- Stanbic PMI Report: Mixed performance as Kenya’s agriculture, construction offset manufacturing decline

- Uganda’s land management gets a tech makeover to boost transparency

- Nigeria’s output dips fastest in 19 months on a sharp rise in costs

- Apple faces growing backlash over Congo exploitation

- Why East Africa is staring at higher wheat prices in 2025

- Nairobi Gate SEZ pumps $7 million into Kenya’s agro-processing industry

- What impact will the US election have on Africa?

- Russia and Tanzania unite to double trade, boost Africa market access

Browsing: African Private Equity and Venture Capital Association

- Africa private capital deals fell to to 450 deals in the past one year.

- The continent’s total private capital deal value stood at $5.9 billion, the fourth largest value on record since 2012.

- Decline in Africa private capital deals marked the continent’s steepest year-over-year decline in volume in 12 years.

Africa recorded a 28 per cent year-over-year (YoY) decline in the total private capital deal volume for the first time since 2016, falling to 450 deals. This downturn is attributed to the global economic turmoil, which led to inflation spikes and the devaluation of continental currencies.

In Kenya and Nigeria for instance, the Shilling and the Naira plunged to historic lows in 2023, while in Egypt, a shortage in foreign currency led to increased controls over its usage in the country.

According to the 2023 African Private Capital Activity Report, the depreciation of local currencies and the depletion of foreign …

As a form of private equity funding, venture capital finance African startups at the nascent stage. Money is given to firms with significant growth and revenue creation potential. Across economies, VC firms are critical drivers of growth and development in Africa. They drive job creation and innovation and finance the rollout of new products and technologies.…

[elementor-template id="94265"]

- Egypt has overtaken Nigeria by raising $540 million in tech startup funding in the year to June 2023.

- This year, Egypt achieved a major milestone by creating its first unicorn, MNT-Halan.

- In the year to June 2022, the Big Four—Nigeria, Kenya, South Africa and Egypt—jointly raised $4.6 billion. This was a 25 per cent drop from the $710 million raised previously.

Egypt is today the leading market across Africa with total equity in tech funding raised by start-ups in the last one year surpassing rival Nigeria. Data from the African Private Equity and Venture Capital Association (AVCA) shows that the North African country overtook Nigeria as start-ups raised $540 million in funding in the year to June 2023.

This was, however, a 25 per cent drop from the $710 million raised the previous year. The least decline recorded among the big four African countries

- African Development Bank tells Japanese investors putting their money in the continent is profitable.

- Japan’s Foreign Direct Investments in Africa declined from $10 billion in 2016 to just $4.7 billion in 2020 during Covid-19, before picking up to $6 billion in 2021.

- According to AfDB, Africa accounts for only 0.003 percent of Japan’s $2 trillion global Foreign Direct Investments.

- Japan’s Prime Minister Fumio Kishida announced during the TICAD 8 Summit in Tunis last year $30 billion for Africa, including support for startups.

Africa is keen to increase Japanese investment in the continent, the African Development Bank (AfDB) has indicated amid growing interest from other countries including China, Europe and the US.

The move comes after a slump in Japan’s Foreign Direct Investments (FDIs) in Africa, which declined from $10 billion in 2016 to just $4.7 billion in 2020 during Covid-19, before picking to $6 billion in 2021.

According to AfDB, …

- 2021 was a significant year for venture-backed companies worldwide, investing more than US$ 675B into startups globally, with more than US$5B allocated to African startups

- VCs have been keenly eyeing a spectrum of sectors from fintech, edtech, biotech, health tech, insurtech, mobility, logistics, e-commerce, crypto, connectivity, proptech, software and mobile commerce

- A report from Partech further reveals that more than 600 tech companies in Africa, raised US$5.2B from venture capitalists in 2021.

Striking whilst the iron is hot, is the shrewd move that Venture Capitalists (VC) are making, to seize opportunities presented by the lucrative African Startup ecosystem that is burgeoning by the day; heralded by the massive technology wave sweeping across the continent, a prominent harbinger that the fourth industrial revolution is but within grasp.

Currently, Africa boasts of a myriad of VC-backed startups, with big investors like Jeff Bezos sinking tentacles into this frontier, that has seen the…

Africa is one of the world’s fastest-growing economies with the continent expected to be home to nearly 1.7 billion people by 2030 and have a combined business and consumer spending of $6.7 trillion according to the Brookings Institute.

This potential in the economy has made Africa attractive for investors seeking high growth businesses with long-term impact. Because of this, Venture Capital (VC) and Private Equity (PE) have emerged as important drivers for directing capital into these businesses hence stimulating capacity building and economic growth across Africa.

According to a report from the African Private Equity and Venture Capital Association (AVCA), African companies which are backed by PE and VC firms are among the most innovative and pioneering firms in the world and attract more international and local investments.

According to the report, despite the effect of the pandemic on businesses, many businesses backed by the PE and VC firms especially …

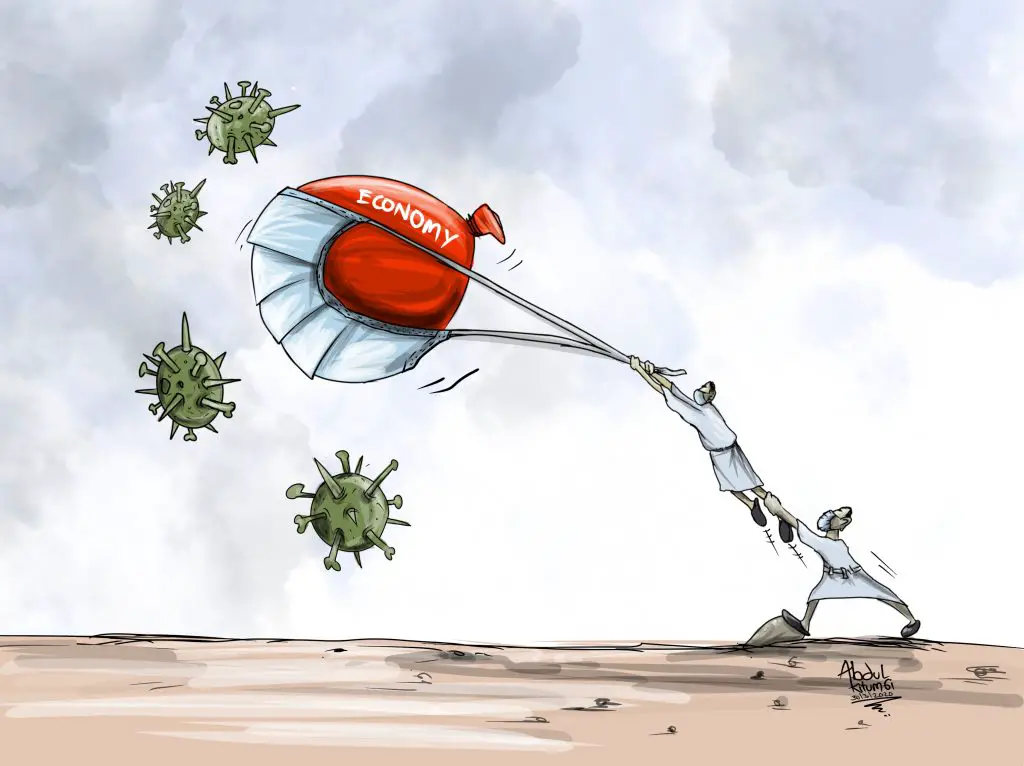

In anticipation of an extreme business environment brought about by the Coronavirus, various players in the African region are rolling out rescue plans for businesses. Economists have voiced their concerns of an extremely difficult economic situation and have urged players to brace for a rough 2020.

Heeding such calls is EquaLife Capital, the East African based fund managers which has announced plans to roll out a $20MM Africa Venture Debt Relief Fund by April 15th for venture businesses starting with a preliminary focus on the East African region.

“The Relief Fund is created and structured by entrepreneurs for entrepreneurs as we understand the need to act quickly to ensure businesses can survive, and then thrive again, minimizing impact and economic development opportunity lost to unforeseen business cycle pressures,” a statement calling for international venture capitalist read.

“The Relief Fund will provide short-term debt on concessional venture debt terms by utilizing