- Visualising the state of debt in Africa 2024

- Abu Dhabi radiates optimism as over 300 startups join AIM Congress 2024

- TLcom Capital Raises $154 million in Funding to Boost Its African Growth

- Africa’s $824Bn debt, resource-backed opaque loans slowing growth — AfDB

- LB Investment brings $1.2 trillion portfolio display to AIM Congress spotlight

- AmCham Summit kicks off, setting course for robust future of US-East Africa trade ties

- Why the UN is raising the red flag on the UK-Rwanda asylum treaty

- Portugal’s Galp Energia projects 10 billion barrels in Namibia’s new oil find

Browsing: East Africa Breweries Limited (EABL)

According to the brewer, profit after tax for the period declined 1 per cent to Sh7 billion mainly impacted by cost inflation, tax and foreign exchange impact.

Further, the COVID-19 related tax reliefs in Kenya on corporation tax and VAT ended in December 2020, resulting in higher tax charges for the year as the rates reverted back to pre-COVID levels.

The company said the slower profit growth rate was driven by the impact of cost inflation, adverse foreign exchange and tax charges.…

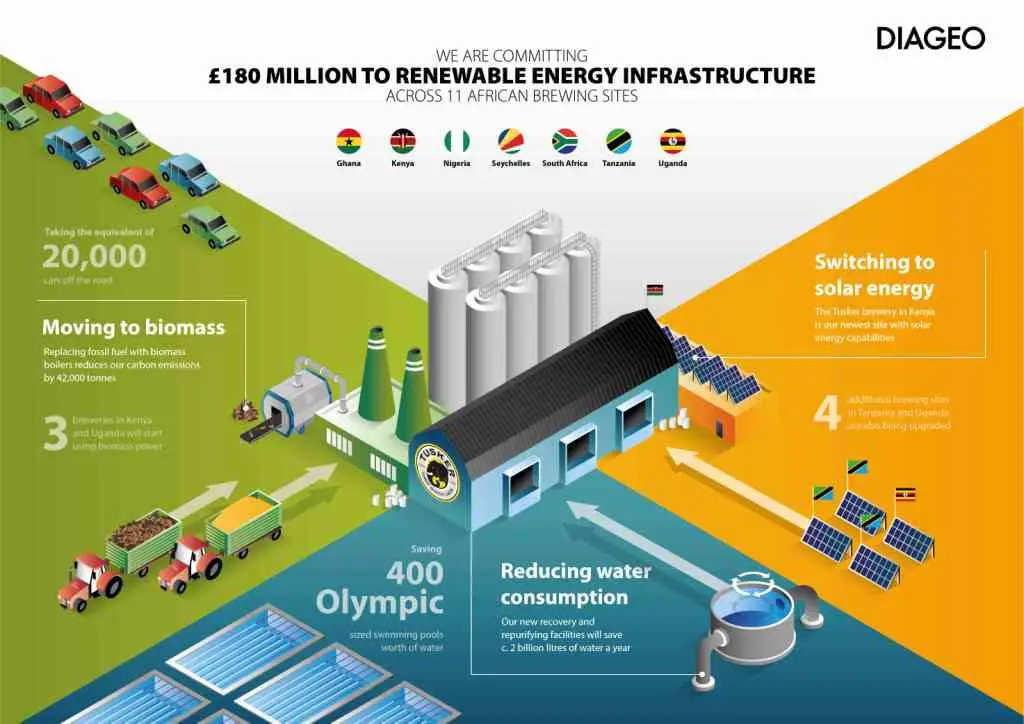

Diageo has committed to invest £180 million (US$217million) in renewable energy resources across its African sites, the British multinational alcoholic beverages company has announced.

According to the world’s second largest distiller, the move is to ensure its breweries are the most carbon and water efficient.

This commitment represents Diageo’s largest environmental investment in a decade confirming its commitment to reducing its carbon footprint and addressing climate change.

READ ALSO:How KBL’s water savings are quenching communities’ thirst

The investment will touch 11 of Diageo’s African brewing sites where it will deliver new solar energy, biomass power and water recovery initiatives.

It is also targeting to bring new infrastructure designed to improve the long-term sustainability of Diageo’s African supply chain in seven countries.

“We believe this is one of the biggest single investments in addressing climate change issues across multiple sub Saharan markets. It demonstrates the strength of our commitment to …

Nairobi Security Exchange’s top share index-NSE 20 shed some 43.09 points or 1.67 per cent to stand at 2543.59 on Friday, even as volumes rose from the previous trading.

The index that tracks blue chip companies at the bourse has been on a downward streak in recent weeks, affecting other indices, amid a continued decline in large cap stocks.

READ ALSO:NSE dips as 2018 ends on a bear market territory

During the last day of the week trading, All Share Index (NASI) shed 0.28 points to stand at 148.05. The NSE 25 Share index ended 9.25 points lower to settle at 3572.56, market data shows.

Market turnover for Friday however stood at Ksh332 million (US$3.2 million) from the previous session’s Ksh179 million (US$1.7 million) as the number of shares traded rose to 12.5 million against 9.9 million posted the previous day.

Week on week turnover however retreated to Ksh1.16 …

Trading at the Nairobi Securities Exchange (NSE) more than doubled this week compared to the previous week, as the market recorded increased investor activities.

Week on week turnover rose Ksh3.7 billion (US$36.3 million) on 102 million shares traded against 51.8 million shares valued at Ksh1.3 billion (US$12.8 million) transacted the previous week.

During the week’s trading which closed on Friday, the NSE 20 share index was up 6.32 points to stand at 2706.78. All Share Index (NASI) shed 0.35 points to settle at 150.12 while the NSE 25 Share index lost 11.08 points to settle at 3637.98.

Banking Sector

The banking sector was busy with shares worth Ksh1.3 billion transacted which accounted for 35.78 per cent of the week’s traded value. Equity Group Holdings actively moved 15 million shares valued at Ksh601 million at between Ksh39.75 and Ksh40.05.

KCB Group moved 11 million shares worth Ksh446 million and closed the …

NSE 20 share Index which tracks top listed companies at the bourse was down 16.21 points

Trading at the Nairobi Securities Exchange (NSE) opened the week with low activities as shares traded close Monday at a total of 10 million, valued at Ksh302.5 million (USD 2.9 million).

This was down compared to 19.8 million shares valued at Ksh560 million (USD5.5 million) posted on Friday before the market took a break for the weekend.

On Monday, the NSE 20 share Index, which tracks blue chip companies was down 16.21 points to stand at 2783.01. All Share Index (NASI) shed 2.40 points to settle at 157.79 while the NSE 25 Share index dropped 52.07 points to settle at 3886.48.

Banking

The banking Sector had shares worth Ksh148 million transacted which accounted for 49.16 per cent of the day’s traded value. Equity Group Holdings was the day’s biggest mover with 1.9 million shares …