- Residential property prices in Kenya experienced a jaw dropping 425% increase since 2000 compared to 201% in the U.S., 151% in France, and 122% in Singapore.

- Property tracker HassConsult’s study reveals that homes in Kenya are fully paid, which makes the market super-resilient.

- Home owners in Kenya rarely end up grappling with mortgage repayments they can’t meet, preventing the waves of forced sales suffered in other economies.

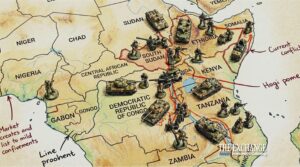

Investors in Kenya’s property markets have experienced higher returns than their counterparts across comparable hot addresses globally including the U.S., South Africa, Singapore and Canada over the last 25 years, a special market survey released in Nairobi today shows.

According to HassConsult’s International Investment Outperformance: The Kenyan Residential Property Market report, East Africa’s largest economy expanded its property market lead this year compared to other destinations due to rising middle class, reduced dependency on mortgages, and increased uptake of homes under off-plan purchase strategy.

The survey revealed that residential property prices in Kenya experienced a jaw dropping 425 per cent increase since 2000 compared to 201 per cent in the U.S., 151 per cent in France, and 122 per cent in Singapore.

“A critical factor in the strength of Kenya’s housing market has been its source of finance,” said HassConsult Co-CEO, Sakina Hassanali, adding: “Homes in Kenya are fully paid, which makes the market super-resilient. Owners rarely end up grappling with mortgage repayments they can’t meet, preventing the waves of forced sales suffered in other economies.”

Mortgage-financed homes in Kenya

Official statistics show that in Kenya, mortgage-financed homes account for under two per cent of properties while in the developed markets under review home loans are upwards of 90 per cent.

Property tracker HassConsult noted that the surge in property prices in Kenya was attributable to steady rise in the number of wealthy individuals which the economy has been churning out across education, health, trade, and agriculture industries. Another source of home buyers has been “mortgage-financed banking staff” the company noted.

“Multiple factors are driving down property demand in western and eastern economies, not least of which is declining populations, while the value of property in Kenya’s expanding economy and population only keeps growing,” said Hassanali.

Rising value in property markets yield

Meanwhile, the study shows that Kenya’s rental yields have remained above the international average, at 5.5 per cent, delivering a combined return in the year to June 2025 of 13.28 per cent. Rental yields from property denote the percentage of a buyer’s original property investment which they are earning as rent each year, meaning that the higher property prices go, the lower rental yields tend to fall.

Interestingly, rental yields have remained high for thousands of Kenyans, who have bought properties in offplan developments. HassConsult report analysed eight prime offplan developments in Kenya, reporting an average return on investment in 2025 of 18.06 per cent.

“With off-plan now the main point of entry for many Kenyans into property, the discounts and instalment payments are creating gains that are, in reality, over twice the norm in other global markets,” said HassConsult Development Sales Advisor, Ian Mutinda.

“It’s easy to see how this is creating an expanded class of property investors, where we regularly see a buyer who started with two units quickly able to afford a third based on their accumulated rents. And this is another phenomenon that is emerging as uniquely Kenyan in its scale,” Mutinda added.

Take the case of a Cameroonian on holiday in Nairobi who has ended up accumulating wealth of approximately KES100 million through offplan property purchase.

“He [Cameroonian] saw the Enaki development from the road, and asked for a real estate tour. It was sold out, but we showed him around anyway. When he got the numbers, he bought a different offplan and has since kept buying more, himself, as well as in groups with friends,” Mutinda narrated.

Property prices in South Africa

In South Africa, between 2000 and 2025, property prices have increased by 69 per cent, a lower pace than Kenya due to muted expansion of the country’s middleclass as well as the negative impact of inflation over the years in Africa’s most advanced economy.

“South Africa has a far larger mortgage market than ours [Kenya] but its middleclass has been growing very slowly. Ours [Kenya], by contrast, continues to add high earners at speed, with tens of thousands of new high earners in the education sector, tens of thousands more in health, in trade, in banking, and in agriculture,” explained HassConsult co-CEO Sakina Hassanali.

Across the U.S. the survey established that the investment avenue of choice for Americans is usually shares and mutual funds, which offers investors an average return of 13.5 per cent.

“Less than an eighth of U.S. households have invested in buy-to-rent properties, which in the last year earned them a return of around 9 per cent, from capital appreciation and rental yields combined,” stated Mutinda.

Survey findings showed that unlike Kenya, all debt-leveraged property markets were negatively affected by fiscal policy owing to high inflation. This means that home buyers increasingly found themselves unable to service their loans, further limiting the number of purchases.

“Kenyan property is barely affected by these debt and loan changes, removing it from a world of defaults and reduced buyers.”

Read also: Dubai to host IPS 2025 expo, elevating global property investments