Just before the onset of Covid-19, banks in many parts of Africa were pushing for adoption of online-based financial solutions but with little pressure. Then came Covid-19 and changed how people access their finances; this has created an urgency of sorts to promote financial inclusion.

Some governments are currently providing incentives to pay for goods or services digitally, through mobile money or e-wallets. For example, Uganda has cut mobile money transfer fees; Egypt, Liberia, and Myanmar have increased transaction size limits, while authorities in Bangladesh, Cameroon, the Democratic Republic of Congo, Ghana, Kenya, Mozambique, Pakistan, Rwanda, Senegal, and Zambia have taken both sets of measures (cutting mobile transfer fees and raising transaction size limits) in response to the pandemic.

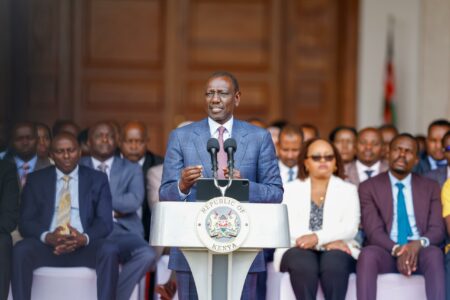

When Kenya reported its first case of Covid-19, the Central Bank of Kenya called a consultative meeting with Bank CEOs and immediately passed ways of ensuring that the country adopts use of online means of accessing money. This included the promotion of online banking and mobile money transfers to limit the chances of the communities coming into contact with contaminated money.

While the immediate objective was to reduce the risk of transmission of Covid-19 through handling banknotes, this also was meant to reduce the use of cash in the economy over the medium term. These measures included waiver of charges for mobile money transactions up to Ksh.1,000, increasing the transaction limit for mobile money to Ksh.150,000 and waiver on banking fees like bank balance check and elimination of charges for transfers between mobile money wallets and bank accounts.

Read also: Digital banking key in boosting financial inclusion(Opens in a new browser tab)

This has been adopted across various countries in Africa enabling many players to transact their businesses without many limitations.

Financial inclusion in sub-Saharan Africa has increased rapidly in recent years due mainly to the development of digital financial services and innovative business models such as agent banking. More than 30 percent of adults had a bank account in 2014, up from 24 percent in 2011. While just 2 percent of adults worldwide have a mobile account, 12 percent in Sub-Saharan Africa have one.

The shift towards digital financial services according to IMF was already helping societies advance financial inclusion before the pandemic started, benefiting many low-income households and small firms with typically little access to traditional financial institutions. Lockdowns and social distancing are accelerating the use of digital financial services, just as the SARS epidemic in 2003 hastened China’s launching of digital payments and e-commerce.

Africa and Asia lead digital financial inclusion, but with significant variation across countries. In Africa, Ghana, Kenya, and Uganda are front runners. In most countries digital payment services are evolving into digital lending, as companies accumulate user data and develop new ways to use it for creditworthiness analysis. Marketplace lending, which uses digital platforms to directly connect lenders to borrowers doubled in value from 2015 to 2017.

Read also: Tanzania shines for financial inclusion in Africa(Opens in a new browser tab)

Several governments already make digital payments and transfers to households and businesses. Government payments to households, commonly referred to as G2P, include payments (or transfers) of tax refunds, subsidies, social programs, salary, stipends, pensions, scholarships, and emergency assistance.

For SMEs, one of the most valuable consequences of digitalization is improved access to information—both within the firm, to increase efficiency and profit maximization, and to create data for external partners including financial institutions.

The World Bank references the case of Kopo Kopo in Kenya. The fintech company offers digital payment access to merchants through M-Pesa, and then applies Big Data analytics to merchant payment transaction data to offer SMEs a range of value-added services, such as unsecured, short-term loans.

“Digital financial inclusion was a development priority before the COVID-19 emergency; now, it is indispensable for both short-term relief and as a central element of broad-based, sustainable recovery efforts,” notes Margaret Miller, Lead Financial Sector Economist, Finance, Competitiveness & Innovation, World Bank and her colleagues in a World Bank blog.

Experience in the African region suggests that mobile money services, such as M-Pesa in Kenya or MTN Mobile Money in West Africa, can close the gender gap in financial inclusion more rapidly than traditional banking products.

Miller and her colleagues note that digital payments also provide a path toward financial inclusion for women—with strong evidence on the impact of government payments for women.

With the relaxation of these regulations by governments, it has enabled SMEs, financially strained communities and individuals to access and transact from a less constrained environment. For example, women in business are able to order their goods and offer services right from their phones without leaving their homes.

The path is not all smooth according to Anzetse Were, an Economist at Financial Sector Deepening Kenya. The costs linked to participating in the digital economy translate to wealthier Kenyans being better positioned to participate in the digital economy.

“FinAccess 2019 revealed that 57% of Kenyans cite affordability as the main reason they do not use mobile money more. Given that most digital economy opportunities require either payment through mobile money, or the purchase of internet bundles to engage in the opportunity, financial inequality may lead to a form of financial discrimination if digitization is prioritized without taking cost into account,” he notes.