Having done business a few times before in the Democratic Republic of Congo (DRC), namely in the mining and the value-added services (VAS) services sector, I have always believed that the DRC had immense potential albeit the challenges that exist in navigating the rules and regulations.

The admission of the DRC in the East African Community (EAC) has been received with mixed feelings of scepticism and fear that essentially the problems of the DRC will become the problems of all Member States in the EAC, but also excitement that this may well be a game-changer for the East African regional bloc. However, I choose to look at the risks as well as the opportunities.

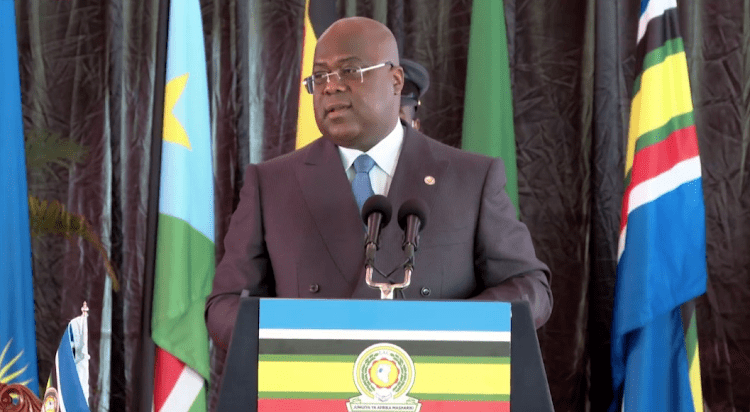

The EAC, one of the most successful regional blocs in Africa, has grown its membership from 6 to 7 Partner States (Kenya, Uganda, Tanzania, South Sudan, Burundi, and Rwanda). On March 29, 2022, the 19th Extra-Ordinary Summit of the EA Heads of States noted the successful conclusion of the negotiations between the DRC and the EAC and admitted the DRC into the EAC. The DRC had expressed its interest in acceding to the Treaty of the EAC at the end of 2019 and had to meet the requirement of adhesion to the Community provided under Article 3 of the EAC Treaty. Therefore, the DRC met all the set criteria for admission as provided for in the Treaty for the establishment of the EAC. It will take a few more months or even years depending on how fast the DRC legislators can move for the ratification of the EAC laws and regulations to take place in the DRC and for its membership to therefore come into full effect.

Why did the Congo join the East African Community?

It is obvious that the DRC’s desire to become a member of the EAC is to tap into the benefits of regional trade, i.e. an expanded market of 300 million people, and to increase Foreign Direct Investment (FDI) through its membership in the EAC bloc. DRC’s capital market remains underdeveloped and consists mainly of the issuance of treasury bonds.

There is no stock exchange in the country and only a small number of private equity firms are actively investing in the mining industry. There are hardly any institutional investors in the DRC except for an insurance company and a state pension fund. The Central Bank of Congo (BCC), developed a market for short-term bonds, which are bought and held by local Congolese banks. The absence of a domestic debt market has meant that the fixed-rate market is limited to government-issued treasury bonds with maturities of up to 28 days traded through commercial banks.

Nevertheless, admission to the DRC can be mutually beneficial for all parties. Although Rwanda and Uganda are the leading countries in the EAC to trade with the DRC and might stand to gain more, countries like Tanzania and Kenya will also benefit. On the one hand, the EAC can provide a growth stimulus to develop full natural resource exploitation, infrastructural development and regional security. On the other hand, the EAC partner states can leverage DRC’s membership for a broader market and stimulate resource-based industrialisation in the region.

Also Read: EAC: From the Indian Ocean to the Atlantic Ocean!

DRC’s admission in the EAC is a game-changer to the bloc’s trade performance given the DRC’s natural resources base and a consumer market of 90 million people, which is almost half the current EAC population. DRC is the World’s biggest producer of cobalt, a significant component in the manufacture of rechargeable batteries for electric vehicles, and Africa’s leading copper producer. It is also a major producer of gold, diamonds, uranium, coltan, oil, and other precious metals, making it one of the most resource-rich countries in the World. Therefore, the availability of these resources, coupled with appropriate transport infrastructure which still needs to be developed, can boost the EAC’s industrialisation agenda through reduced transactional costs for labour from lower- to higher-productivity activities. This would lead to economic transformation in the East African economies.

Congo’s Trade with the East African Community

Generally speaking, all EAC member states are net exporters to DRC, with Rwanda and Uganda being the most prominent trade partners while Burundi has the lowest export values. Data from UNCTAD and the EAC Secretariat show that the EAC’s exports to the DRC have more than doubled from USD 419 million to USD 855 million between 2010 and 2018. Relatedly, imports from DRC in the same period equally increased albeit by a lesser 28 per cent. The data reveals that in 2010, Uganda and Tanzania were the leading EAC exporters to DRC, valued at USD 183 million and USD 156 million, respectively and Rwanda trade has grown exponentially by 120 % to USD 337 million in 2018. The DRC stands as the leading export destination for Rwanda and accounts for 75 per cent of the country’s exports.

Analysis of EAC export trade structure with DRC reveals that exports are predominantly primary products that include ores and metals, mineral fuels, agricultural commodities, and food and beverages. For instance, the top 6 exports, which account for 44.5 percent of the total exports, are all primary products. These are mineral fuels (USD 73 million), iron and steel (USD 59 million), Cereals (USD 52 million), cement (USD 46 million), Vegetable/animal Oil (USD 49 million), and mineral and ores (USD 49 million).

DRC mainly imports high-value manufactured goods from outside of the EAC and mainly from the USA and China namely machinery, electronics, motor vehicles, and pharmaceutical products, since the EAC does not have a competitive edge to produce.

In order to really win on the estimated trade gains that the EAC may have with the DRC as a member state, the EAC members states need to urgently address issues of the non-Tariff barriers (NTBs) that limit the trade between DRC and the rest of the EAC namely the development of transport infrastructure and addressing security issues as well. The need to develop the DRC railway and road links would also be an added benefit to the EAC region since the DRC could become a gateway to the West African region.

Given that the DRC still relies mainly on imports from outside the EAC, the EAC Members States should adopt a long-term strategy of building their capacity to produce high technology products such as machinery, electrical equipment, and motor vehicles to meet the supply-demand. Equally, there is a need to develop agro-processing industries to add value to the raw agricultural products that are heavily imported from the EAC by the DRC such as sugar, palm oil, and cereals, and invest in commercial agricultural production supplying inputs to the ago-food industries.

The admission of the DRC into the EAC does not suddenly remove the challenges that the DRC the lack of infrastructure development in many areas of the country which make trade and investment difficult. In addition, the security problems that have been crippling the county’s economy for decades is a massive factor to the reason why there is less private capital and FDI inflows into the country. However, the fact that the DRC now must adhere to standards in the EAC might bring about the change that has been long-awaited and although the EAC has its own weaknesses, perhaps the Member States can serve as mediators in the civil conflicts and unrest in the region.

Amne Suedi is an international lawyer with sound knowledge of doing business in East Africa where she advises and accompanies investors in the region on their investment journey. For more information please contact amnesuedi@shikanagroup.com or visit www.shikanagroup.com.