- Kenya Airways losses for FY2023 have majorly stemmed from FX fluctuations.

- Despite the heightened operating costs, Kenya Airways achieved an operating profit of $79.4 million.

- International Air Transport Association (IATA) predicts full recovery of the aviation industry from the Covid-19 crisis in 2024.

Kenya Airways net losses for the trading period ending December 2023 have dropped to $171.6 million (KES22.7 billion) majorly attributed to the forex exchange losses suffered during the review period.

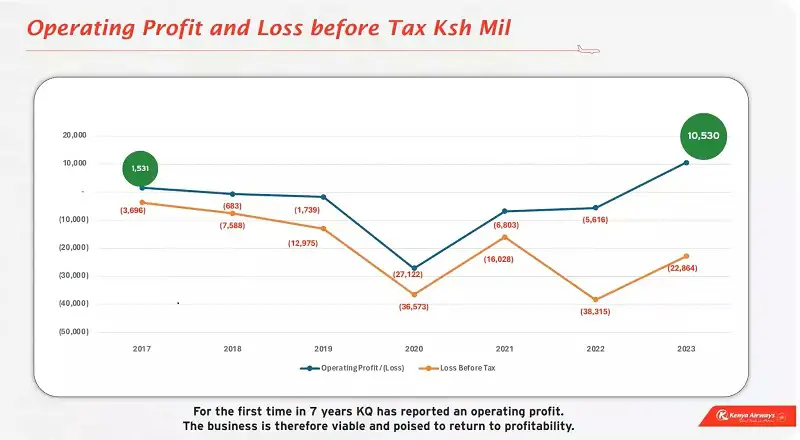

The latest result is a 41 percent reduction from the $289.6million (KES38.3 billion) reported in 2022 in what the airline attributes to continuing efforts aimed at navigating KQ’s back onto the path to profitability.

These losses stemming from fluctuations in currency exchange rates (FX Losses), impacted the airline’s financial position, posting the greatest drawback to its financials with $181.4 million loss.

Kenya Airways Chief Executive Allan Kilavuka said that in the review period the airline increased flight frequencies by 24 per cent and the capacity increased by 44 per cent.

“During the year, the company’s main focus remained on improving customer experience, operational excellence, and cash conservation. These efforts resulted in the airline improving its On-Time Performance (OTP) to a high of 76 per cent from an average low of 58 per cent at the beginning of the year, ranking it as Africa’s second most efficient airline,” said Kilavuka.

KQ’s total income also posted a 53 per cent rise from $883.1 million (KES116.8 billion) in the last financial year to $1.3 billion (KEs178.5 billion) in 2023.

Read Also: Kenya Airways Cargo to Operate 2 Direct Flights Between UAE and Somalia

Hellen Mwariri, the Head of Internal Audit at Kenya Airways (KQ), noted that the rise in revenue signals positive progress for the airline, indicating a surge in passenger numbers and enhanced revenue channels.

However, operating costs grew to $1.3 billion (KES167 billion) from $925.5 million (KES122.4 billion), indicating a 37.2 per cent increase in operational expenditures.

The key drivers of Kenya Airways losses

Despite the heightened operating costs, Kenya Airways achieved an operating profit of $79.4 million (KES10.5 billion), marking a substantial rebound from the previous year’s operating loss of $42.3 million (KES5.6 billion).

“The company also exploited opportunities of raising the much-needed revenues by ramping up its scheduled operations as well as through passenger charters. Other initiatives undertaken by the management included partnerships with other airlines and cost containment measures,” added Kilavuka.

On the financial front, Kenya Airways reported a 2 percent increase in finance costs, totaling $254.1 million (KES33.6 billion) attributed to interest payments on loans or other financial obligations.

“Interest loan repayment and funding of lease obligations are the major concerns facing the airline currently,” said Mwariri.

The CEO added that the airline has renegotiated some of these costs and is working to further bring them down in line with its 2024 projections.

One notable aspect highlighted in the firms financials is that Kenya Airways did not receive any loans from the government during the fiscal year 2023. This indicates that the airline managed its financial operations without relying on additional government support.

“In 2023 we didn’t get any allocation from treasury but they are supporting us to restructure some of our debt. In the period Sh19.2 billion was directed to loan repayments,” said Kilavuka.

Despite the overall improvement, the airline still faces challenges in turning a net profit after accounting for all expenses and tax obligations.

Kenya Airways 2024 outlook

While 2023 has seen Kenya Airways’ achieve its first operating profit in seven years, the company remains optimistic of 2024.

Kilavuka explained that the airline’s top priority going forward, is to continue building on the gains made in the airline’s turnaround strategy, Project Kifaru. Along with this, in the near term, he said the focus is on completing the capital restructuring plan whose main objectives are to reduce the Company’s financial leverage and increase liquidity to ensure the company can operate at normalized levels.

“Our primary focus going ahead is dedicating ourselves to fostering innovation, nurturing partnerships, and cultivating a culture of excellence to ensure that Kenya Airways soars to new heights of success. Additionally, we will continue to engage government on recapitalizing the business to place Kenya Airways on a stronger footing and provide a stable base for long-term growth,” said Kilavuka.

The Government of Kenya in its capacity as a major investor in Kenya Airways has indicated their continued strong support for the Company’s operational and capital structure optimization process and are closely involved throughout the transaction process and intend to remain major stakeholders in the Company over the long term.

International Air Transport Association (IATA) predicts full recovery of the aviation industry from the Covid-19 crisis in 2024. This projected growth signifies a substantial rebound and resurgence for airlines, reflecting a renewed vigor and vitality within the industry.