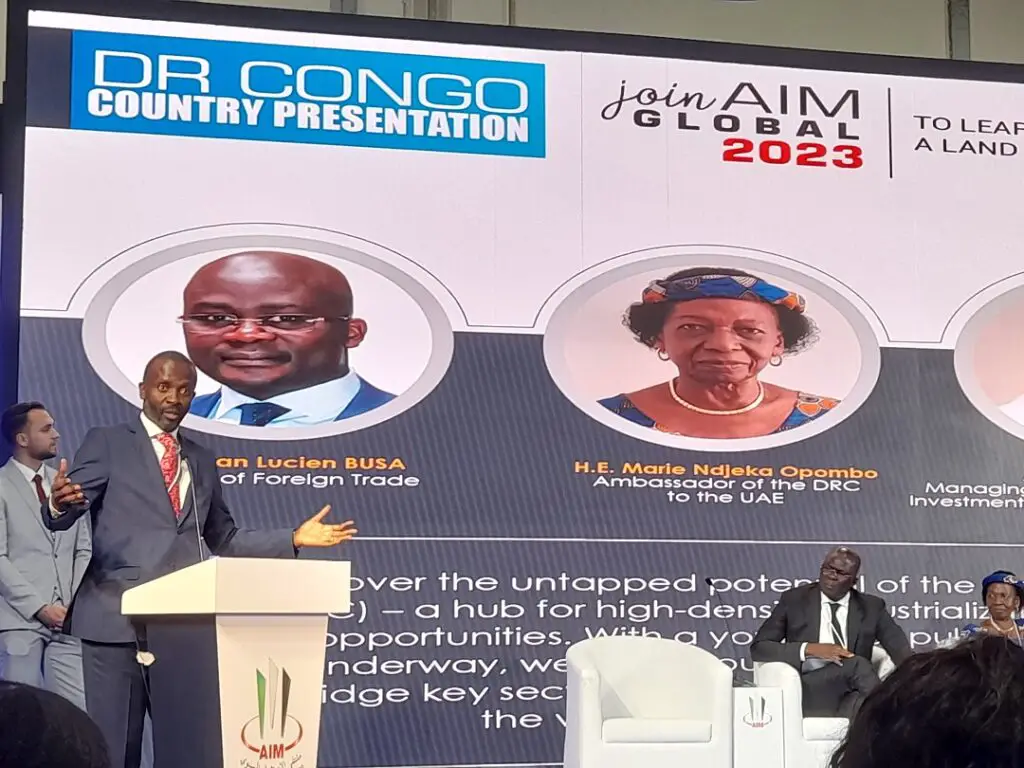

- DR Congo’s top government officials woo UAE investors at the Annual Investment Meeting 2023 in Abu Dhabi.

- From mining to agriculture to energy DR Congo is the global centre of billion-dollar focus sectors.

- In February 2022, logistics giant DP World started the construction of Banana Port, near Kinshasa.

DR Congo is inviting investors from the United Arab Emirates to bet big on the country’s vast investment opportunities. From mining to agriculture and fishing, to health, DR Congo is the global centre of billion-dollar focus sectors. DRC is the second-largest country in Africa with vast deposits of natural resources.

Speaking at the ongoing Annual Investment Meeting 2023 in Abu Dhabi, top government officials from DR Congo said the country’s ongoing legal and tax reforms are making the country ready for business.

The Annual Investment Meeting has attracted participants from 170 countries for its 12th edition in Abu Dhabi city, UAE.

At the forum, DRC’s Trade Minister Jean Lucien Busa lauded his country’s ongoing economic connections with the UAE. Mr Bussa expressed hopes for a more fruitful partnership in the coming years through trade and investment.

Mr Bussa singled out the country’s young population and a border giving access to nine countries as key selling points as a top investment destination. “We are eliminating non-tariff barriers,” Mr Busa.

Attract huge vessels cruising from Asia and Europe

Since the ascension of Felix Tshisekedi to the presidency in 2019, his administration has set out to attract international investors, raising hopes for growth, Mr Busa said.

Already, the UAE has been growing presence in DR Congo. In February 2022, logistics giant DP World started the construction of Banana Port, on the Congo River near the capital Kinshasa. The port is projected to attract huge vessels cruising from Asia and Europe, boosting DRC’s connection with international supply chains.

The project includes the construction of a deep-water port, container terminals, and other critical logistics infrastructure.

Featuring the latest technologies, DP World is building 600-meter quay with an 18-metre draft, fit to handle giant vessels. Banana Port will have a container handling capacity of about 450 000 TEUs (20-foot equivalent units) per year, and a 30-hectare container yard. (Ambien)

Transform Banana Port into a modern logistics hub

Overall, DP World aims to transform the Banana Port into a modern logistics hub, facilitating international trade and attracting investment to the region. The port, roads and railway system are part of DRC’s new investments in infrastructure that are meant to enhance investments in other sectors, the country explained to investors.

In 2018, DP World signed an agreement with the government of the DRC to develop and operate the Banana Port.

The natural resource sector has historically attracted the lion’s share of foreign direct investment in DRC. With over 1,500 minerals including copper, coltan, diamond, and nickel, the extractive sector might see investors from the UAE spoiled for choice.

Globally, the DRC eonctrols a vast mineral resources, including lithium and cobalt. Lithium is used in the production of lithium-ion batteries in electric vehicles industry that is projected to hit over $850 billion in 2027.

Lithium is also a widely used component needed in powering the roughly $500 billion smartphone industry. Additionally, it is used in making portable electronics including laptops, a market which is worth about $160 billion.

World’s largest producer of cobalt

The DRC has substantial reserves of lithium, primarily in the southern part of the country. While lithium is an essential element in lithium-ion batteries, cobalt is another critical component.

At the moment, the DRC is the world’s largest producer of cobalt, a mineral that often occurs together with lithium deposits. The country’s copper-cobalt deposits in the Katanga region are particularly rich in cobalt.

The DRC’s mining sector, including lithium and cobalt extraction, is often associated with informal or artisanal mining practices.

Artisanal mining involves small-scale and often unregulated mining systems, which can lead to environmental degradation, poor working conditions, and human rights concerns.

The extraction of lithium, like other mineral extraction processes, can have environmental implications. It involves the use of large amounts of water, energy, and chemicals, which can lead to water pollution and habitat destruction if not properly managed.

Promote responsible sourcing of minerals

Previously, there have also been concerns about the lack of transparency and accountability in DRC’s mineral supply chains. This lack of transparency makes it difficult to ensure that the mining operations are free from human rights abuses, child labor, and environmental degradation.

Anthony Kamole, the Managing Director of DRC’s National Investment Promotion Agency (ANAPI) told investors that efforts are underway to address these challenges and promote responsible sourcing of minerals.

Trade minister Busa added that DRC is also undertaking fiscal reforms to streamline the ease of doing business. Ongoing initiatives will boost the country’s competitiveness in attracting investments.

Already, initiatives such as the Responsible Minerals Initiative (RMI) and the Global Battery Alliance (GBA) aim to improve transparency, sustainability, and ethical practices in the battery supply chain.

A 2021 United Nations-backed study by BloombergNEF on a unified African supply chain shows the world would benefit more by producing lithium batteries in DRC.

DR Congo’s proximity to cathode raw materials

The survey noted that it would cost $39 million to build a 10,000 metric-tonne cathode precursor plant in the DRC. This is three times cheaper than what a similar factory would cost in the US. In comparison, it would cost about $112 million and $65 million respectively to build a similar factory in China and Poland.

By setting up plants in DRC, pollution related to electric batteries production could be slashed by 30 percent, BloombergNEF study stated. This is due to the DRC’s proximity to cathode raw materials and heavy reliance on hydroelectric power plants.

Read also: Top business leaders gather in Abu Dhabi for Annual Investment Meeting

According to The Cost of Producing Battery Precursors in the DRC report, the electric vehicles industry represents a $7 trillion market by 2030 and could hit $46 trillion by 2050.

Artisanal miners, often working in informal conditions, contribute to a significant portion of the cobalt production in the country. Increased awareness of the ethical and sustainability issues surrounding cobalt mining has led to the introduction of regulations and initiatives.

Tapping into DR Congo’s gas reserves

For instance, the Organization for Economic Cooperation and Development (OECD) developed the Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas, including cobalt.

Companies and organizations, including those in the battery and electric vehicle industries, are working towards responsible sourcing and contributing to sustainable development in the cobalt supply chain.

In energy, DRC singled out the production of 100,000MW across 780 sites in the country at the heart of Africa. Already DRC is producing 44,000MW. The country is also seeking investors to tap into its gas reserves extraction to boost the energy sector’s revenue contribution.

DRC, which IMF projects it will post 9.2 percent GDP growth in 2023 has proven reserves of 180 million barrels. At the moment, however, the country’s output is about 25,000 barrels per day from its coastal basin.

In January, the country’s Ministry of Hydrocarbons awarded three firms permits to exploit three gas blocks in Lake Kivu.

Inviting investors into the agricultural industry

In agriculture, DRC is asking investors to harness over 80 million hectares of arable land. Of the available land for agriculture, four million hectares are irrigable, the officials said.

“They (provincial) governors can give you land. So, you don’t need to pass by anyone else. They have authority from the Constitution,” Mr Kamole told investors.

Agriculture accounts for about 20 percent of DRC’s GDP although it offers jobs to roughly 6o percent of the population.

The country also has pasture resources that could sustain over 40 million cattle industry. And inland fishery resources that could supply millions of tonnes from marine and inland fisheries annually.