financial Year 2023/2024, transacting worth $115.63 million.

- Ethiopia’s National Financial Inclusion Strategy 2021–2025 aims to increase financial inclusion from 45 to 70 per cent of all adults by 2025, partly by scaling digital payments through mobile money services.

- The country also aims to increase the use of digital payments from 20 per cent of all adults in 2020 to 49 per cent by 2025.

Revenue growth for M-Pesa Ethiopia

Safaricom’s M-Pesa in Ethiopia reported revenue returns of $277,139.43 over the nine months ending in December 2023.

Following its August 2023 launch, the operations generated $45,000 over the first four months, with further commitment to grow the numbers.

Registered customers for M-Pesa Ethiopia rose to 3.1 million from 1.2 million as of half the Financial Year 2023/2024, transacting worth $115.63 million.

However, the opportunity for …

Currently, financial inclusion is a target that all African countries must achieve. Boosting Africa’s financial inclusion will have a positive impact on economic growth and the prosperity of society. Through financial inclusion, everyone has access to a variety of quality, effective, and efficient financial services. Increasing public accessibility to financial service products will further reduce the level of economic and social inequality which in turn will improve the welfare of the community.

One of the efforts to achieve this financial inclusion target is through technology in the form of digital finance. When financial products and services use internet technology, it makes it easier for people to directly access various kinds of payments, shopping, savings, and investments, including loan and credit facilities. Among these digital financial elements, the payment facility is the service that is experiencing the fastest development and contributes greatly to the achievement of Africa’s financial inclusion targets.…

- For millions of households in Uganda, remittances play a vital role in safeguarding food security, healthcare, savings and investment opportunities.

- IFAD data shows 75% of money sent to Uganda is used to fight poverty and improve access to nutrition, health, housing and education.

- The remaining 25 percent is used to support small businesses and facilitate access to financial products.

The UN’s International Fund for Agricultural Development (IFAD) has partnered with Stanbic Bank Uganda (SBU) in a plan to reduce the cost incurred by Ugandans sending money back home by half through a digital payment platform dubbed FlexiPay.

The partnership will also provide remittance recipients, especially in rural areas, with digital and financial training to promote the savings culture and foster digital finance uptake among these communities.

Cost of remittances in Uganda

At the moment, the average cost of sending money back home for Uganda’s migrant workers is 11.3 per cent, …

Airtel, Kenya’s second-largest mobile service provider, has partnered with Kenya Power and Lighting Company (KPLC). This partnership will allow Kenyans to pay their electricity bills through their mobile money platform at no cost.…

- An infusion of new investments and regulatory transformations is shaping financial interactions and digital payments in Africa.

- Africa’s digital payments operations produced around $24 billion in revenue in 2020, comprising domestic and cross-border payments.

- For Africa’s digital transition to run smoothly, a cohesive environment that ensures investment and funding remains necessary.

Human commerce constantly seeks more efficient exchange mediums, and this innovation is currently intensifying. Consequently, how individuals pay for products and services has changed dramatically in the 21st century. Digital payments in Africa are gradually replacing cash, and cryptocurrencies and virtual currencies have lately emerged as substitutes for conventional money concepts.

Africa has kept up with, and in some instances led, technological advancement. An infusion of new investments and regulatory transformations is shaping financial interactions and digital payments in Africa. Cash remains king in Africa. However, research indicates that its dominance may be challenged in the future years as …

- New standard to guide how Payment Service Providers and institutions regulated by the CBK issue quick response (QR) codes.

- Merchants will be able to receive payments from multiple channels such as banks or mobile wallets.

- CBK says long-term use of standardized QR codes will facilitate the launch of innovative products.

Consumers in Kenya can now make digital payments in an easy, fast, and convenient way through quick response codes. This week, the Central Bank issued the Kenya Quick Response Code Standard 2023, also shortened as KE-QR Code Standard 2023.

The service seeks to boost digital payments, which are offered by multiple financial institutions in the country. Normally, many companies use in-house payments solutions meaning customers can only use vendor-specific channels. Kenya’s financial industry regulator now wants to eliminate that friction through deployment of the new standard.

The regulator said the standard will guide how Payment Service Providers and institutions …

- Index shows that 90% of Kenya’s consumers who receive money transfers want integrated mobile ‘super apps’ so they can manage remittances with other financial needs.

- Kenya’s receivers want choice in digital and in-person remittance platforms as they look to the future.

- Kenya is a leader when it comes to financial innovation especially in the world of mobile money.

Kenya’s consumers are calling for greater innovation in international money transfer services so they can easily manage their personal finance needs.

According to Western Union’s inaugural Global Money Transfer Index, about 90 per cent of Kenya’s receivers want providers to offer remittance services in an integrated mobile ‘super app’, so they can efficiently manage collecting remittances with other commitments, such as paying for utilities.

The Global Money Transfer Index asks consumers how, when and why they use international money transfer capabilities today, as well as their expectations for tomorrow.

The results …

Bolt Food has also created a feature that enables customers to use promo codes and coupons to pay for orders made on the app. As restaurants on the platform offer promotional items and campaigns, all active promotions will always be displayed in the Bolt Food app.

These initiatives are meant to create a flexible and convenient environment for customers as they enjoy excellent service on the Bolt Food app.

“Customer Experience on our platform remains a key priority in our operations. Our focus is to continue growing our brand and serving our customers in the best way possible through quality services tailored towards their needs”, said Edgar.

Bolt Food continues to scale up its operations and invest more into initiatives geared towards enhancing customer experience and offering quality services as it grows its courier earnings. …

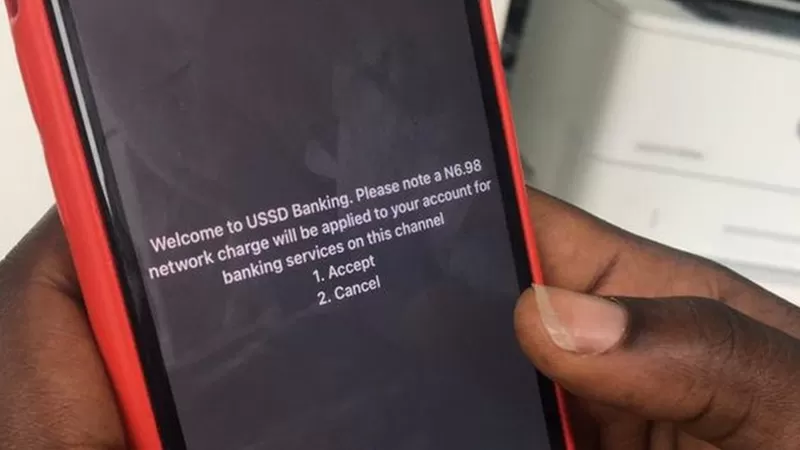

As far back as June 28, 2017, This Day Live said another point to note is that USSD is very important within emerging economies, where the cost to access data services is increasing. Despite the growth of smartphone penetration and 3G/4G coverage, the data access cost is a key factor in deciding how information is consumed.

Meanwhile, the continued reliability of USSD will enable mobile service providers and financial institutions more opportunities to satisfy new market segments, add more value to the customer, and meet underserved customer needs.

In a related article by Myriad Connect published January 29, 2018, the core benefit of USSD is that it doesn’t rely on a data connection to operate, thereby helping reach the billions of people in areas where network coverage is at its most basic or for sectors of the population for whom a data connection is too expensive to access.

So long …