- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: European Union

- In the first three months of this year, Asia remained the leading source of Kenya’s imports accounting for goods worth $3.4 billion, as the country’s import bill closed the quarter at $5.4 billion.

- Kenyan traders and government imported goods worth $990.2 million from China, data by the Kenya National Bureau of Statistics (KNBS) shows, making it the biggest import source by country.

- Unlike his predecessors, President Ruto is seen to lean more towards the West as he seeks financing and trade cooperation.

Kenya’s imports from Asian countries including China

China and India remained the top exporters to Kenya in the first quarter of this year, leading other Far East nations in retaining a firm grip on the East African economic powerhouse’s trade and investment space, which they have dominated for over a decade.

This trend continues despite President William Ruto’s heightened charm offensive to economies from the West, which is …

- For African universities, governments and businesses, 5G Tech Spaces are part of the solution to enable Africa to leapfrog with clean innovation.

- Africa’s climate finance inflows remain very low, at 3 percent of global climate finance.

- The continent requires as much as $2.8 trillion through 2030 to implement its climate commitments.

Africa’s most renowned universities are keen to be at the forefront of Research, Innovation and Outreach (RIO) of technologies, products, services and operating models that reduce CO2 emissions and help attain Net Zero Emissions (NZE).

To achieve this, the gap between rhetoric and action needs to be reduced, if we are to have a fighting chance of reaching Net Zero by 2050 and capping the rise in global temperature at 1.5 °C in full attainment of the Paris Agreement.

Africa produces only about 4 percent of the world’s emissions, but is disproportionately vulnerable to the impact of climate change. …

- In Berlin, German Chancellor Olaf Scholz says his country will invest 4 billion euros in Africa’s green energy until 2030.

- Scholz made the green energy plans after meeting African leaders and heads of international organizations during the G20 Compact with Africa conference.

- Compact with Africa was initiated by Germany in 2017 during its presidency of the G20 to improve conditions for sustainable private sector investment and investment in infrastructure in Africa.

The government of Germany has pledged to invest $4.37 billion (4 billion euros) in Africa’s green energy until 2030. German Chancellor Olaf Scholz made the announcement at a press conference in Berlin after meeting African leaders and heads of international organisations including the President of the African Development Bank (AfDB) Group Dr Akinwumi Adesina, during the G20 Compact with Africa conference.

The Compact with Africa was initiated by Germany in 2017 during its presidency of the G20 to improve …

A considerable gap exists between symbol and substance regarding an African climate change approach. Foreign leaders often nod to how Africa accounts for only four per cent of global emissions but bears the brunt of the devastating climate change effects. Rising temperatures, extreme weather conditions, and ecosystem disruptions threaten millions of Africans’ livelihoods.

For many communities across the continent, the climate threat is already existential. With 18 per cent of the global population, Africa has 16 of the 20 countries most vulnerable to climate change, according to Notre Dame Global Adaptation Initiative.…

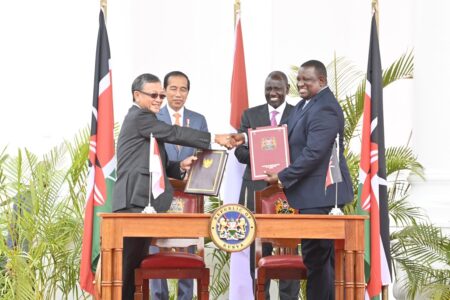

- Investment and trade between the two countries was valued at more than $600 million last year.

- Kenya’s exports last year increased to $7.9 million from $6.3 million in 2021, the country’s Economic Survey 2023 indicates.

- Imports from Indonesia were valued at $187.7 million having dropped from $307.5 million the previous year.

Kenya is now keen to increase trade volumes mainly exports to the Asean market, with its renewed ties with Indonesia. President William Ruto said investment scope will also be broadened to bring about a balance of trade that is currently in favour of the Southeast Asian country.

“We will seize our energies and create the necessary environment for increased trade between our countries,” President Ruto said on Monday.

Investment and trade between the two countries was valued at more than $600 million last year. Indonesian economy registered a growth of 5.3 per cent in 2022 compared to of …

- The program, which runs for 18 months, aims to support political stabilization and reconciliation in Somalia, a fragile country in the Horn of Africa.

- In line with the National Stabilization Strategy the financing will go to water infrastructure, security, and reconciliation initiatives.

- The EU is making tangible progress in supporting Somalia’s transition to a peaceful and stable nation. The project also seeks to enhance the legitimacy of Somali authorities in locations recently liberated within Hirshabelle, Galmudug, Southwest, and Jubaland State.

The European Union alongside the Nordic International Support Foundation have launched a $4.9 million Rapid Nationwide Stabilisation project in Somalia aimed at further strengthening the fragile country’s water infrastructure, security and reconcilliation initiatives.

The European Union to the Federal Republic of Somalia together with the Somali authorities and its implementing partner the Nordic International Support Foundation recently launched the new program which will run over an 18-month period.

“We are …

- President William Ruto is seen to be leaning more towards the West as opposed to his predecessor and former boss Uhuru Kenyatta, who had built a strong relationship with Asian countries.

- During Mr Kenyatta’s 10-years rule, China became a major financier and developer of key projects among them the $3.6 billion Standard Gauge Railway (SGR).

- China and India have also been dominating the country’s trade as the Asian market accounts for 65.7 per cent of Kenya’s total import bill.

Since coming into office in September last year, Kenya’s fifth President William Ruto has been keen on building and expanding alliances with countries that can help foster trade that remains in favour of foreign nations.

An interesting facet, however, has been his renewed interest in the United States and Europe, in what is seen as a slow but sure move to attract more investments while growing market for Kenya’s exports, manly …

- EIB Vice President confirms EIB support for green hydrogen engagement with President Ruto

- New agreement to develop and unlock investment to produce green hydrogen using renewable energy

- EIB and Kenya to identify potential green hydrogen investment projects

The European Investment Bank (EIB) has committed to support and strengthen green hydrogen investment in Kenya.

Thomas Östros, European Investment Bank Vice President and Professor Njuguna Ndung’u, Cabinet Secretary, National Treasury and Economic Planning signed the Joint Declaration on Renewable Clean Hydrogen following discussions on green hydrogen investment with Kenya’s President William Ruto.

“Kenya has some of the best renewable energy sources in the world if the storage components were equally developed. The route to storage has the potential to develop green hydrogen to deliver sustainable, green and inclusive growth. Today’s agreement builds on decades of close cooperation with the European Investment Bank to support renewable energy across Kenya. Together we will develop …

Mozambique may, however, be offered a lifeline. In its recent position on CBAM, the European Parliament has proposed an amendment to the CBAM legislation through which revenues generated by the CBAM levy could be used to finance least developed countries’ efforts towards the decarbonisation of their manufacturing industries.

If accepted, the funding could be applied to support the implementation of a green industrialization process in the country fuelled by accelerated investments in Mozambique’s unique renewable energy assets.

The trialogues between the European Parliament, the Commission, and the Council on the design and implementation of the CBAM are expected to continue in the coming weeks, which will lead to a decision on the final form of the CBAM. The result of these discussions will show to what extent the EU will walk the talk on realizing a green transition that “leaves no one behind” and ensures that it supports countries like …

What is good for the goose must also be good for the gander. However, the EU commission has commissioned the Baltic pipe project, somewhat similar to the EACOP. The Baltic Pipe project was inaugurated on September 27, 2022, at an opening ceremony in Goleniów, Poland.…

![Is the EU Carbon Border Adjustment Mechanism good for Mozambique’s aluminium exports? Mozal Aluminium. Mozambique’s aluminum exports may be exposed to an annual CBAM levy in the order of €350 million per year. [Photo/Mozal Aluminium]](https://theexchange.africa/wp-content/uploads/2022/11/Mozal-Mozal-Aluminium_Mozal-Aluminium-1024x458.jpg)