- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

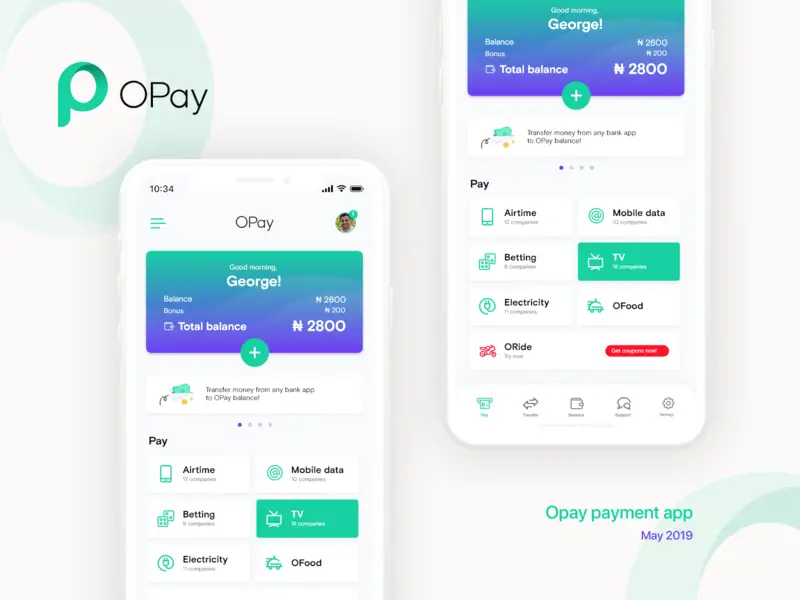

Browsing: OPay

- The Mastercard, OPay partnership will make it possible for OPay customers and merchants in the region to interact with brands and businesses worldwide

- The partnership will benefit users in Kenya, Egypt, Algeria, Nigeria, Morocco, Ethiopia, Pakistan, South Africa and the United Arab Emirates

- Opay customers will be able to make use of the Mastercard virtual payment solution that is linked to their OPay wallets

The announcement of a strategic partnership between Mastercard and the African fintech giant OPay, which took place on May 19 of this year, represents a significant boost for broader financial inclusion.

This partnership makes digital commerce accessible to millions of people across the Middle East and Africa.

The collaboration will make it possible for OPay customers and merchants in the region, which includes Kenya, Egypt, Algeria, Nigeria, Morocco, Ethiopia, Pakistan, South Africa, and the United Arab Emirates, to interact with brands and businesses located anywhere in …

PAGA, a payment processing company in Nigeria (similar to PAYPAL) started by Tayo Oviosu in 2009 is on track to potentially be the next unicorn as it processed $2.3 billion worth of transactions in 2020 and $8 billion during the past four years. The company is now expanding into Ethiopia and Mexico as part of its global growth plan.

Another future unicorn is CNG TRANSFER founded during the pandemic by Emmanuel Tochi and Vincent Omulo, a Nigerian and Kenyan, respectively. The startup’s flagship product is www.Transfy.io – a cross border intra-African money transfer platform built on blockchain enabling Africans to transparently move money from one country to another at no cost. Within a year of launch, they have already processed 100 million of Kenyan Shillings in Kenya alone while operational in Nigeria, Zambia, Botswana, South Africa, Rwanda and Ghana.…

Many companies are thus rushing to claim a share of this market as the global banking industry earnings shrink.…

In mid-January, US based financial whistleblower and research organization Hindenburg Research released a report titled’ The Phantom of the turn-around’ in which it questioned the operations of Opera, the Chinese owned browser whose popularity in Africa has remained high. What has followed is a series of class-action lawsuits by a dozen law firms in US and UK against the browser.

The research firm accused Opera of “developing predatory short-term loans in Africa and India, deploying deceptive ‘bait and switch’ tactics to lure in borrowers and charging egregious interest rates ranging from 365-876%.” This, the company says is going against Google policies of charging fair rates on short term loans.

According to financial firm Hindenburg Research, Opera has launched at least four payment apps under various developer accounts. There’s Okash and OPesa in Kenya, CashBean in India, and OPay in Nigeria.

It noted that Opera has scaled its “Fintech” segment from …

OPay, one of the fastest scaling growth companies in Africa, has announced that it raised $120 million of series B funding, less than 6 months after it announced its last funding round of $50 million in June.

The company, which was incubated by Norwegian based, global consumer Internet company Opera, is already Nigeria’s leading mobile wallet and motorbike ridesharing provider, and is rapidly expanding.

Series B investors included Meituan-Dianping, DragonBall Capital (The Investment fund backed by Meituan-Dianping), GaoRong Capital, Source Code Capital, SoftBank Ventures Asia, Bertelsmann Asia Investments (BAI), Redpoint China, IDG Capital, Sequoia Capital China and GSR Ventures.

OPay is one of the fastest growing companies in Nigeria, providing consumers with a wide range of services including mobile payments and transfers, ridesharing and food delivery. The company plans to use the new capital to further accelerate its expansion across its multiple verticals, as well as entering new African markets.…