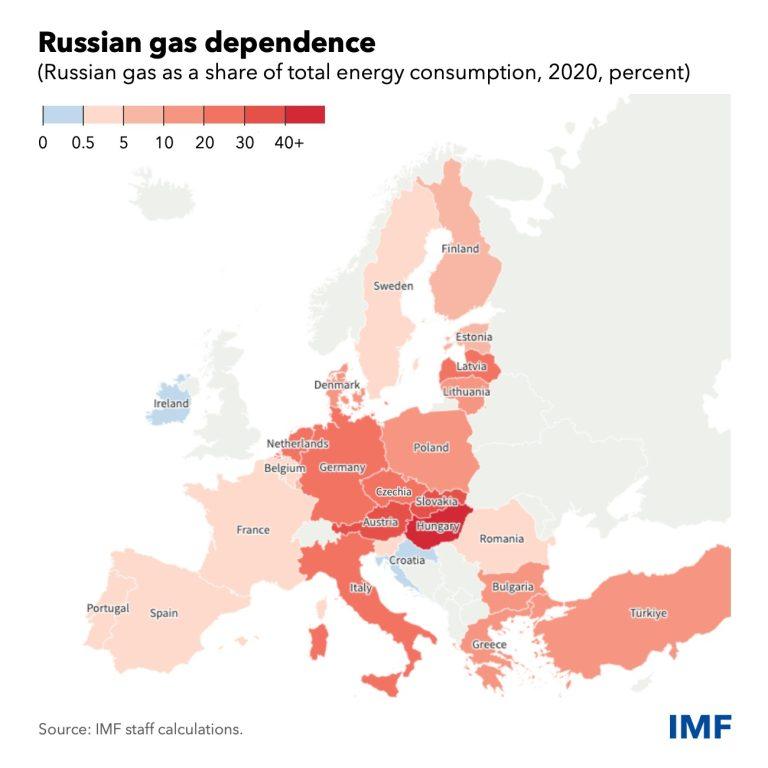

The war in Ukraine has shown how dependent Europe is on natural gas for power. Before the conflict broke out in February, Russia supplied up to 40 per cent of Europe’s gas requirements.

The European Commission announced its REPowerEU plan on March 8 and stated that it may “phase out our dependency on fossil fuels from Russia well before 2030.” This strategy aims to secure a significant immediate reduction in the EU’s consumption of Russian gas.

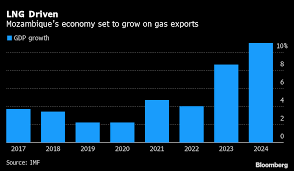

- Mozambique is poised to ship its first cargo of liquefied natural gas overseas, joining the ranks of the world’s exporters as a global energy crunch pushes prices of the fuel to record highs

- Mozambique is the world’s third-poorest country according to data from the World Bank, has in recent years had its economy battered by a sovereign debt scandal, a series of severe tropical cyclones, and the jihadist insurgency

- According to estimates from Oxfam and the Ministry of Finance, Mozambique will receive around US$11.6 billion in revenue from Coral Sul FLNG over its operating life

Hungary, the Slovak Republic, and the Czech Republic are some of the Central and Eastern European nations most impacted by their reliance on Russian gas.

There is a risk of shortages of as much as 40 per cent of gas consumption and of gross domestic product shrinking by up to 6 per cent. However, the effects might be lessened by securing substitute supplies and energy sources, removing infrastructure bottlenecks, encouraging energy conservation while safeguarding disadvantaged households, and extending solidarity agreements to share gas across countries.

As Russia cuts supplies, these nations are rushing to strike deals in the Middle East and Africa as prices soar.

African countries that in the past would not have been considered as viable energy producers to meet Europe’s demands are now among the top contenders.

Senegal, a country in West Africa, is quickly developing its liquefied natural gas industry to become an exporting country. Similar to how Egyptian operations are being expanded as a result of the finding of the largest LNG resources in the Mediterranean, European businesses also have projects in Mozambique under development.

As a result of a global energy shortage that has caused the price of the fuel to reach all-time highs, Mozambique is about to export its first shipment of liquefied natural gas abroad, joining the ranks of the world’s exporters. Mozambique is firing up its first export terminal.

According to ship-tracking information provided by Bloomberg, the BP-operated LNG tanker British Mentor is scheduled to arrive on August 24 at a brand-new floating terminal that Eni is building off the northern coast of Mozambique. The Italian company said it’s already planning a second floating export platform in Mozambique that could be brought on in less than four years.

Eni’s US$7-billion Coral-Sul project had been targeting first exports by October and has moved forward despite the pandemic and an Islamic State-linked insurgency in Mozambique that derailed a US$20 billion Total Energies SE export facility. BP in 2016 signed a deal to buy all of the output for 20 years from Coral-Sul, which is designed to produce 3.4 million metric tons of LNG.

According to estimates from Oxfam and the Ministry of Finance, Mozambique will receive around US$11.6 billion in revenue from Coral Sul FLNG over its operating life. According to Eni, Mozambique will make US$16 billion in revenue. While up to US$24.5 billion in revenue has been predicted by the Ministry of Mineral Resources and Energy.

Claudio Descalzi, CEO of Eni, said that increasing supply for the company’s portfolio would depend heavily on Africa. He cited development at Baleine in Cote d’Ivoire, Congo LNG, and Coral Sul in Mozambique as having a significant part in this.

Up to 2025, Eni intends to initiate 14 projects, half of which will be in Africa, according to the CEO. Agogo phase 2 in Angola, Coral Sul FLNG, and Berkine South in Algeria are just a few of the start-ups this year. Both the first phase at Baleine and the Congo LNG development in Marine XII will begin operations in 2023.

Eni also plans to begin producing gas at the A&E project in Libya in 2024, with a goal of reaching 205,000 boepd. According to a March 18, 2022, Energy Voice story, the Melehia phase 2 project in Egypt should then go online in 2025.

“Exploration is the foundation of our high value upstream,” Descalzi said, “and is the key enabler to our more gas-rich portfolio. We have discovered 12 billion barrels of oil equivalent over the last 10 years, of which 80pc is gas.”

Eni is eager to secure additional gas production in response to current demand. This drive saw Eni take final investment decision (FID) at its Congo LNG project earlier this year. It is exploiting this gas resource through flexible modular LNG.

“We are sending to Europe all the gas we can find. We have found a huge amount,” Descalzi said.

The company is “well positioned to supply key markets. We expect to reach more than 15 million tonnes per year of LNG in contracted volumes by 2025”.

According to an article by Maritime Executive published on August 17, 2022, since May, Senegal and Germany have been working together to fast-track the completion of the BP-led Greater Tortue Ahmeyim (GTA) LNG project. The offshore field straddles the border between Senegal and Mauritania and is set to produce 2.5 million tons of LNG in the first phase. Plans call for output to double to 5 million tons in the second phase.

Earlier, Kosmos Energy, which is developing the GTA field with BP, said phase one is 80 per cent complete. Senegal is now reporting that it will be ready to export its first LNG cargo to Europe in 2024 when production at Tortue Gas project is scheduled to start.

“Senegal will be able to sell its quota to Europe, especially Germany already, in the second half of 2024,” Mamadou Fall Kane, deputy permanent secretary of COZ-Petrogas, the government committee that monitors and develops oil and gas projects, told Bloomberg.

Senegal is well-positioned to become a significant gas producer thanks to its offshore hydrocarbons reserves. EU representatives visited Dakar in February to meet with Mamadou Kane in an effort to strengthen their relationship and obtain guarantees on the LNG exports as Europe struggles to find new resources. A month later, the EU unveiled the REPowerEU plan, which outlined a way to “diversify supply” in order to lessen Europe’s reliance on Russian gas and oil.

Olaf Scholz, the chancellor of Germany, went to Senegal in May to promote gas and renewable energy initiatives.

Egypt is attempting to aggressively increase its exports as Senegal tries to expand its activities. Egypt switched from being a net importer of LNG to being one for the first time at the end of 2018. According to Refinitiv, Egyptian natural gas exports have climbed by 44 per cent since the year 2022 began.

In order to increase its exports, Egypt also declared it would reduce the amount of gas supplied for domestic power generation by 15 per cent. As reported by Reuters, businesses are being instructed to use less energy so that Egypt may increase its LNG exports and alleviate its severe foreign currency deficit.