- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: Equity Group Holdings

- According to the 2022 Annual report released by Brand Finance Banking 500, the brand value of Equity Group stood at US$388 million.

- The report shows that Equity Group held position 338 overall but topped in Sub-Saharan Africa, outside of South Africa.

- This year, the world’s top 500 banking brands have recorded an upward trend, reporting a 9 per cent year-on-year brand value growth to reach an all-time high of US$1.38 trillion.

- Equity Group Foundation’s corporate social arm has scaled its operations to reach a total spend of US$513 million in social investment programs.

Banking in Africa

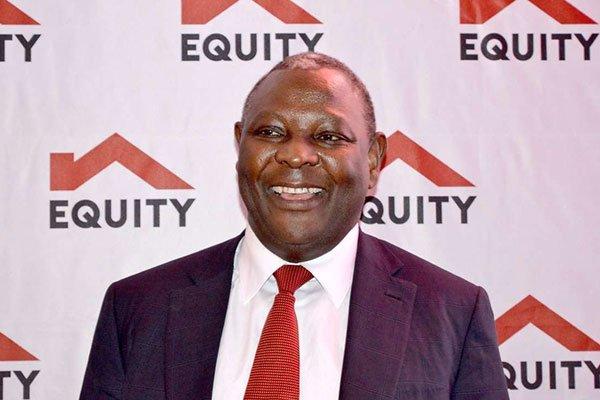

Equity Group Holdings, the most influential financial service group in East and Central Africa, has ranked the fifth strongest banking brand globally.

According to the 2022 Annual report released by Brand Finance Banking 500, the brand value of Equity Group stood at US$388 million. The financial company is among the few banks from …

The Equity Group Holdings Managing Director and CEO James Mwangi will be a keynote speaker at the upcoming 9th Angel Fair Africa (AFA) that will be held in Port Louis, Mauritius.

Equity Group's CEO, Dr. James Mwangi is a keynote for the 9th Angel Fair Africa – Mauritius. #getready

.

.

.#countdown #dodeals pic.twitter.com/hIZl42aGA5— Angel Fair Africa (@AngelFairAfrica) September 13, 2021

Dr. Mwangi will keynote the event alongside EDventure Holdings chairwoman Arch Angel Esther Dyson, who is also the executive founder of Wellville.

Arch Angel @edyson is keynote for the 9th Angel Fair Africa – Mauritius. #getready

.

.

.#countdown #dodeals pic.twitter.com/X2cdZHZZUZ— Angel Fair Africa (@AngelFairAfrica) September 6, 2021

AFA is a Chanzo Capital event that brings selected African entrepreneurs to pitch to a room of curated investors with the intent of doing deals.

Africa India Entrepreneurship Forum (AIEF)

In this year’s event, Chanzo Capital has …

Equity Group Holdings has recorded huge profits of $80.6 million after-tax in its first quarter of 2021 amidst the impacts of the pandemic on economies.

In its latest financial report, for the first quarter that ended on March 31, 2021, Equity group profits increased by 64 percent after-tax to $80.6 million compared to $49.1 million recorded in 2020, which shows recovery in the financial sector.

Equity group holdings total income grew by 29 percent to $236.3 million in the same period while staff costs, loss loan provisions and other operating expenses increased to $127.9 million from $117.7 million. During the same period, non-performing loan book grew by 11.3 percent compared to 14.6 percent which is the industry average.

The group’s interest income grew by 32 percent while non-funded income grew by 30 percent to contribute 42 percent of the total income.

While releasing the report, the Equity Group CEO James …

Equity Group Holdings Plc has completed the acquisition of a majority stake in the Congolese lender Banque Commerciale Du Congo (BCDC) at a discounted price of $95 million after getting a 10 per cent discount.

Last year September, Equity bank announced it had agreed with the George Arthur Forrest and family a major shareholder to acquire all its 625,354 shares which is 66.53 per cent owned by the Belgian entrepreneur at a cost of $105 million with the dividend price per share of $167.9.

In a bank’s statement, it said the takeover is now complete making it the second-largest commercial bank in the Democratic Republic of Congo (DRC).

George Arthur Forrest and family was the majority shareholder owning 66.53 per cent, the government of the Democratic Republic of Congo (25.53 per cent), while the remaining 7.94 per cent shares are owned by other minority shareholders.

Equity Bank has more than …

Nairobi Security Exchange’s top share index-NSE 20 shed some 43.09 points or 1.67 per cent to stand at 2543.59 on Friday, even as volumes rose from the previous trading.

The index that tracks blue chip companies at the bourse has been on a downward streak in recent weeks, affecting other indices, amid a continued decline in large cap stocks.

READ ALSO:NSE dips as 2018 ends on a bear market territory

During the last day of the week trading, All Share Index (NASI) shed 0.28 points to stand at 148.05. The NSE 25 Share index ended 9.25 points lower to settle at 3572.56, market data shows.

Market turnover for Friday however stood at Ksh332 million (US$3.2 million) from the previous session’s Ksh179 million (US$1.7 million) as the number of shares traded rose to 12.5 million against 9.9 million posted the previous day.

Week on week turnover however retreated to Ksh1.16 …

Trading at the Nairobi Securities Exchange (NSE) more than doubled this week compared to the previous week, as the market recorded increased investor activities.

Week on week turnover rose Ksh3.7 billion (US$36.3 million) on 102 million shares traded against 51.8 million shares valued at Ksh1.3 billion (US$12.8 million) transacted the previous week.

During the week’s trading which closed on Friday, the NSE 20 share index was up 6.32 points to stand at 2706.78. All Share Index (NASI) shed 0.35 points to settle at 150.12 while the NSE 25 Share index lost 11.08 points to settle at 3637.98.

Banking Sector

The banking sector was busy with shares worth Ksh1.3 billion transacted which accounted for 35.78 per cent of the week’s traded value. Equity Group Holdings actively moved 15 million shares valued at Ksh601 million at between Ksh39.75 and Ksh40.05.

KCB Group moved 11 million shares worth Ksh446 million and closed the …

NSE 20 share Index which tracks top listed companies at the bourse was down 16.21 points

Trading at the Nairobi Securities Exchange (NSE) opened the week with low activities as shares traded close Monday at a total of 10 million, valued at Ksh302.5 million (USD 2.9 million).

This was down compared to 19.8 million shares valued at Ksh560 million (USD5.5 million) posted on Friday before the market took a break for the weekend.

On Monday, the NSE 20 share Index, which tracks blue chip companies was down 16.21 points to stand at 2783.01. All Share Index (NASI) shed 2.40 points to settle at 157.79 while the NSE 25 Share index dropped 52.07 points to settle at 3886.48.

Banking

The banking Sector had shares worth Ksh148 million transacted which accounted for 49.16 per cent of the day’s traded value. Equity Group Holdings was the day’s biggest mover with 1.9 million shares …

Equity Group Holdings was the day’s main feature with 2.3 million shares traded

The week’s trading at the Nairobi Securities Exchange (NSE) opened on a modest pace marked by low volumes and value of shares.

The bourse opened the week with a total of seven million shares valued at Ksh219 million (US$2.2 million) against 9.3 million shares valued at Ksh249 million (US$2.5 million) posted on Friday.

The NSE 20 share Index, which tracks blue chip companies, was down 15.38 points to stand at 2899.41.

All Share Index (NASI) shed 0.58 points to settle at 157.33. Equally, the NSE 25 Share index dropped 8.23 points to settle at 3957.02.

Banking

The banking sector had shares worth Ksh148 million transacted which accounted for 67.76 per cent of the day’s traded value.

Equity Group Holdings was the day’s main feature with 2.3 million shares valued at Ksh100 million changing hands at between Ksh42.75 …