- Zimbabwe has relaxed regulations barring importation of basic commodities to avert shortage of goods ahead of elections.

- The move not only bolsters the domestic market but also improves Zimbabwe’s exports with SADC and China.

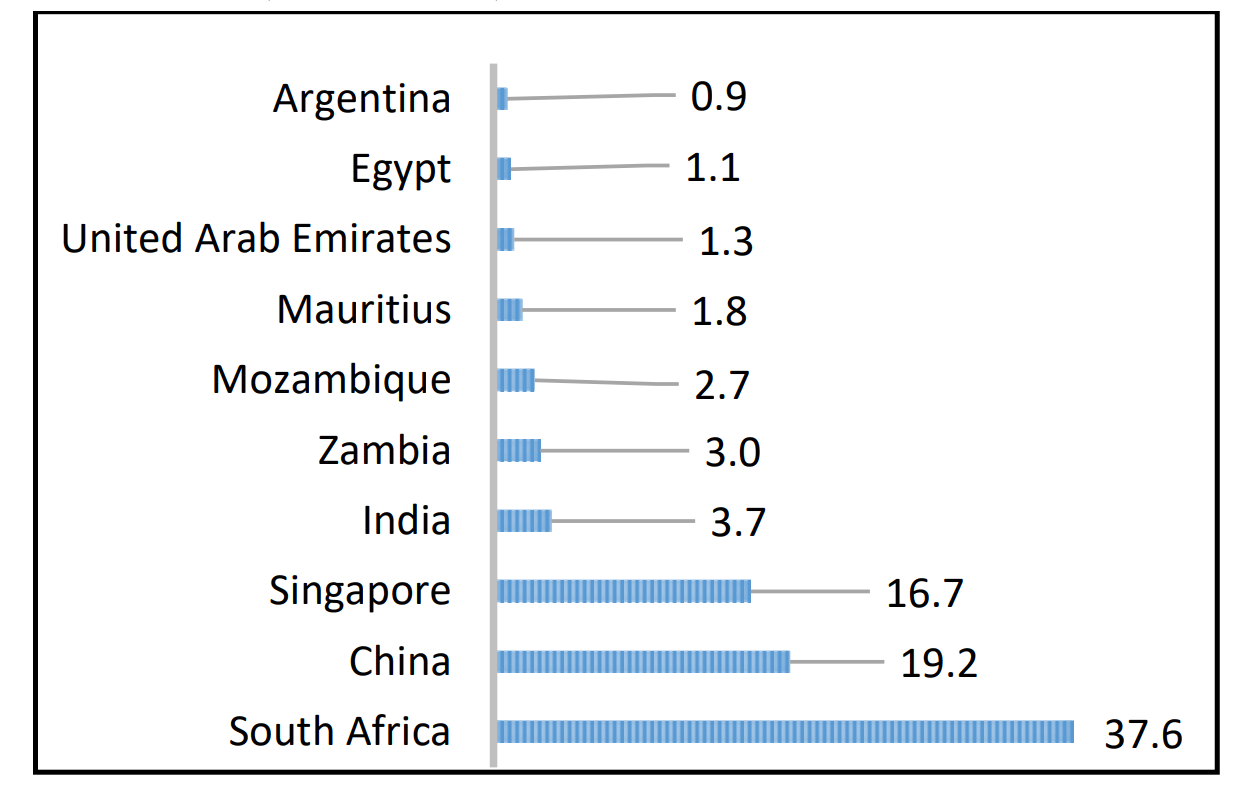

- In March, South Africa emerged as Harare’s primary source of imports, contributing 37.6 percent of the total. China, Singapore, India, and Zambia followed accounting for 19.2 percent, 16.7 percent, 3.7 percent, and 3 percent respectively.

In a strategic move aiming to avert looming drought of essential goods ahead of 23 August 2023 elections, authorities in Harare have rolled out bold steps, relaxing rules that are choking the flow of Zimbabwe imports. The strategy further aims at countering escalating prices and ensuring smooth flow and access of essential goods in the country.

Minister of Finance and Economic Development, Mthuli Ncube, has announced the complete elimination of import restrictions on basic goods. The initiative will be complemented by the exemption of import duties and taxes. By allowing unhindered entry of basic goods, Zimbabwe is seeking to streamline access to vital goods.

“In order to enhance the supply of basic goods to the public, all basic goods will no longer be subject to import licenses. They will come into the country free of import duties and taxes,” Mthuli Ncube said.

Zimbabwe imports cushioning economy

This measure underscores the administration’s efforts to fostering macroeconomic stability and eliminating exploitative tendencies.

But the latest move conjures up memories of how Zimbabwe managed challenging economic circumstances about fifteen years ago. At the height of hyperinflation in May 2008, Zimbabwe froze customs duty on a range of commodities for four years. As a result, policymakers managed to cushion the economy from a severe body blow from sanctions.

According to Tralac, on May 17 last year, Zimbabwe introduced Statutory Instrument 98 of 2022, which suspended customs duties on imports of basic commodities. The principal regulations being amended by SI 98 of 2022 was the Customs and Excise (Suspension) Regulations, 2003.

To complement efforts to avert shortages of basic commodities ahead of polls, government through the Ministry of Industry and Commerce gazetted Statutory Instrument 103 of 2022.

This instrument effectively removed the mandatory production of import licenses on seven basic goods. These are: sugar, milk powder, infant milk formula, petroleum jelly, bath soap, laundry bar and washing powder. Consequently, these goods could be imported by anyone without the need to produce import permits or licenses.

SI 98 and SI 103 all of 2022 complemented each other in accelerating the seamless importation of basic commodities. While the former addressed issues of tariff barrier, the later addressed licenses as non-tariff barriers to trade of basic commodities.

Growing ties with SADC and China

The lifting of import restrictions not only bolsters the domestic market but also holds promising implications for Zimbabwe’s trade ties across Southern African Development Community (SADC) and far flung China.

By fostering an conducive environment for trade and cooperation, Zimbabwe aims to forge strong economic ties with regional and international partners.

Read also: Africa needs to grow its stake in global trade

Data on Zimbabwe imports paint a picture of a country with diverse sourcing channels, with South Africa assuming the top spot. At the moment, South Africa accounts approximately 37.6 percent to the nation’s total import volume.

Its close geographical proximity, well-established trade networks, and robust supply chains make it preferred choice for Harare.

China, with its immense economic muscle, is also assuming a prominent role on Zimbabwe imports matrix. Beijing is the second-largest contributor, accounting for 19.2 percent of Zimbabwe imports.

China’s manufacturing capabilities, vast array of products, and competitive pricing have firmly entrenched it as a key player in Zimbabwe. Manufacturers in China are satisfying diverse consumer demands and stimulating economic activity across Zimbabwe.

Shared border creating opportunities

Singapore, had a sizeable contribution of 16.7 percent of the Southern African country’s imports. According to latest data, India accounted for 3.7 percent of Zimbabwe’s total imports.

Completing the ensemble, Zambia adds its unique flair to Zimbabwe’s import symphony. With a modest share of 3 percent, Zambia is establishing itself as a regional partner, offering vital goods in Zimbabwe’s economy. Its proximity and shared border creates opportunities for seamless trade while fostering regional cooperation.

Zimbabwe’s import bill for March 2023 hit $744.5 million, a 19.8 percent surge compared to February’s $621.4 million. This upward trend in imports signifies a significant growth trajectory. Notably, the imports for the reporting month surpassed those of the comparable period in 2022.

The import basket of the country was primarily dominated by essential commodities diesel, petrol, crude soya bean oil, and electricity. These goods accounted for 11.3 percent, 5.6 percent, 2.9 percent, and 2.5 percent, respectively.

Zimbabwe’s export earnings

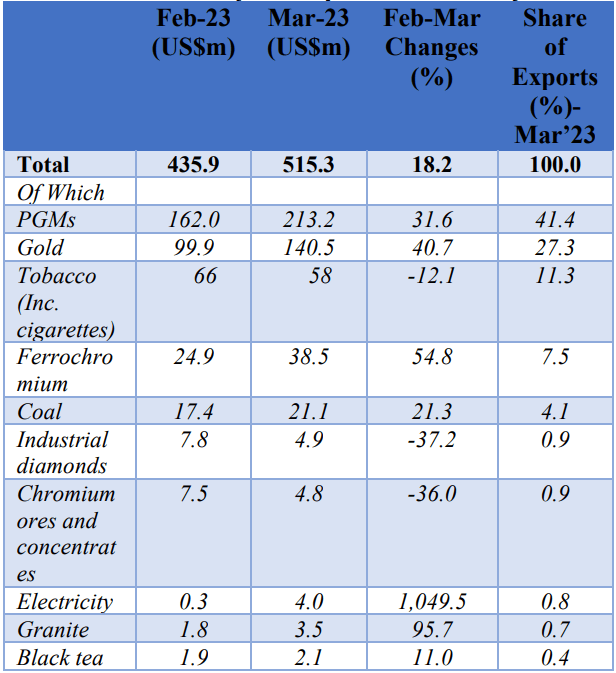

Meanwhile, during the same period, Zimbabwe shipped goods worth $515.3 million to various export destinations. The country’s exports were up by 18.2 percent from $435.9 million recorded in February 2023. The rise was largely on account of increased export value of gold and platinum minerals.

Gold, one of Zimbabwe’s top exports, showed a strong rebound during the reporting month on account of elevated global prices. The bullion market experienced uptick in prices due to global geopolitical tensions and the roiling US banking crisis.

Overall, Zimbabwe’s export earnings for the reporting month were 7.6 percent lower than in the corresponding month last year.

During the month under review, 46.2 percent of the country’s exports were destined for South Africa, the United Arab Emirates (28.1 percent), China (9.8 percent), and Mozambique 2.8 percent. The country’s exports to South Africa were mainly PGMs and tobacco, while those to the UAE were largely precious metals.