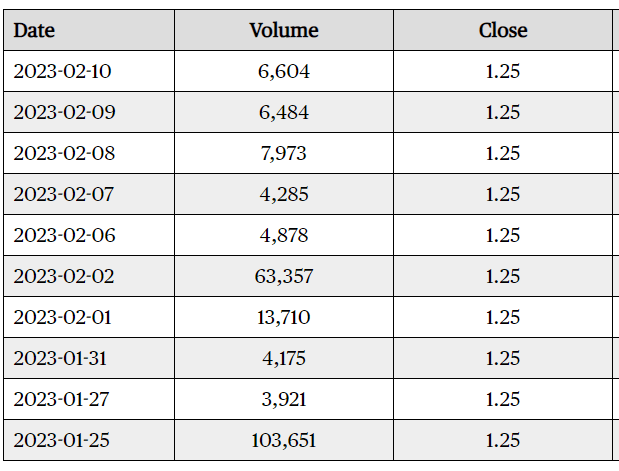

- Letshego Holdings is the number 1 most traded stock on the Botswana Stock Exchange over the past three months.

- The company has traded a total volume of 27 million shares—in 177 deals—valued at BWP 33.8 million over the period, with an average of 429,146 traded shares per session.

- Letshego Holding stated its intention to streamline its business operations in Tanzania, and appointed Gorata Tlhale Dibotelo as Head of Group Legal, Governance, and Group Company Secretary.

Letshego Holdings Limited (LHL), an inclusive financial services group with microfinance, banking and consumer lending subsidiaries across 11 countries in sub-Saharan Africa, has confirmed the appointment of Gorata Tlhale Dibotelo as the new Head of Group Legal, Governance and Group Company Secretary.

The announcement comes on the heels of the Group’s intention to streamline its Tanzania business operations, which was announced on January 27, 2023.

“Letshego Holdings Limited wishes to confirm the appointment of Gorata Tlhale Dibotelo as Head of Group Legal, Governance and Group Company Secretary. Gorata is based in the Group’s headquarters in Gaborone, Botswana and will serve as the Group Compliance Officer to the BSE.”

“In line with Botswana’s listing and company regulations, Gorata Tlhale Dibotelo’s appointment has met all regulatory requirements, and thus her appointment is effective immediately,” added the statement.

Prior to joining Letshego, Gorata held the position of Head of Legal Services and Board Secretary at the BSE. She also worked as a Senior Associate at Armstrongs Attorneys, a law firm based in Gaborone, Botswana. Gorata has a Bachelor of Law Degree from the University of Botswana and a Masters Degree in Commercial Law from the University of Cape Town, South Africa. She has also completed the Executive Development Programme at Stellenbosch University’s Business School.

With regards to the streamlining of the Group’s Tanzania business operations, Letshego Bank Tanzania Limited will seek to acquire Letshego Tanzania Limited T/A Fadika via the legislated process of acquisition. The Bank of Tanzania has issued conditional approval for the transaction, pending final detailed submissions. Letshego Holdings Limited is currently in the process of submitting the necessary regulatory submissions to secure final approval for the corporate action.

“In line with corporate governance standards and compliance with national listings regulations, Letshego Holdings Limited wishes to advise shareholders of the Group’s intention to streamline its Tanzania business operations, thereby maximizing potential commercial and operational efficiencies and sustainable business returns,” read the statement.

The Group has emphasized that both subsidiaries remain fully operational and are committed to delivering impactful and productive financial solutions for all customers, as well as supporting Tanzania’s long-term economic growth potential.

According to African Financials, the Letshego Group is an African multinational, first opening its doors in Botswana in 1998 by offering loans to government employees. Today, the Group has over 3,000 employees comprising more than 21 nationalities, and supports public and private sector individual customers, as well as micro and small entrepreneurs.

Letshego has operations in 11 sub-Saharan African markets, including Eswatini, Ghana, Kenya, Lesotho, Mozambique, Namibia, Nigeria, Rwanda, Tanzania and Uganda. Letshego Holdings Limited (the group holding company) is listed on the Botswana Stock Exchange, with additional listings including a subsidiary listing on the Namibian Stock Exchange, and bond listings on both the Ghana and Johannesburg Stock Exchanges.

With Gorata’s experience in the legal sector and her role as the Group Compliance Officer to the Botswana Stock Exchange, it is likely that she will play a significant role in ensuring that the company complies with all relevant laws and regulations in the process of streamlining its operations in Tanzania.

Moody’s Rating Release

On December 4, 2022, Letshego Holdings Limited received a Moody’s Rating Release that revealed that the Group’s issuer rating had been confirmed at BA3, however, due to the ongoing regional macroeconomic challenges, the Group’s corporate family rating experienced a one notch downgrade to Ba3.

Despite the downgrade, Moody’s recognition of Letshego’s commitment to enhancing its funding structure through reducing its secured debt and minimizing structural subordination for its listed instruments by affirming its issuer rating at Ba3 highlights the Group’s dedication to improving its financial stability.

The downgrade of the Group’s Corporate Family Rating (CFR) was a result of the macroeconomic challenges that have had a significant impact on several regional markets, including rising inflationary pressures, increasing interest rates, and a growing burden on sovereign debt levels. These challenges have put pressure on some of Letshego’s operations in these affected markets.

Aupa Monyatsi, Letshego Group Chief Executive, commented on the rating release, stating that the Group’s business fundamentals remain strong, as demonstrated by Moody’s 11-year confirmation of the issuer rating at Ba3. Despite some markets, such as Ghana, experiencing a downgrade in long-term issuer ratings, Letshego remains resolute in overcoming the challenges posed by adverse economic conditions by preserving business resilience and executing its Group Transformation Strategy.

Letshego Holdings performance on BSE

According to African Xchanges, Letshego Holdings is the number 1 most traded stock on the Botswana Stock Exchange over the past three months (November 11, 2022 – February 13, 2023). LETSHEGO has traded a total volume of 27 million shares—in 177 deals—valued at BWP 33.8 million over the period, with an average of 429,146 traded shares per session. A volume high of 9.82 million was achieved on November 23 for the same period.