We all dream of owning our own homes. Financing solutions help you turn that dream into a reality. Some people may look up to mortgages for financing. A mortgage is a type of loan you get from a bank or building society to help buy a property.

However, several factors affect mortgage rates, including credit score, loan type and down payment.

- Tanzania’s fast-growing housing demand is mainly driven by the strong and sustained economic growth with GDP growth averaging 6-7 per cent over the past decade, the fast-growing Tanzanian population, which is estimated to more than double by 2050, and efforts by the Government in partnership with global non-profit institutions and foreign Governments to meet the growing demand of affordable housing.

- TMRC is supporting mortgage market growth through provision of longer-term funds to members.

- Tanzania’s outstanding mortgage debt as of June 30, 2022 increased to TZS 509.99 billion equivalent to US$220.23 million.

- The average mortgage debt size in Q2 2022 was TZS 82.56 million marking a slight increase from TZS 81.49 million reported in Q1 2022.

According to Forbes, your loan term, or how long you have to pay back your mortgage, also affects the rate. The two most popular terms being 15-year and 30-year mortgages. The 15-year mortgage generally comes with a lower interest rate.

Read: ZB Financial Holdings mulls shutting down home loan unit

The mortgage market in Tanzania has not fully catered the country’s population from accessing housing finance to improve their housing opportunities, the microfinance segment being under-privileged due to lower level of income, lack of access to formal financial system and informal housing.

In Tanzania there are several obstacles to growth of the mortgage market. Most lenders offer loans for home purchase and equity release while a few offer loans for self-construction which continue to be expensive and beyond the reach of the average Tanzanians.

Additionally, cumbersome processes around the issuance of titles (especially unit titles) continue to pose a challenge by affecting borrowers’ eligibility to access mortgage loans. Further, competition in the market has led to emergence of other products that are impacting mortgage market growth as the products have favourable terms than mortgage product and are used for housing purposes.

According to Tanzania Mortgage Refinance Company Ltd (TMRC), these products are competing with mortgage in terms of loan amount and to some extent tenor as they are offering consumer loans for the tenor of up to seven years amounting to around TZS 120 million, an amount enough to buy a housing unit.

However, a key element in the growth of the mortgage market in Tanzania continues to be the provision of long-term funding both in the forms of refinancing and pre-financing by the TMRC to facilitate PMLs matching their assets (mortgage) and liabilities (funding).

TMRC was established in 2010 under the Housing Finance Project (HFP) which was set up by the Ministry of Finance and Planning in collaboration with the World Bank and the Bank of Tanzania.

Another initiative set up under the Housing Finance Project (HFP) was the Housing Microfinance Fund (HMFF) which was geared toward providing long-term loans for lower-income earners who currently lack access to housing finance either for the construction of a home or for home improvements.

The Fund officially began its operations in 2015 and on July 31, 2015, the first disbursement of TZS 1 billion was made under the fund to DCB Commercial Bank Plc with the total credit line to the bank being TZS 3 billion). This marked the first step towards significant progress in the microfinance sector including subsequent disbursements by HMFF. HMFF is currently operated by the Bank of Tanzania.

Various mortgage awareness programmes have been established including TMRC social media pages in Facebook, Instagram, Twitter and Linked-in to provide mortgage product information to the public and stakeholders. Awareness campaigns are conducted by TMRC in collaboration with National Housing Corporation and Primary Mortgage Lenders through TV program sessions and stakeholders’ workshops to further increase information outreach and public understanding of mortgage product and benefits embedded on the product. The awareness also is targeted to address some of market growth impediments including supply, unit titles issuance and awareness hence market growth.

Read: CRDB Bank targets SMEs for growth in Tanzania

Other ongoing initiatives by TMRC in mortgage market growth including collaboration with Habitat for Humanity International to set up an initiative to extend mortgage loans outreach to the microfinance sector. The two institutions signed a Memorandum of Understanding as a first step in the organizations’ joint effort to expand and strengthen the low-income housing finance sector in Tanzania. The initiative is at research phase and its implementation will provide a tailor-made infrastructure to reach this economic segment to include them in decent and affordable homes.

The mortgage market in Tanzania registered a 1.24 per cent growth in the value of mortgage loans as of June 30, 2022 as compared to the 1.41 per cent growth recorded in the previous quarter. On a year-to-year comparison, 7.5 per cent growth was registered in value of mortgage loans as of June 30, 2022.

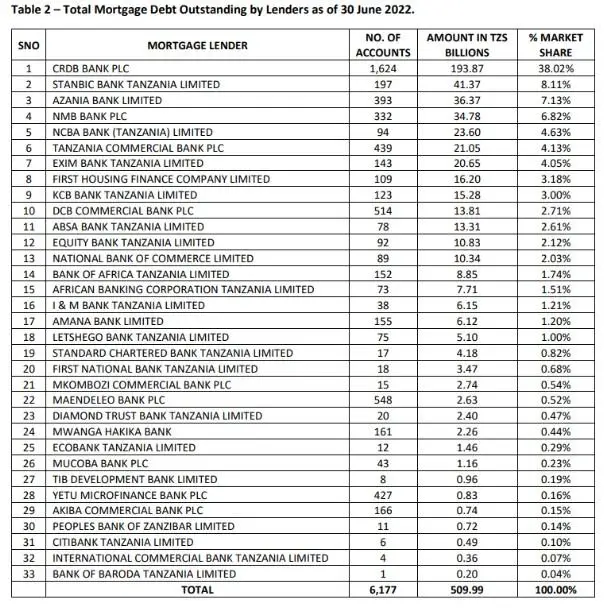

There was no new entrant into the mortgage market during the year. The number of banks reporting to have mortgage portfolios remained at 33 banks.

The mortgage market was dominated by five top lenders, who commanded 65 per cent of the market. CRDB Bank was the market leader commanding 38.02 per cent of the mortgage market share, followed by Stanbic Bank (8.11 per cent), Azania Bank (7.13 per cent), NMB Bank (6.82 per cent), and NCBA Bank (4.63 per cent). The typical interest rates offered by mortgage lenders ranged between an average of 15 per cent and 19 per cent.

Outstanding mortgage debt as of June 30, 2022 increased to TZS 509.99 billion equivalent to US$ 220.23 million as compared to TZS 503.74 billion2 equivalent to US$ 218.07 million reported on March 31, 2022.

Average mortgage debt size as at was TZS 82.56 million equivalent to US$ 35,654 marking a slight increase from TZS 81.49 million equivalent to US$ 35,276 reported on previous quarter.

The ratio of outstanding mortgage debt to Gross Domestic Product (GDP) decreased to 0.29 per cent compared to 0.30 per cent recorded in the previous quarter.

Read: Kenya’s Stima SACCO launches ‘affordable’ housing mortgage scheme