- African Energy 2024: Surging investment, waves of change

- AIM Congress 2025: Competition opens doors for Africa’s top tech innovators

- Zimbabwe rolls out $24M project to reduce use of mercury in gold mines

- Zambia secures $184M IMF support as economic growth set to decline to 1.2 per cent

- Equity enters alliance with ODDO BHF to spur Europe-Africa investments

- Air Tanzania hits turbulence: Can the airline fly back to EU skies?

- Ghana’s President Elect John Mahama Outlines His Economic Blueprint

- AfDB backs “green shares” funding model with $30M AFC equity boost

Browsing: Kenya

- Jersey has just been recognized as a global center for responsible finance, demonstrating its commitment to combating money laundering and terrorist financing.

- The island’s achievement has far-reaching implications for the global financial system, including for economies in Africa struggling with money laundering.

- African countries can take lessons on how to establish robust legal and regulatory frameworks for AML from Jersey to help plug vulnerabilities in their financial systems.

The scourge of money laundering continues to be a serious pain point for authorities across Africa, with many countries struggling to fight illicit flows albeit with persistent risks.

Currently, South Africa, the continent’s most advanced economy is under close watch according to the Financial Action Task Force (FATF) to institute tough measures to check money laundering avenues by October 2024.

In West Africa, persistent challenges of human trafficking, poaching, and wildlife trafficking, and runaway corruption continue to weaken the financial system of …

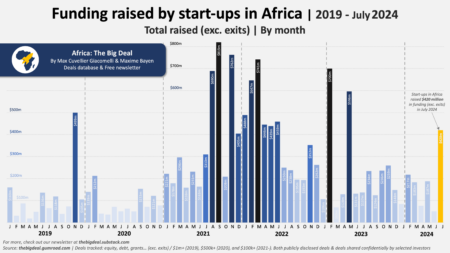

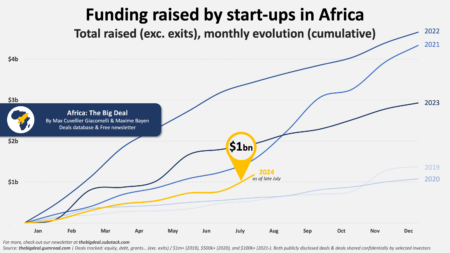

- Startups in Africa have attracted over $1.2 billion in financing this year.

- Experts note that debt financing for startups in Africa is increasingly taking centre stage.

- In July, startups d.light, Va1U, Terrapay as well as Cartona all settled on debt financing to boost operations.

Startups in Africa have defied the odds in declining global capital flow, attracting a record $420 million in financing in July. This funding, which excludes exits, takes to $1.2 billion the amount of money channeled to startups in Africa this year and is the highest on record in 14 months.

“The numbers were heavily skewed by the two mega deals that were announced during the month: d.light’s $176 million securitisation facility and MNT-Halan’s $157.5 million raise. NALA’s $40 million Series A also deserves a mention. Combined, these three deals represent 90 percent of the funding raised,” an update by startup funding tracker, Africa: The Big Deal…

- This year, Watu is set to introduce 10,000 electric motorbikes in Kenya, Tanzania, and Uganda.

- Watu has committed to enhancing its electric vehicle funding portfolio to 40 percent in three years and to finance the acquisition of 500,000 electric motorbikes by 2030.

- The firm has entered into a partnership with Uganda-based GOGO Electric, to power the design and development of Africa’s first fit-for-purpose electric boda bike.

As the global call for the protection of the environment grows louder, the need for individuals, companies, and governments to promote sustainable development such as the adoption of green mobility solutions is gathering pace.

In East Africa, a market of over 300 million people, extreme weather conditions partly worsened by global warming have seen the area swing between devastating drought and deadly floods.

Increasingly, however, investors are collaborating to change the tide. One of the pioneers seeking to play a critical role in checking …

- Chinese firm Chery invests $20 million in Kenya to tap the growing demand for electric mobility

- He added that a $20-million investment is expected to create about 3,000 direct and indirect jobs in the country.

- Shan also revealed that Chery’s entry into the Kenyan market is a result of the cordial and long-standing relations between the two countries.

Chinese vehicle firm Chery will invest $20.1 million (Sh2.62 billion) in Kenya to scale up the production of Electric Vehicles (EVs).

The deal, signed on Saturday, was in partnership with Kenyan firm Afrigreen Automobile, that will see the construction of an assembly plant to produce electric vehicles locally.

Ministry of Investments, Trade and Industry, Principal Secretary Abubakar Hassan Abubakar said the cooperation is expected to boost the uptake of EVs in the country by making them more affordable and accessible.

…“The assembly plant will help the transport sector to become

- Socio-economic development has been constrained by widespread corruption and mismanagement in Kenya.

- The debt constraint will not just affect headline macroeconomic variables, but will also have an impact on the lives of Kenyans, a new report says.

- The variation in unemployment, inflation, and broader economic growth will also have a clear impact on poverty levels.

Kenya’s potential for socio-economic development in the coming decade is no longer promising, a new report has revealed.

The report titled ‘Kenya in 2040: Mapping Kenya’s Future’, which was jointly produced by Oxford Economics Africa and the Institute of Economic Affairs (IEA), a Kenyan think tank, says the earlier projected outlook of the country’s GDP growth beyond 5 per cent, and a consolidated position as the gateway into Africa, is slowly diminishing.

It says Kenya’s socio-economic development has been constrained by widespread corruption and economic mismanagement.

“The former has led to considerable fiscal …

- This milestone is, however, delayed given that startup funding hit $1 billion in April 2023, as early as February in 2022 and May in 2021.

- One of the outstanding investments were d.light’s new $176 million securitization deal to enhance the uptake of solar powered equipment in Kenya, Uganda and Tanzania.

- Another record was Egypt-based MNT-Halan’s $157.5 million raise to fuel their expansion.

With five months to go to the end of 2024, the state of startup funding in Africa looks promising with new businesses attracting over $1 billion by the end of July. According to the startup funding tracker, Africa: The Big Deal, July was “the most successful month in terms of fundraising in Africa in more than a year, and represents what was raised in the whole of Q2 2024.”

This milestone, however, appears to …

- AI in agriculture is being used to drive the sourcing of real-time data, perform predictive analysis, and run algorithms that optimize farming practices.

- In South Africa, Kenya, and Zimbabwe, ITIKI, an innovative project is tapping indigenous environmental knowledge among African communities, integrating it with AI to predict droughts with better precision.

- GSMA: AI in agriculture is poised to enable the deployment of innovative digital financial solutions such as credit and insurance products for millions of farmers.

In Africa, a continent of over 1.2 billion people, agriculture remains the primary economic activity, accounting for 17 percent of the GDP on average while offering jobs to nearly 60 percent of the population.

The bulk of the food produced in Africa or about 80 percent is, however, attributable to the effort of smallholder farms, where women provide much of the workforce. Unfortunately, these smallholder farmers continue to face multiple …

- Central Bank of Kenya says active mobile subscriptions hit 66.8 million by December 2023 compared to 65.7 million a year earlier.

- Increasing usage of mobile money saw the banking industry in Kenya experience a drop in the value of banking transactions via bank agents to $10.5 billion.

- Kenya is a trailblazer in the adoption and usage of mobile money across Africa.

A steady rise in the use of cashless transactions as well as the opening of 8,555 new mobile money agent shops in Kenya drove the value of mobile money transactions up by 13.8 percent to record KSh788.35 billion or $6 billion in 2023.

Kenya has been a trailblazer in the adoption and usage of mobile money across Africa since the launch of pioneer cash transfer platform M-PESA by Safaricom PLC in 2007.

“Amidst the increasing adoption of technology and the widespread use of mobile phones in daily life, coupled …

- Ratings agency Moody’s has downgraded Kenya’s local and foreign-currency long-term issuer ratings to Caa1 from B3, with a negative outlook.

- This downgrade ushers the economy into an era of reduced capacity to rollout revenue-based fiscal consolidation.

- The move also has broader implications for the country’s near-term economic stability.

East Africa’s giant economy is at a pivotal moment following ratings agency Moody’s move to downgrade its local and foreign-currency long-term issuer ratings to Caa1 from B3, with a negative outlook.

This downgrade, which comes just a week after a three-week nationwide revolt forced the government to shelve the Finance Bill 2024, ushers the economy into an era of reduced capacity to roll out revenue-based fiscal consolidation. This negative outlook also has broader implications for the country’s near-term economic stability, Moody’s states.

Kenya’s fiscal consolidation challenges amid negative outlook

Moody’s downgrade signals the Kenyan government’s shift away from planned tax increases, opting …

- In the first three months of this year, Asia remained the leading source of Kenya’s imports accounting for goods worth $3.4 billion, as the country’s import bill closed the quarter at $5.4 billion.

- Kenyan traders and government imported goods worth $990.2 million from China, data by the Kenya National Bureau of Statistics (KNBS) shows, making it the biggest import source by country.

- Unlike his predecessors, President Ruto is seen to lean more towards the West as he seeks financing and trade cooperation.

Kenya’s imports from Asian countries including China

China and India remained the top exporters to Kenya in the first quarter of this year, leading other Far East nations in retaining a firm grip on the East African economic powerhouse’s trade and investment space, which they have dominated for over a decade.

This trend continues despite President William Ruto’s heightened charm offensive to economies from the West, which is …