- 1.5°C future on the line: Why nations must cut emissions now or lose target

- IMF Growth Forecasts: BRICS to Lead the World in the Next 5 Years

- Vantage Capital seals exit from PickAlbatros Hotels after $18.4M pandemic boost

- Madica backs Earthbond in bold pre-seed bet on sustainable solutions

- Venture capital and debt drive growth in Kenya’s agri-tech sector

- Sustainability Week Africa: Pioneering change amidst climate challenges

- Refugee Crisis in Chad as War and Hunger in Sudan Drive Thousands Across Border

- Senegal 2050: A Blueprint for Economic Transformation

Browsing: Kenya

- Pepea’s investment will provide Kenya-based Gaea Foods with the working capital necessary to meet growing demand from both new and existing customers.

- This, in turn, will enable the company to source from a larger number of smallholder farmers, further strengthening the local agricultural economy.

- Launched in 2023, Pepea Fund was created to provide funding for early-stage companies.

Gaea Foods, a Nairobi-based potato processing company, has become the first-ever investment of Pepea, an impact fund from Oxfam Novib managed by Goodwell Investments, marking a historic milestone for the fund

This move not only highlights the potential of Gaea Foods in the B2B market but also underscores Pepea’s focus in fostering sustainable and inclusive growth in East Africa. Gaea Foods is a pioneering female-led business focused on Kenya’s potato value chain. By providing venture debt to Gaea Foods, Pepea aims to empower smallholder farmers, enhance local value chains, and promote gender …

- A key aspect of the ShafDB and CPF Group alliance is the setup of a Housing Solutions Fund for Kenya.

- By co-financing projects and providing capital raising and technical support, this Fund aims to catalyze the development of affordable housing across Kenya.

- The ShafDB and CPF Group alliance exemplifies the potential of Public Private Partnerships to drive meaningful change in the housing sector.

Kenya’s housing crisis has long been a pressing issue, with millions of citizens lacking access to decent and affordable housing. However, a new development seeks to address this challenge, following a partnership between two key players in the housing sector—Shelter Afrique Development Bank (ShafDB) and CPF Group.

This collaboration, sealed through a Memorandum of Understanding (MOU), aims to scale up the development of large-scale affordable housing projects across the country.

A strategic partnership for affordable housing

The agreement between ShafDB and CPF …

- The Dar-Dodoma SGR cuts travel time by more than half the time.

- Two Presidents and one former President aboard the maiden trip.

- Fast speed SGR expected to boost regional economic activities.

The launch of Tanzania’s SGR has ushered a new era across East Africa, where member countries are fast embracing electric train services to enhance transport and spur trade. This month, Tanzania became the latest of several other East African countries to invest in the Standard Gauge Railway (SGR). President Samia Suluhu Hassan and Zanzibar President Hussein Mwinyi as well as former President Jakaya Kikwete officiated the launch of the commercial operation of the country’s first SGR.

This initial August launch of the SGR services will serve between the commercial port city of Dar es Salaam and the capital city Dodoma. Being the first electric train, it marks a new age for the Tanzanian transport sector.

“The new SGR electric …

- Though encouraging that the number of female CEOs has risen from 230 (9.6%) in 2023 to 310 (11.1%) in 2024, these numbers show a tech segment that is still heavily dominated by men.

- Interestingly, smaller ecosystems such as Zambia, Rwanda, and Senegal are outperforming traditional hotspots like South Africa, Nigeria, Egypt, and Kenya in terms of female leadership.

- Between January 2022 and June 2024, startups with female co-founders raised $747M, representing just 11.9% of the total, while those led by female CEOs secured only $289M.

The African tech ecosystem, renowned for its dynamic growth and innovative potential, is transforming. Yet, a pressing issue remains, gender diversity within leadership roles. This year’s “Diversity Dividend: Exploring Gender Equality in the African Tech Ecosystem” survey by Disrupt Africa highlights the gender disparities that continue to plague this burgeoning industry.

Despite recent improvements, the representation of women in leadership positions within African …

- Globally, Norway, Finland, and Iceland were ranked the top three countries with close to zero fragility.

- A fragile state according to the research body is a country that possesses characteristics that substantially impair its economic and social performance.

- The Fragile States Index is designed to measure countries’ vulnerability and assess how it might affect projects in the field.

Kenya has moved a step away from the risk of state collapse according to the latest Fragile States Index by the international research and educational institution Fund For Peace (FFP). The index, which is designed to measure countries’ vulnerability and assess how it might affect projects in the field, ranks Kenya position 36 out of 179 countries globally.

This is with an indicator score of 86.7 out of the maximum 120. Compared to the previous year, the rank is a one-step improvement from position 35 which earned a score of 87.8. Ideally, …

- Authorities in Kenya are planning to embrace zero-based budgeting starting 2025/26 financial year.

- The International Monetary Fund (IMF) believes that this kind of budgeting will help developing countries such as Kenya improve efficiency in their spending plan.

- Currently, Kenya is using traditional budgeting, where previous spending levels are typically adjusted.

President William Ruto has announced that Kenya will shift to zero-based budgeting starting in the 2025/26 financial year, marking a departure from the current incremental budgeting system. This change means that each new financial year’s budget will start from scratch, requiring all expenses and revenue lines to be justified afresh, rather than building on the previous year’s allocations.

“I believe that that time has come for us to break new grounds. That is why in the next financial year we will adopt a zero-based budget,” President Ruto said Thursday.

However, this is not the first time Kenya has attempted such …

- Kenya protests led to a steep decline in business activity in July.

- Kenya’s private sector reported backlogs of work build-up and lengthened supplier lead times.

- In the month under focus, however, rates of inflation remain muted.

July 2024 has proven to be a turbulent month for Kenya’s economy, as widespread protests wreaked havoc on the nation’s private sector. The resulting decline in business activity and output has raised concerns about the long-term implications of political instability on Kenya’s economic health.

According to the Stanbic Bank Purchasing Managers’ Index (PMI) survey Kenya protests, which started in June with calls for the rejection of Finance Bill 2024, have triggered a significant downturn in business conditions, posing grim implications for various sectors, and the broader economy.

The PMI Plunge: A stark indicator of economic strain

The Stanbic Bank PMI report for July 2024 offers a sobering snapshot of the state of Kenya’s private …

- Jersey has just been recognized as a global center for responsible finance, demonstrating its commitment to combating money laundering and terrorist financing.

- The island’s achievement has far-reaching implications for the global financial system, including for economies in Africa struggling with money laundering.

- African countries can take lessons on how to establish robust legal and regulatory frameworks for AML from Jersey to help plug vulnerabilities in their financial systems.

The scourge of money laundering continues to be a serious pain point for authorities across Africa, with many countries struggling to fight illicit flows albeit with persistent risks.

Currently, South Africa, the continent’s most advanced economy is under close watch according to the Financial Action Task Force (FATF) to institute tough measures to check money laundering avenues by October 2024.

In West Africa, persistent challenges of human trafficking, poaching, and wildlife trafficking, and runaway corruption continue to weaken the financial system of …

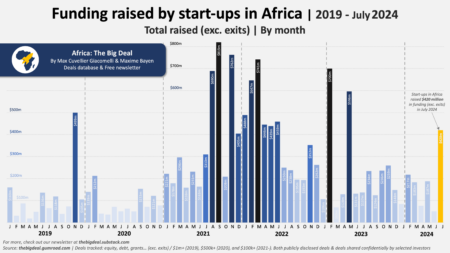

- Startups in Africa have attracted over $1.2 billion in financing this year.

- Experts note that debt financing for startups in Africa is increasingly taking centre stage.

- In July, startups d.light, Va1U, Terrapay as well as Cartona all settled on debt financing to boost operations.

Startups in Africa have defied the odds in declining global capital flow, attracting a record $420 million in financing in July. This funding, which excludes exits, takes to $1.2 billion the amount of money channeled to startups in Africa this year and is the highest on record in 14 months.

“The numbers were heavily skewed by the two mega deals that were announced during the month: d.light’s $176 million securitisation facility and MNT-Halan’s $157.5 million raise. NALA’s $40 million Series A also deserves a mention. Combined, these three deals represent 90 percent of the funding raised,” an update by startup funding tracker, Africa: The Big Deal…

- This year, Watu is set to introduce 10,000 electric motorbikes in Kenya, Tanzania, and Uganda.

- Watu has committed to enhancing its electric vehicle funding portfolio to 40 percent in three years and to finance the acquisition of 500,000 electric motorbikes by 2030.

- The firm has entered into a partnership with Uganda-based GOGO Electric, to power the design and development of Africa’s first fit-for-purpose electric boda bike.

As the global call for the protection of the environment grows louder, the need for individuals, companies, and governments to promote sustainable development such as the adoption of green mobility solutions is gathering pace.

In East Africa, a market of over 300 million people, extreme weather conditions partly worsened by global warming have seen the area swing between devastating drought and deadly floods.

Increasingly, however, investors are collaborating to change the tide. One of the pioneers seeking to play a critical role in checking …