- Rising volatility in Kenya’s Fixed Income Market derives from a combination of global and domestic factors.

- The yield curve soared fastest at the head and upper belly of the curve, rising by a cumulative 661bps on the three-month treasury bill.

- There is hope as it is anticipated, that a rebound in trading activity will happen in 2024.

The Kenyan Fixed Income Market displayed remarkable flexibility last year to experience one of the most rapid annual increases in yields resulting in a notable inversion of the effective yield curve.

According to financial experts, the rising volatility in the fixed income space derives from a combination of global and domestic factors.

On the external front, the rapid monetary policy tightening in 2022 and 2023 led investors to price-in bearish capital gain expectations for bonds.

On the domestic front, the rising concerns around fiscal sustainability indicators, coupled with an elevated inflationary regime in 2023 led investors to raise the macroeconomic risk premium in purchasing treasuries.

The Kenyan Shilling, which invariably responds to macroeconomic pressures, similarly experienced higher volatility in 2023, fueling the upward yield spiral.

According to Ronny Chokaa, Senior Research Analyst at AIB-AXYS AFRICA, in many ways, the past few years have demonstrated that volatility is the new normal.

“The global economy has been through immense challenges; from the embers of a global health pandemic, to cost of living pressures and simmering geopolitical tensions, threatening to split the globe into major rival blocs. The ensuing rapid monetary policy tightening not only chipped away at business and consumer confidence, but also triggered bouts of financial sector instability,” Says Chokaa

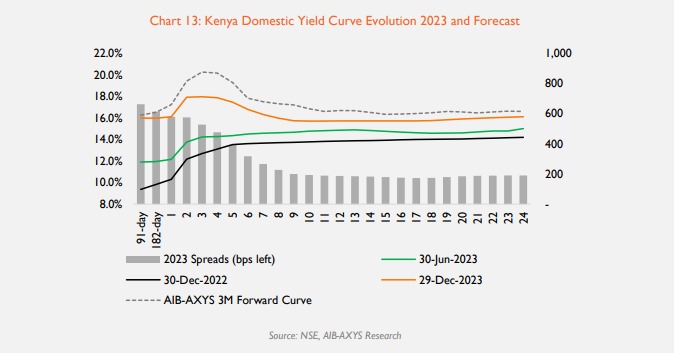

According to the analyst, the yield curve soared fastest at the head and upper belly of the curve, rising by a cumulative 661 basis points on the 3-month treasury bill, to end 2023 at 16 percent.

Yields similarly humped at around the two-year to five-year, driven by aggressive investor bidding at Treasury bond auctions.

Higher CBK base lending rate

At the tail-end, yields similarly adjusted upwards, albeit at a slower pace, due to declined demand for long-duration bonds in a highly uncertain environment.

In response, the Central Bank of Kenya altered its strategy of barbell issues – long-duration coupled with short-duration bonds – in the first half of 2023, to primarily issuing short-duration securities in the second half of the year.

“The turning point came around April 2023 when the Central Bank of Kenya withdrew the re-open of the FXD1/2019/015 paper, presumably on account of prohibitively high yields. This set off notable yield curve disturbance, alongside other chain of events, which led to an inversion in the second half of 2023,” added Chokaa.

Trading volumes across the secondary market declined markedly by 11.4 per cent to $4 billion (KSh651.1 billion) worth of bonds.

“We maintain the view that fast-rising yields dissuaded investors from selling-off bond holdings to avoid crystallizing mark-to-market losses. As such, the bond market presently remains a buyer’s market,” says the analyst.

Fixed income market 2024 outlook

However, there is hope as it is anticipated, that a rebound in trading activity will happen in 2024, arising partly from rising liquidity needs on account of a long-running quantitative tightening by the Central Bank of Kenya.

An analysis of the most recent auctions for Treasury Bonds and Treasury Bills indicates a growing inclination among investors towards seeking higher risk-adjusted returns.

Read also: Kenyan elections and NSE, investors to adopt precautionary behaviour

Yields on government securities

Given the heightened uncertainty present both domestically and globally in 2023, it is expected that investors will persist in elevating term premiums to offset the increased risk in the financial landscape.

This is set to support a further uplift in yields on government securities. Across the corporate bond space, trading activity was largely suppressed as the rising yield environment, especially on Treasuries, pummeled corporate bond valuations.

Corporates shied away from issuing new fixed rate bonds due to the rising yield landscape. However, from our point of view, we spot pockets of opportunities for corporates to issue floating rate bonds, anchored to global benchmark rates.