- Kenyan Farmers Receive $2M Boost from Africa Fertiliser Financing Mechanism

- Brace for High Interest Rates for a Longer Period World Bank Warns Kenya

- Kenya-Ethiopia Trade Relations: Legislators Advocate for Policy Alignment to Boost Ties

- Visualising the state of debt in Africa 2024

- Abu Dhabi radiates optimism as over 300 startups join AIM Congress 2024

- TLcom Capital Raises $154 million in Funding to Boost Its African Growth

- Africa’s $824Bn debt, resource-backed opaque loans slowing growth — AfDB

- LB Investment brings $1.2 trillion portfolio display to AIM Congress spotlight

ALSF signed an agreement to provide advisory services support to the government of Rwanda for the negotiation of its deal with Symbion Power.…

The IIC will award a total of USD1.6 million this year —including USD250,000 to each of the four winning organisations.…

How two Norwegians-turned Kenyans built a global traveltech success from five apartments in Syokimau

When Håvar Bauck landed in Kenya in 2002, the country was in chaos. The government of outgoing president Daniel Moi was preparing to exit the scene after 24 years in power. It was not clear who would become the next leader and despite great optimism of the future of the country, fear of instability was still evident.

“Kenya was experiencing a great moment of change. When Mwai Kibaki won the election, the country exploded in optimism. I was excited to see Kenya starting to realize its potential. The spirit of ‘yote yawezekana’ was contagious,” notes Bauck who was on a student exchange program through the Norwegian Peace Corps.

For Bauck, there began his great love for Kenya and an exciting journey for sixteen years that has pushed him to developing one of the biggest start-ups ever …

Joel will manage Tell-Em PR’s operations and client portfolio

Tell-Em Public Relations, one of Kenya’s leading Public Relations firms, has appointment veteran PR practitioner Joel Chacha as the agency’s new General Manager effective April 1, 2019.

Joel brings over 10 years of experience in developing and implementing successful communications and digital strategies.

“We are very pleased to announce the appointment of Joel Chacha as Tell-Em PR’s General Manager. Joel’s broad mix of strategy, crisis communication and media relations experience will be a fantastic addition to our agency’s Top Executive Team,” said Tell-Em PR’s Managing Director Elizabeth Cook.

Mutahi Kagwe, Tell-Em PR’s chairman, added:“On behalf of our Board of Directors, I welcome Joel Chacha to his new position. He brings a wealth of knowledge in strategic planning and business development.”

Joel has spent the last few months at the agency overseeing an aggressive client acquisition through strategic pitches and leveraging on …

The factory can produce about 7.8 billion pellets of chewing gum annually

US headquartered Mars Wrigley Confectionery has cemented its business in the East and Central Africa region with the new state of the art Ksh7billion (USD68.9 million) manufacturing plant in Athi River, Machakos County, Kenya.

The plant was officially commissioned by President Uhuru Kenyatta on Tuesday. The President was represented by Industry, Trade and Cooperatives Cabinet Secretary Peter Munya.

Kenyatta has since hailed Mars Wrigley for putting up the new factory citing the need to invest in additional manufacturing capacity to create more jobs for Kenyans.

The investment gels well with his ambitious Big Four Agenda’s manufacturing pillar that seeks to increase manufacturing’s contribution to GDP from the current 8.5 per cent to 15 per cent by 2022.

“To create the desired jobs, we need to invest in existing and new industries that will grow our country’s manufacturing capacity …

Delivery has become the in-thing in the market. Customers nowadays don’t have to go to the shops but can just order, make a payment (either before or on delivery) and receive their orders at home, in the office or have them delivered wherever they want. The Exchange spoke to Glovo, a startup founded in 2015 in Barcelona, and launched in Kenya in February this year. The service is present in over 20 countries and more than 100 cities. With over 10 years in business development, seven of which have been in the tech world, Glovo Market Lead (Sub-Saharan Africa) Priscila Muhiu divulges into the logistics business in Kenya and the region.

What makes the logistics space in Kenya an attractive prospect and why is Glovo in this business?

Logistics is the key driver to any economy. Without logistics, businesses will not be able to get their goods to their …

The Kenya Revenue Authority (KRA) has hit a technical snag in its efforts to collect taxes amounting to more than Ksh2.7 billion (USD26.6 million) per month, accruing from betting wins.

This follows a court order issued by a magistrate’s court barring the taxman from accessing the monies.

The orders issued by Senior Resident Magistrate D.M. Kivuti sitting at the Milimani Commercial Courts (Nairobi) have stopped the operations of crucial Income Tax Act sections (Sections 2, 10, 34 and 35), effectively rendering KRA unable to collect the levies, earmarked for national development projects.

This is per the budget for the current financial year ending June 30, where National Treasury Cabinet Secretary, Henry Rotich, had planned to have taxes drawn from betting activities finance sports, art, cultural developments and the rollout of the Universal Health programmes.

The order issued by Senior Resident Magistrate Kivuti follows the 2014 filing of a suit by …

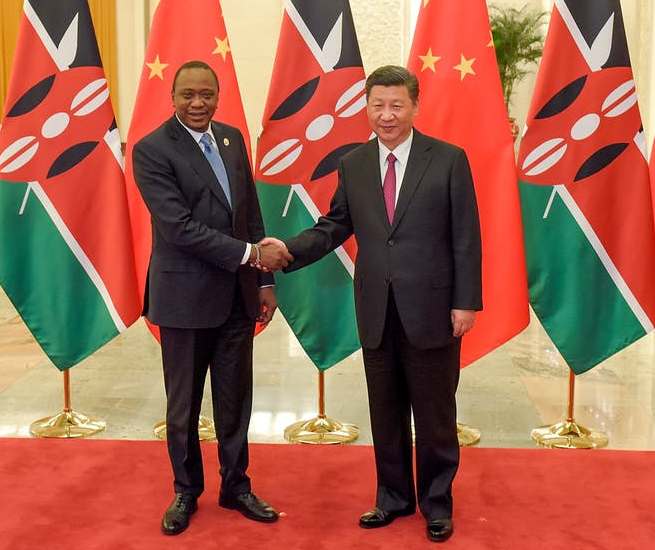

The Belt and Road Initiative is a China-led strategy to strengthen global trade links across the world, in particular between Asia, Africa and Europe…

Loans from China closed 2018 at USD6.2 billion (Ksh 627.1 billion)

Kenya will be keen to secure additional funds from China for construction of Phase 2B of the Standard Gauge Railway (SGR), as the World meets for the second Belt and Road Forum for International Cooperation (BRF) in Beijing.

The forum which takes place this week is expected to attract a high number of Heads of States from Africa and across the globe, with thousands of delegates from over 100 countries.

President Uhuru Kenyatta’s administration is seeking a Ksh370 billion (USD 3.67 billion) loan to extend the rail project which is currently at its second phase of construction (Nairobi-Naivasha).

Phase one of the project, 472 kilometre Mombasa —Nairobi line, is currently operational having been completed and commissioned by President Kenyatta on May 31, 2017.

It was constructed by China Road and Bridge Corporation (CRBC) on a Ksh327 billion (USD3.2 billion) …

Majority of the deals are tier 1 banks going for struggling tier 2 and 3 lenders

Kenya’s banking sector is on an evolution path evidenced by the high number of mergers and acquisitions being witnessed; a trend the government is hoping will realign and strengthen the sector.

The most recent is last week’s offer by the country’s largest bank by asset-KCB, which has made a move to acquire a hundred per cent (100%) of the ordinary shares in National Bank of Kenya (NBK).

This is the sixth deal in the last nine months (between August 2018 and April this year) with a total 13 banking merger and acquisitions in the last six years.

Majority of the deals are tier 1 lenders going for smaller struggling banks in tier 2 and tier 3, in the market which has a total of 42 commercial banks and one mortgage finance institution-Housing Finance.

KCB, …