Zimbabwe’s US dollar-denominated equities market the Victoria Falls Stock Exchange (VFEX) continues to evolve since its launch in October 2020 as the bourse has witnessed growth while interest from potential listings has increased.

- The Victoria Falls Stock Exchange is awaiting approval for the plans to set up an exchange-traded fund that will give investors exposure to shares in Old Mutual and PPC

- Trading in Old Mutual and PPC on the Zimbabwe Stock Exchange was suspended in July 2020 after authorities blamed moves in the insurer’s locally listed stock for fueling a collapse in the currency because of a mechanism known as the Old Mutual Implied Rate

- Since its launch, the listed companies on VFEX have grown to four counters: SeedCo International, Padenga Holdings, Caledonia Mining Corporation, and Bindura Nickel Corporation

The Victoria Falls Stock Exchange (VFEX) is awaiting approval for the plans to set up an exchange-traded fund that will give investors exposure to shares in insurer Old Mutual and cement maker PPC from the Securities and Exchange Commission of Zimbabwe.

Chief Executive Officer of the bourse, Justin Bgoni, said that the ETF should be available next month, with pricing derived from trading in the two stocks in Johannesburg,

“It will give people choice to get in,” Mr. Bgoni said. “We will ensure that there are market makers to ensure liquidity.”

Trading in Old Mutual and PPC on the Zimbabwe Stock Exchange (ZSE) was suspended in July 2020 after authorities blamed moves in the insurer’s locally listed stock for fueling a currency collapse because of a known mechanism as the Old Mutual Implied Rate, or OMIR. The OMIR was used by businesses to calculate the future cost of goods and services, measuring the difference between Old Mutual’s share prices in Johannesburg, Harare, and London to produce forward pricing on the Zimbabwean dollar. The South African insurer was not involved in determining the rate.

The two counters won’t be listed on the VFEX and remain suspended on the ZSE.

VFEX, a subsidiary of the Zimbabwe Stock Exchange (ZSE), was launched as part of efforts to attract global capital, restore foreign investor confidence in Zimbabwe’s capital markets, and help companies raise capital in foreign currency.

Read: The Victoria Falls Stock Exchange A Stepping Stone Towards Zimbabwe’s Economic Progression?

Since its launch, the listed companies on VFEX have grown to four counters: SeedCo International, Padenga Holdings, Caledonia Mining Corporation, and Bindura Nickel Corporation.

Seed Co International Limited pioneered trading on the VFEX, followed by crocodile skin, gold producers, Innscor spinoff Padenga Holdings, and Caledonia Mining Corporation. Caledonia Mining ended up issuing more shares in respect of its VFEX listing to raise more funds than originally anticipated. BNC also indicated that it has an ambitious capital program that will be sustained through funds raised from the VFEX.

In an article by The Zimbabwean Mail published June 8, 2022, VFEX chief executive Justine Bgoni said the bourse has a strong pipeline and anticipates getting some listings this year from the mining sector, Financial Services, and Government Institutions.

“We appreciate the efforts being implemented by the Government and the various incentives that have been put in place on VFEX.

“VFEX is working to deepen the market and to establish the commodities exchange,” said Bgoni.

He added, “We will continue to lobby with the Government for tax incentives that will make the bourse more attractive to investors and issuers as we work towards the commodities exchange.

Recently, the government instituted measures to sweeten the VFEX through legislation adjustments. Exporters who list on the VFEX will retain 100% of their export earnings on incremental volumes above their average monthly volumes over a predetermined period.

“Once the commodities exchange is established, we expect to roll out the derivatives.”

Finance Minister Mthuli Ncube in the 2022 National Budget said that the Treasury will issue US$100 million worth of Government bonds on VFEX in 2022 as part of deficit financing.

Minister Mthuli said the bonds would be issued to reduce the cost of borrowing and deepen the capital markets, with a particular objective of developing the Victoria Falls Offshore Financial Services Centre aimed at attracting foreign capital.

Meanwhile, the VFEX introduced broker-controlled accounts to ensure convenience in trading on the US dollar-denominated stocks trading platform.

“VFEX is pleased to advise stakeholders on the introduction of broker-controlled accounts with effect from July 1 2022 for the VFEX investors,” VFEX said in a statement.

According to an article by The Zimbabwe Mail dated July 5, 2022, a brokerage account is an arrangement in which an investor deposits money with a licensed brokerage firm, which places trades on behalf of the customer.

VFEX said, “The broker-controlled account is opened by a VFEX registered stockbroker on behalf of their clients who wish to trade in securities on the VFEX, allowing the stockbroker to interact with a licensed custodian on behalf of the investors.”

According to the directive and international standards, the account will be registered in the beneficial owner’s name.

“The broker-controlled model was necessitated by the need to simplify the account opening process for retail investors,” the statement read.

Broker-controlled accounts deliver lower costs and easier account opening procedures for investors wanting to open a VFEX trading account.

This offers a one-stop-shop facility for the investor, given by opening an account with the custodian and transacting through a securities dealer, the broker-controlled model offers investors all the services under one roof to the convenience of the investor.

The securities dealing firms will perform all the services on behalf of investors and these include, among others, opening accounts for investors, and performing the necessary due diligence exercise including the Know Your Customer (KYC) requirements.

It also includes day-to-day communication with the client, mailing of customer transaction statements at no cost, and transacting on the stock exchange on behalf of the investor.

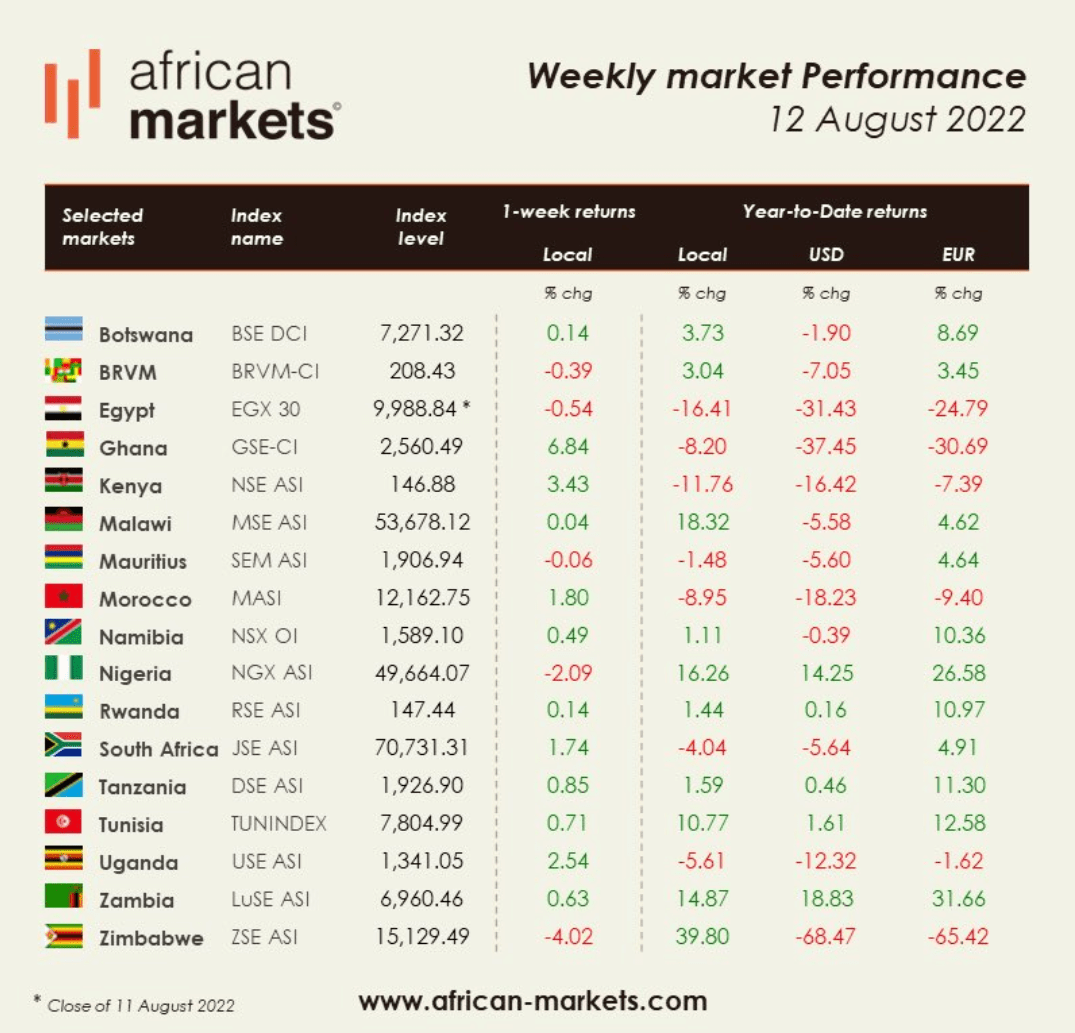

The Zimbabwe Stock Exchange (ZSE) is the worst performing stock exchange on the continent this year in US Dollar terms, according to the website AfricanMarkets.com which tracks stock markets across the continent.

The ZSE lost 68.47 per cent year-to-date, which is almost twice the next worst performing exchange, the Ghanaian Stock Exchange, which lost 37.45 per cent in the same period.

In the week closing on August 11, 2022, the ZSE lost 4.02 per cent but maintained a 39.80 per cent gain year to date in local currency terms.

The foreign currency denominated bourse, the Victoria Falls Stock Exchange (VFEX) registered notable gains after Bindura, Padenga, and SeedCo International closed the short week in the positive. Caledonia’s price remained unchanged.