- AmCham Summit kicks off, setting course for robust future of US-East Africa trade ties

- Why the UN is raising the red flag on the UK-Rwanda asylum treaty

- Portugal’s Galp Energia projects 10 billion barrels in Namibia’s new oil find

- Wärtsilä Energy offers tips on how Africa can navigate energy transition and grid reliability

- Powering Africa: Africa’s Path to Universal Electricity Access

- Global investment trends at AIM Congress 2024: a spotlight on the keynote speakers

- South Africa’s deepening investment ties in South Sudan oil industry

- Agribusiness could drive Africa’s economic prosperity

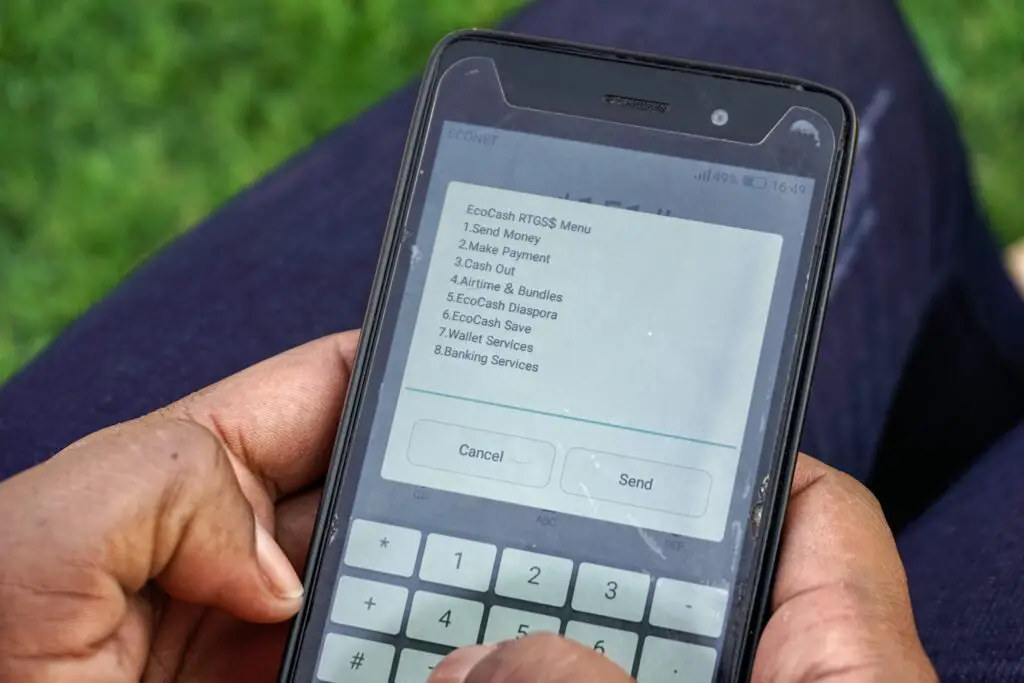

Browsing: Mobile money

Pyypl uses advanced Artificial Intelligence (AI) and Machine Learning (ML) for regulatory compliance, Anti Money Laundering (AML), and Counter-Terrorism Financing (CTF).

The platform also conducts real-time Politically Exposed Persons (PEP) and sanctions (both country and individual) screening against the latest and historical UNSC, USDT, FATF, OFAC, and EUCFSF records, as well as all local databases.

Fintech startups in Africa have continued to gain a lot of attention from investors who have been pouring billions of dollars to support the industry. …

Safaricom has a network of partners whose collaboration allows subscribers to send and receive money from more than 200 countries and territories.

The launching of the M-Pesa supper app has also enabled its users to operate mobile money transfer easily and securely making it rise faster in the African continent.

For instance, access to financial services and products in Kenya grew by an astonishing 56 per cent between 2006-2019 due to the availability of the mobile money services . M-Pesa has been credited with lifting at least two per cent of Kenyan households out of extreme poverty.…

Airtel Network Kenya, the second biggest telecommunications network, saw shareholder loans from its holding firm, Bharti Airtel Kenya BV, rise by 12.01 per cent from sh46.6 million in 2020 to sh52.2 million in the year ending December 2020.

The causes of the financial losses have been additional lending, forex losses as the shilling depreciate, and postponement in paying interests.

Capitalization interest due to being paid stands at Sh1.34 billion, which has disrupted cash flow in the firm.

Airtel Kenya said that the issued shareholder funds, revenue generated from its operations, and borrowing from external lenders had kept the company afloat.…

In 2020, total transaction values climbed by 22% to hit US$767 billion. or the first time, and in a pandemic, the industry is processing more over US$2 billion per day which has more than doubled since 2017.

The GSMA predicts that by the end of 2022, this value will be in excess of US$3 billion every single day. Some of the innovations that will help propel this growth include APIs and regulation initiatives like tightening transaction and balance limitations which could bolster the industry’s transaction values growth.

Transaction costs remain a big concern for many with users calling for a review of this in countries like Kenya. When the pandemic was announced in Africa, Kenya and Ghana- which also happen to be the continent’s two biggest mobile money markets– were swift to scrap fees on small person-to-person transactions. …

The shortage of cash is a legacy of the hyperinflation 13 years ago that caused the government at the time to abandon the Zimbabwean dollar. In 2018, the government printed 100 trillion bank notes, causing inflation to reach 500 billion per cent.

In a report published by the), a worldwide organization representing the interests of mobile money operators, Zimbabwe is ranked top among the 16 member states of the Southern African Development Community (SADC) in reference to mobile money penetration.

The GSMA, on the other hand, has stated that the), also known as the 2% tax, is making mobile money transactions more expensive.…

- Mobile money is growing fast in East Africa

- Despite of the pandemic, still mobile money regulators enabled its performance

- Financial technologies are changing the way unbanked populations access finance services

Mobile money is still king in Africa and will be so for long. With more than 548 million (up 12 per cent) registered accounts attached to a 27.4 billion transaction volume worth $490 billion, Africa stands to draw billions from mobile money and transform its economies significantly (GSMA 2021).

Thanks to financial technology (fintech) which has accelerated financial inclusion in sub-Saharan Africa, now more than ever, the unbanked population in rural areas of Africa can access financial services seamlessly, even during the coronavirus pandemic’s harsh times.

Today fintech technologies are challenging traditional financial services, particularly banks in Africa. This has forced banks to adapt to the new game brought by fintech aggregators, including fusing their services to mobile services and …

The government amended the Electronic and Postal Communication Act (CAP) last month by imposing a levy of between US$0.0043 (10Tsh) and US$4 on mobile money transactions, depending on the amount sent and withdrawn.

One of the key factors that led to the expansion of mobile money in Africa and Tanzania, in this case, was the increased interoperability, product expansion—which brought financial inclusion to enable nearly everyone with decent income-earning schedules to own a mobile wallet account.…

Airtel Uganda and KCB Bank Uganda announced a partnership to introduce a variety of mobile loans and savings solutions in Uganda.

From the partnership, its customers will earn interest on savings of five percent per annum on regular savings and 9 percent per annum on fixed deposits.

The automated digital products include Regular Savings, Instant Unsecured Mobile Loans and Fixed Deposit Savings Accounts that will allow its customers to borrow mobile loans from as low as UGX300 (KSH 9.15). Airtel Money Agents will be able to get unsecured loans at UGX300 interest only while KCB and Airtel customers can earn up to 9 percent interest on mobile savings.

The partnership is set to revolutionize savings in Uganda by providing the best interest rate in the market.

“Most of our customers are unbanked with limited or no access to financial products especially saving deposits. By offering competitive interest rates in an …

Ethio- telecom launched a service called ‘Telebirr’ as it seeks to boost growth by offering cashless transactions in Ethiopia.

Telebirr will allow ethio-telecom’s customers to send, store and receive money using their phones. The mobile money service aims to extend mobile services to areas that have been financially excluded.

With just 19 commercial banks which serve a population of 115 million, Telebirr will bridge the financial gap to those who do not have access to banks in Ethiopia.

The CEO of Ethio telecom, Frehiwot Tamiru said that within its first year of operations, the telecom plans to recruit 21 million users and 33 million in five years. She added that by the end of the five years, Ethiopia’s annual economic output of about 40 to 50 percent will be transacted on the platform.

The telecom has 1600 agents onboard already and will increase to more than 15,000 within 12 …

A survey revealed that 77 per cent of temporary workers would be willing to receive their wages digitally if this gave them access to health insurance.

Combining digital payments with health insurance benefits offers an excellent opportunity for social inclusion, formalization, and financial innovation.

Data shows that if 50 per cent of temporary workers in Senegal received payments digitally, 45 billion CFA francs would be added to GDP per year (around US$80 million). Paying workers digitally, speeds up the financial inclusion for the population, boosts business competitiveness and increases financial system liquidity. …